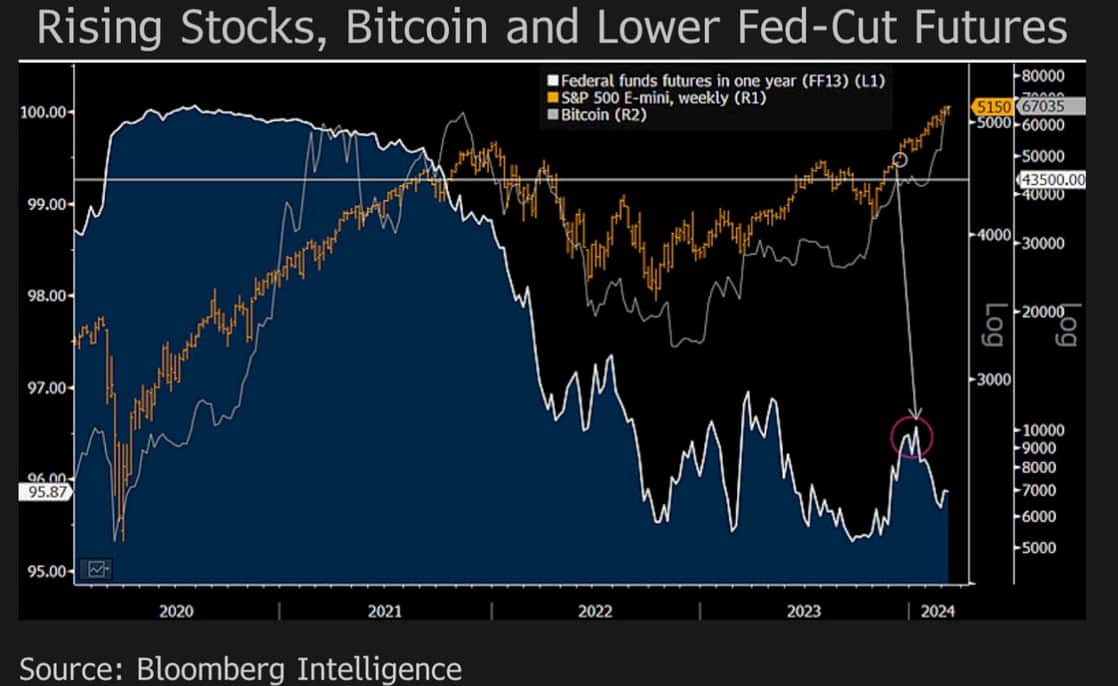

Gold, Bitcoin (BTC), and the S&P 500 peaked at new highs on March 8, rapidly retracing to ranges seen on yesterday. On the identical time, the finance market‘s expectations for decrease rates of interest enhance, creating a robust sign for buyers.

In a current evaluation, Bloomberg Intelligence’s Mike McGlone highlighted an important relationship between commodity costs, the S&P 500, and Federal Reserve rate-cut expectations amid potential recessionary warnings.

Notably, McGlone’s findings level to a paradoxical scenario the place the remedy for top commodity costs may inadvertently set off financial downturns. In the meantime, threat property reaching new highs would result in elevated inflation metrics. Additional, it has doubtlessly triggered renewed hawkish insurance policies by the Federal Reserve.

“A easy technical sign could also be higher off not working on account of deflationary dominoes and recession implications of the S&P 500 falling about 10% from March 7. Our graphic reveals the rising inventory index and diminishing Fed rate-cut expectations. There seems to be a connection.”

– Mike McGlone

Mike McGlone’s evaluation of S&P 500, Bitcoin, and FED-cut charges

Central to McGlone’s evaluation is a technical sign hinting at deflationary pressures and potential recession. Thus, suggesting a development reversal for the S&P 500. This comes in opposition to a backdrop of the S&P 500 reaching an all-time excessive of $5,189, signaling investor confidence and a strong financial outlook.

But, the accompanying information reveals a dip in Federal Funds Futures, displaying a lower from almost 97% to 95.87%, and a parallel surge in Bitcoin’s worth, breaking its earlier all-time excessive at $70,000.

Understanding the Fed Funds Futures is vital to decoding McGlone’s insights. Basically, these futures are monetary contracts that speculate on the path of the U.S. Federal Reserve’s rate of interest coverage.

The next share implies market expectations leaning in the direction of regular or rising rates of interest, whereas a drop suggests anticipation of price cuts. Traders monitor these futures to gauge market sentiment towards financial well being and coverage shifts, utilizing them as a barometer for funding choices.

Gold, Bitcoin, and the S&P 500 thrive underneath rate of interest lower expectations

Connecting the dots, McGlone’s evaluation underscores a direct linkage between diminishing Federal Reserve rate-cut expectations and the surge of each the S&P 500 and Bitcoin. This correlation means that whereas inventory and cryptocurrency markets thrive, underlying expectations of financial easing trace at considerations over financial sustainability.

Within the meantime, Gold carves an identical chart sample to that of the previous monetary indicators. The main commodity reached new highs at $2,195 per ounce, closing the week at $2,178. Due to this fact, it provides a possible signal of power regardless of the shadows of recession raised by Bloomberg’s commodity skilled.

In the end, the essential takeaway from McGlone’s submit is the fragile steadiness between fostering financial development and averting inflationary spirals. The interaction between Federal Reserve insurance policies, investor sentiment, and market efficiency encapsulates the tightrope policymakers stroll in steering the financial system by way of uneven waters.