With the approval of an Ethereum (ETH) spot ETF doubtlessly on the horizon in Might, the second largest cryptocurrency by market cap is on many merchants and buyers eyes given the way it may stand to learn

Nevertheless, regardless of the thrill, ETH has been struggling to maintain tempo with Bitcoin (BTC) in current instances. This 3-year low ETH/BTC trade charge challenges what fanatics name “the flippening”- a hypothetical state of affairs the place Ethereum surpasses Bitcoin because the dominant cryptocurrency by market capitalization.

A number of components are contributing to this underperformance. One key motive is the decline in exercise on Ethereum’s community. The variety of energetic customers and the general transaction quantity on ETH’s decentralized purposes (DApps) have each dropped considerably.

This decline is regarding as a result of DApps are the guts of the Ethereum ecosystem. They’re the platforms that allow customers to work together with decentralized finance (DeFi), non-fungible tokens (NFT), and different blockchain-based functionalities.

When person engagement with DApps drops, it means that there may be underlying points with the Ethereum community itself, or a scarcity of innovation and improvement inside the DApp ecosystem.

Including to ETH’s woes is the rise of Solana (SOL). This competing blockchain has been grabbing market share within the DeFi house, notably fueled by current tendencies in memecoins and stablecoin transfers.

Forecasting ETH’s potential trajectory

Leveraging machine studying algorithms, monetary analysts mission a cautiously bullish outlook for Ethereum’s value. These synthetic intelligence (AI)-driven instruments forecast a continuation of the optimistic pattern, doubtlessly propelling ETH to $3,633 by the tip of April.

This interprets to a possible rise of three.15% from its present value. Whereas optimistic, the upward pattern is anticipated to be comparatively modest.

Ethereum value evaluation

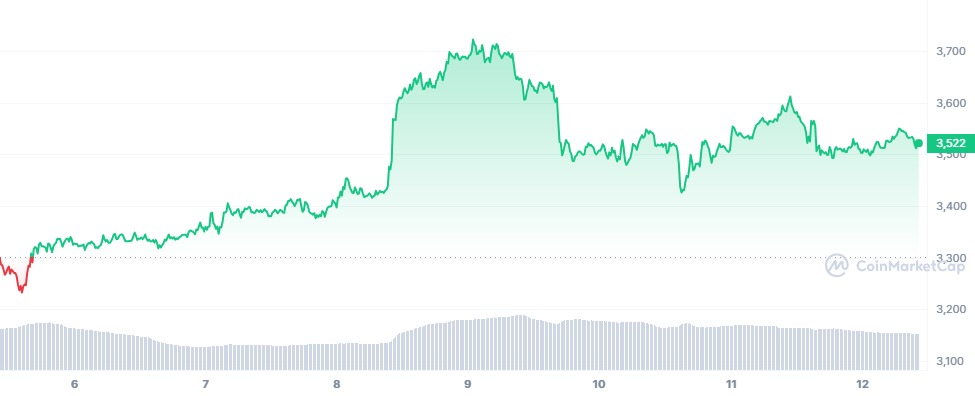

At press time, Ethereum’s value at this time stands at $3,522. Regardless of experiencing a slight decline of two.08% for the day, ETH has seen a rise of 6.71% over the previous week.

Nevertheless, this upward momentum contrasts with a lower of 11.48% over the previous month.

Nonetheless, ETH had 17 inexperienced days within the final 30 days, accounting for 57% of the month. Moreover, the worth has elevated by 88.14% over the 12 months.

Regardless of current fluctuations, the general pattern suggests resilience and potential for additional development within the close to future.

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.