Contemplating the Pi Cycle Prime Indicator, the ETH value evaluation means that Ethereum may see extra corrections earlier than trying to achieve the $4,000 mark once more. Moreover, the Web Unrealized Revenue/Loss (NUPL) signifies it’s nonetheless distant from the euphoria zone, hinting at a possible interval of consolidation within the close to future.

Moreover, the Exponential Shifting Common (EMA) Strains reveal costs converging carefully, suggesting that there’s sturdy assist on the present ranges, which can stabilize ETH costs earlier than any important upward motion.

Ethereum Pi Cycle Exhibits An Necessary State of affairs

ETH trajectory on the Pi Cycle Prime Indicator suggests a brewing consolidation section, as evidenced by the hole between the 111-day shifting common and the 350-day shifting common instances two.

At the moment, the indicator’s higher boundary is about close to $4,231, whereas the decrease boundary rests round $2,750, a selection that permits for a respiration room indicative of market stabilization somewhat than a peak. It’s inside this bandwidth that the ETH value might be carving out a basis for its subsequent ascent.

ETH Pi Cycle Prime Indicator. Supply: Glassnode.

Pi Cycle Prime Indicator operates on the precept that when the value surpasses the longer-term common (350-day multiplied by 2), a market high might be imminent, suggesting an overheated market poised for a downturn. When it’s beneath the short-term common, it may point out the asset is undervalued.

ETH value between these averages and the parallel trajectory of the traces and not using a crossover occasion implies that whereas the heights of market euphoria are but to be reached, the groundwork is being laid for a strong assist stage. This lack of convergence, mixed with the present value exercise, lends weight to the argument that ETH might be getting into a consolidation section.

Learn Extra: Ethereum ETF Defined: What It Is and How It Works

ETH Is Nonetheless Far From Euphoria

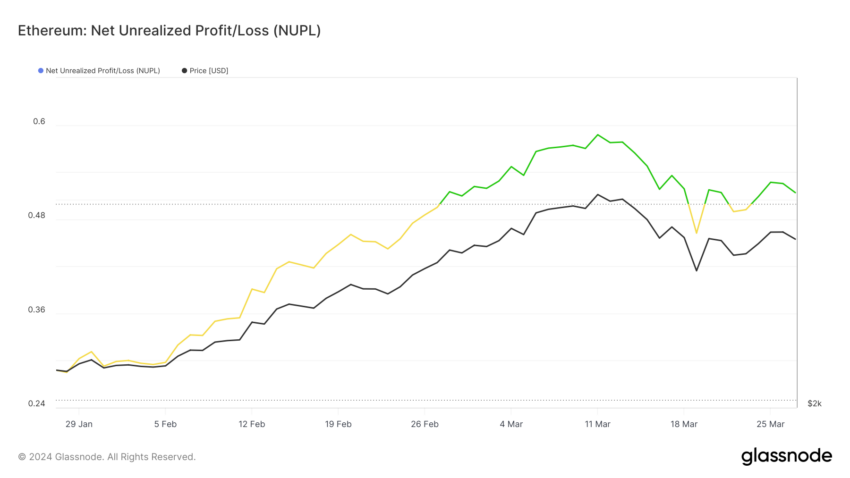

ETH Web Unrealized Revenue/Loss (NUPL) has been persistently oscillating between “Optimism — Nervousness” and “Perception — Denial,” a sample that’s indicative of the market’s indecision. Such a rhythmic shift between sentiment zones means that traders are alternating between cautious optimism and a stronger conviction within the asset’s potential, but with out totally committing to an overarching pattern. This back-and-forth motion, or ‘going and coming,’ implies a possible consolidation section for Ethereum.

ETH Web Unrealized Revenue/Loss. Supply: Glassnode.

The NUPL’s transient stays in “Perception — Denial” to forestall market overheating. The sentiment suggests a market stabilizing, avoiding large sell-offs or selloffs.

This sentiment stability could prep ETH’s value for regular climbs. With out sturdy greed or concern, a gradual rise is extra seemingly than unstable swings.

ETH Worth Prediction: Consolidation Earlier than New Surges

ETH Exponential Shifting Common (EMA) traces on the 4-hour value chart present priceless perception into the asset’s value motion. The EMA traces are monitoring shut to one another, which signifies that there’s little volatility and the value is experiencing a consolidation section.

EMAs are a sort of shifting common that offers extra weight to latest costs, making them extra conscious of new data. When EMA traces converge, as they appear to be on the chart beneath, it usually signifies {that a} sturdy pattern isn’t in place, and costs may transfer sideways for a while.

ETH 4H Worth Chart and EMA Strains. Supply: TradingView.

The worth of ETH is hovering round these traces, suggesting an equilibrium between patrons and sellers. If an uptrend is to start, a decisive break above these tangled EMA traces may propel ETH’s value towards the $4,100 resistance stage. An upcoming ETH ETF may assist this uptrend to seem.

Learn Extra: Ethereum Restaking: What Is It And How Does It Work?

If the consolidation section turns bearish, ETH may drop to $3,200 assist. A deeper slide to $2,900 is feasible beneath wider destructive sentiment. At the moment, clustered EMA traces trace at ongoing range-bound buying and selling for Ethereum. Any decisive transfer out of this band will seemingly outline its subsequent main value pattern.