What’s Bitcoin halving? Find out about its mechanics, significance, and funding implications on this complete information.

In the event you’re desirous about investing in crypto, you’ll need to learn about Bitcoin halving. It’s one of the crucial important occasions on the planet of cryptocurrency, usually surrounded by anticipation and hypothesis.

Analysts consider this occasion may drastically have an effect on the cryptocurrency’s worth, so it’s vital to grasp it.

What’s Bitcoin halving?

So, what precisely is Bitcoin halving? Merely put, it’s the method of halving the reward given to miners who confirm the legitimacy of transactions earlier than they’re added to a everlasting document, or block, on the Bitcoin (BTC) community.

These miners resolve complicated issues to earn the proper so as to add new transactions to the blockchain, and they’re rewarded with new Bitcoins for his or her efforts.

At present, miners obtain 6.25 Bitcoins for every transaction they confirm. Earlier than the final halving in Might 2020, they used to get 12.5 BTC for a similar process. After the subsequent halving, they’ll be receiving 3.125 BTC.

One other query: How usually does Bitcoin halve? The halving occurs roughly each 4 years, or after 210,000 blocks have been mined.

The method is a form of scheduled financial coverage written into Bitcoin’s code to guard it towards inflation, protect its worth, and guarantee its long-term viability.

However when will the subsequent Bitcoin halving occur? Proper now, nobody is aware of the precise date of the subsequent halving; it’s projected to happen round mid-April. Nevertheless, predictions are anticipated to grow to be extra correct as we strategy block #840,000, the place the occasion is coded to happen.

You may additionally like: Bitcoin’s fourth halving would possibly result in mining energy centralization, Bitfinex says

How does Bitcoin halving work?

We’ve already talked about the core operate of the halving course of, which is block reward discount. Nevertheless, you must know that the discount charge is predetermined and written into Bitcoin’s code. It’s a hard and fast 50% lower, that means the reward will get halved with each occasion.

The method can also be automated, needing no immediate or guide intervention. The Bitcoin community protocol adjusts itself upon reaching a programmed block top.

It will proceed till all 21 million Bitcoins have been mined, a milestone anticipated round 2140. After that, miners will now not obtain new Bitcoins as a reward however will earn from transaction charges as a substitute.

Bitcoin halving historical past

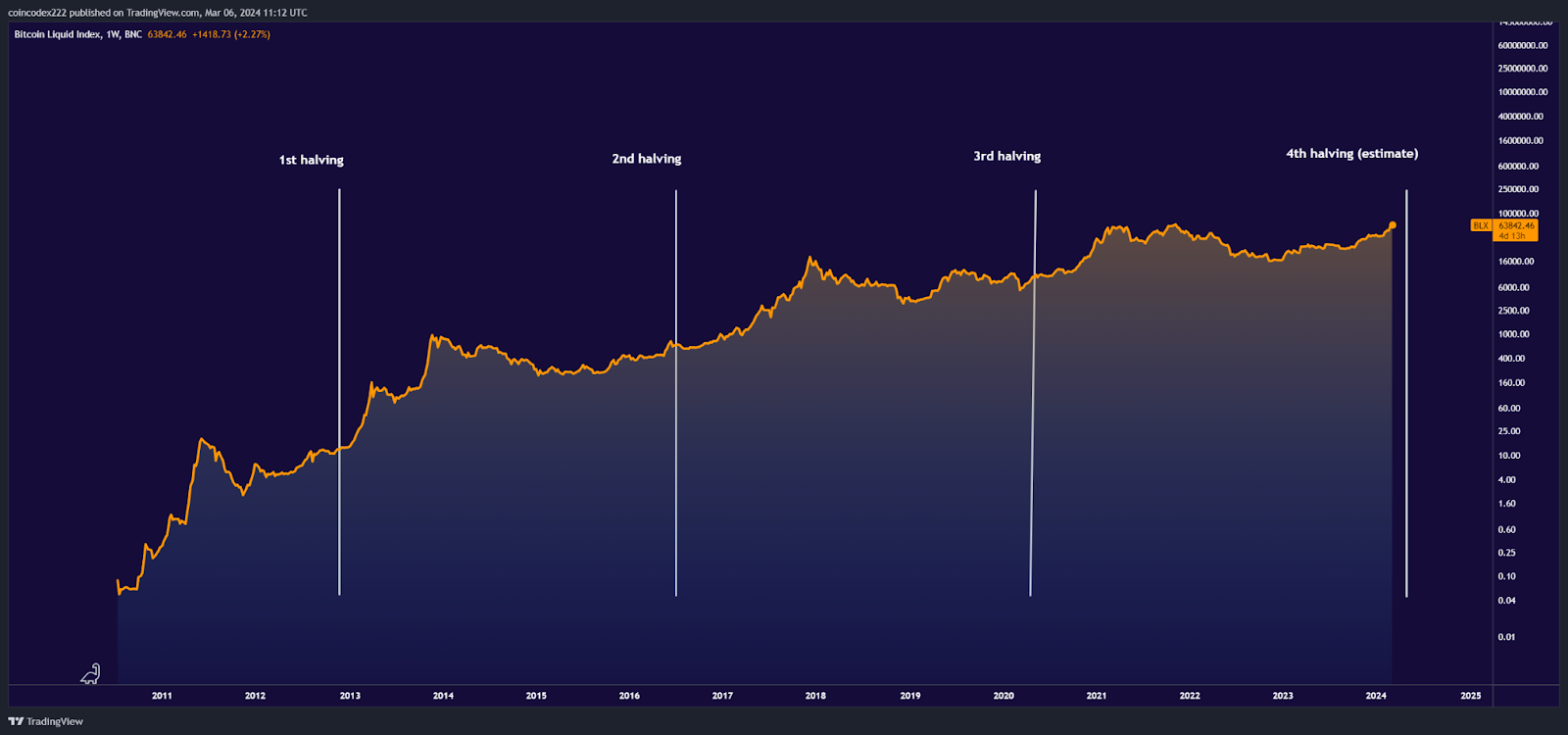

Halving happens roughly each 4 years, with the primary occurring on Nov. 28, 2012. There have been two different BTC halvings: the second that befell on July 9, 2016, and the third that occurred on Might 11, 2020.

Earlier than the primary halving, Bitcoin block rewards stood at a princely 50 BTC. After the occasion, miners began getting 25 BTC, with the coin’s greenback worth surging from $13 to over $1,000 within the following 12 months.

The identical factor occurred after the 2016 halving. Earlier than the occasion, BTC bought for about $664, however quickly after, between 2017 and 2018, the worth shot as much as as excessive as $20,000.

Round Might 2020, simply earlier than the final halving, you would purchase Bitcoin for about $9,700. Nevertheless, as quickly as block rewards dropped to six.25 BTC, the coin led the remainder of the crypto market on a merry run that resulted in late 2021, with Bitcoin buying and selling at an all-time excessive of about $69,000.

After we take a detailed have a look at the historical past of Bitcoin halving, we discover that these occasions usually mark important modifications within the cryptocurrency’s market worth. This sample signifies that when the variety of new cash coming into the market is lower in half attributable to halving, and the demand stays the identical or will increase, the worth of Bitcoin sometimes rises significantly.

Nevertheless, they not solely affect the worth of BTC, attractive investor curiosity, however in addition they problem miners by decreasing their earnings for the computational energy expended, doubtlessly prompting advances in mining applied sciences and techniques to take care of profitability amidst rising operational prices.

Bitcoin halving historical past

You may additionally like: The potential affect of Bitcoin halving on the cryptocurrency market | Opinion

Expectations for 2024 halving

As we get nearer to the April 2024 occasion, pleasure is rising amongst specialists and analysts within the crypto house. Over at crypto.information, Max Kalmykov, CEO of BitsGap, has shared his ideas. He sees the halving as a serious occasion that might push Bitcoin’s worth attributable to its shortage.

Kalmykov notices a sample in these cycles but additionally factors out that every one is totally different. Bitcoin takes extra time to achieve new highs after every halving. He predicts a stabilization in Bitcoin’s worth between $50,000 and $60,000 by year-end following a post-halving adjustment.

Analyzing historic developments round halvings, the crypto worth prediction web site CoinCodex additionally notices the patterns talked about by Kalmykov rising, suggesting a possible improve in Bitcoin’s worth forward of the occasion.

Within the opinion of the web site’s analysts, whereas Bitcoin’s worth trajectory following these occasions doesn’t adhere to an easy sample, they’ve famous an total upward development throughout every halving cycle. In accordance with them, observations from the three earlier halvings point out a constant improve within the cryptocurrency’s worth one month previous to the occasion.

Alternatively, post-halving outcomes have diversified, with the worth considerably rising after two halvings and falling after one. Nevertheless, the analysts contend that a broader timeline, Bitcoin constantly reached new all-time highs inside the four-year intervals between halvings, underscoring its robust long-term efficiency.

BTC halving worth chart | Supply: TradingView

After all, such sentiments haven’t been with out detractors, with sure colleges of thought believing that Bitcoin costs may doubtlessly come crashing down after the halving. As an illustration, JP Morgan analysts declare that BTC costs may go as little as $42k. In accordance with them, the halving occasion could negatively affect BTC mining profitability, resulting in greater manufacturing prices and, finally, decrease costs for the coin.

Others additionally argue that the halving’s affect on BTC costs could also be overstated, emphasizing elements like institutional adoption, growing demand, and the truth that the Bitcoin market is now extra mature, backed by the next market cap.

Why is Bitcoin halving vital?

The affect of Bitcoin halving is critical throughout the cryptocurrency ecosystem, inflicting a ripple impact amongst miners, traders, and companies.

For miners, the halving means a lower in earnings, which may lead to solely probably the most environment friendly and well-equipped miners remaining aggressive. This strategy of pure choice not solely slows down the speed at which new Bitcoins are created but additionally strengthens the community by making certain that probably the most dedicated individuals maintain mining energy.

Companies concerned within the Bitcoin economic system, both by working inside it or accepting it as fee, might also face the problem of adapting to the post-halving panorama.

They might recalibrate pricing fashions in anticipation of market volatility, discover monetary devices reminiscent of Bitcoin derivatives, or reassess client spending developments inside the crypto market to mitigate potential impacts on their operations.

Traders, alternatively, are prone to expertise a mixture of volatility, hypothesis, and anticipation. As earlier mentioned, traditionally, the aftermath of a halving has seen Bitcoin’s worth surge, a feat attributed to a tightened provide met with rising or sustained demand.

This sample of worth motion post-halving has grow to be a focal point for these making an attempt to foretell Bitcoin’s future worth, making many surprise in regards to the causes behind the worth rise following a halving.

Investor methods

To guard themselves from the Bitcoin halving impact on costs, specialists advocate a number of methods for traders. Firstly, specializing in long-term investments in Bitcoin may be useful, as its worth is anticipated to extend over time.

One other technique is to make use of dollar-cost averaging (DCA). This entails investing a hard and fast quantity in BTC at common intervals, whatever the present worth. In that manner, they might common out the price per Bitcoin over time and scale back the affect of any halving-induced volatility.

Moreover, diversifying their investments by together with different digital currencies of their portfolio may assist traders unfold their danger and reduce their dependence on Bitcoin’s market efficiency.

Staying well-informed by following information and developments about Bitcoin and the broader cryptocurrency market is essential for efficiently implementing these methods.

Keep in mind that investments in crypto are extremely unstable. Don’t danger cash you’re not able to lose.

Future implications of subsequent Bitcoin halving

With the halving, Bitcoin is anticipated to cement its popularity as “digital gold.” It is because the diminished circulation of recent Bitcoins is prone to make it much more worthwhile and seen as a dependable funding to maintain.

This transformation means there may be fewer Bitcoins out there for buying and selling, which may make the availability even tighter.

Consultants consider this occasion will have an effect on not simply Bitcoin however the complete cryptocurrency market. They anticipate it to result in loads of speculative buying and selling as traders search for earnings in what may be a extra unpredictable market.

Additionally, smaller cryptocurrencies, generally known as altcoins, may expertise massive modifications of their worth. It is because the cryptocurrency neighborhood would possibly shift their investments to search out the subsequent massive success.

Because the creation of recent BTC slows down, some assume that different digital currencies may grow to be extra distinguished, both competing with or supporting Bitcoin. This might change their worth and the way they’re used on-line.

You may additionally like: The Bitcoin impact: why altcoins comply with BTC’s lead

Conclusion

In abstract, the upcoming halving occasion in April 2024 indicators a momentous event for the cryptocurrency world, shedding gentle on the intrinsic worth and shortage of Bitcoin.

This occasion highlights Bitcoin’s distinctive financial strategy, likening it to “digital gold” and making ready for what may be one other thrilling part in its extraordinary story.

The halving impacts everybody, from miners to traders, bringing each challenges and alternatives. It encourages a recent have a look at methods to take advantage of its results.

Regardless of varied predictions and excessive expectations, one factor is obvious: the halving emphasizes Bitcoin’s growing significance and its essential position in the way forward for international finance.

As each the cryptocurrency neighborhood and wider monetary analysts await the halving, there’s a basic settlement that its affect will lengthen past Bitcoin’s worth, affecting the complete digital foreign money panorama.

Learn extra: Why aren’t massive Bitcoin holders promoting regardless of excessive costs? Insights and evaluation