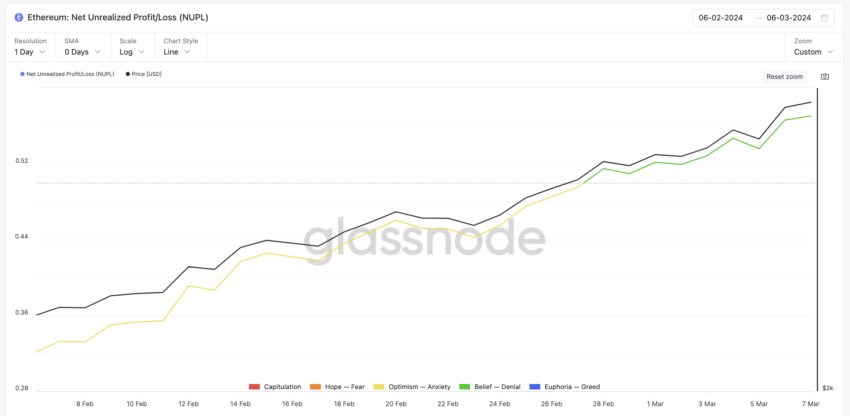

The current shift in ETH Web Unrealized Revenue/Loss (NUPL) into the ‘Perception — Denial’ zone indicators a pivotal juncture. Ethereum’s present place at this delicate threshold means that whereas confidence in its long-term worth stays strong, there exists a looming warning that market dynamics may pivot.

For an in-depth exploration of those components and a strategic examination of Ethereum’s potential paths ahead, delve into the entire evaluation.

ETH Is the Clear Winner Among the many High 10

In an evaluation specializing in the year-to-date (YTD) progress of the main 10 cryptocurrencies, excluding stablecoins and memecoins, ETH has demonstrated a outstanding improve, surging by 67.22% this 12 months. This progress price has allowed it to surpass all its key opponents, together with Bitcoin (BTC), Binance Coin (BNB), Solana (SOL), and Chainlink (LINK).

At first of the 12 months, ETH was valued at $2,352. Since then, it has seen a major rise, reaching a worth of $3,946 extra just lately. Regardless of this spectacular progress, ETH’s present worth stays 18.39% beneath its all-time excessive (ATH) of $4,849.03. Nonetheless, there’s a robust risk that ETH may retest its ATH within the close to future. This optimism is partly as a result of Bitcoin (BTC) having just lately surpassed its file excessive.

ETH YTD progress in contrast with different cash. Supply: Messari.

Nonetheless, there’s a likelihood that the cryptocurrency market might expertise a point of consolidation within the quick time period. This potential improvement may happen as traders in ETH, the place at present 79% of them are in a worthwhile place, might resolve to liquidate a few of their holdings.

The motivation behind such a transfer may very well be diversifying their investments in direction of different cryptocurrencies with larger progress alternatives, together with memecoins.

NUPL Indicator Adjustments Standing

ETH Web Unrealized Revenue/Loss (NUPL) metric just lately transitioned from the ‘Optimist – Nervousness’ class to the ‘Perception – Denial’ part. This transition signifies that almost all of holders are at present observing their holdings in a worthwhile mild, which, in flip, solidifies their confidence and perception in ETH. This phenomenon is usually interpreted as a trademark of a maturing bull market, characterised by traders who exhibit confidence of their investments with out veering into the territory of irrational exuberance.

ETH NUPL. Supply: Glassnode.

The Web Unrealized Revenue/Loss (NUPL) metric represents the distinction between Relative Unrealized Revenue and Relative Unrealized Loss throughout all on-chain addresses. It primarily reveals whether or not the community as an entire is at present in a state of revenue or loss.

Nonetheless, if NUPL strikes into the ‘Euphoria – Greed’ vary, it usually signifies that the market is grasping, the place most traders are in revenue. Traditionally, this has usually been an indicator of a market high. This might result in a market correction as extra traders resolve to revenue.

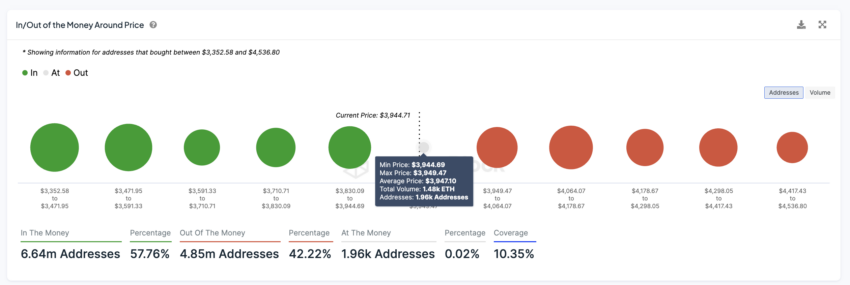

IOMAP Knowledge Exhibits Robust Assist and Resistance Ranges

Ethereum (ETH) at present advantages from important ranges of robust assist, recognized at two key worth factors: $3,830 and $3,710. These ranges act as essential buffers for the cryptocurrency. Nonetheless, ought to ETH be unable to keep up these assist ranges, there’s a potential for the value to say no additional. Particularly, it may drop to as little as $3,591. This situation factors to a notable lower in ETH market worth.

ETH IOMAP. Supply: IntoTheBlock.

Conversely, the asset displays a major degree of resistance in the intervening time, particularly at worth factors of $3,949 and $4,064. Nonetheless, ought to it handle to penetrate by these resistance ranges, there exists a possible for its worth to escalate additional, probably reaching as excessive as $4,500.

This worth level is notably near its all-time excessive (ATH). The prevailing temper inside the broader market may affect such an upward trajectory. Provided that BTC, together with different cryptocurrencies, has been reaching new peaks just lately, ETH appears poised to emerge as one of the substantial beneficiaries on this present market cycle.

Present metrics present a doable consolidation within the quick time period, however total market traits, like a doable Ethereum ETF, counsel ETH may hit $4,500 and check a brand new all-time excessive quickly.

Disclaimer

All the data contained on our web site is revealed in good religion and for basic data functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own danger.