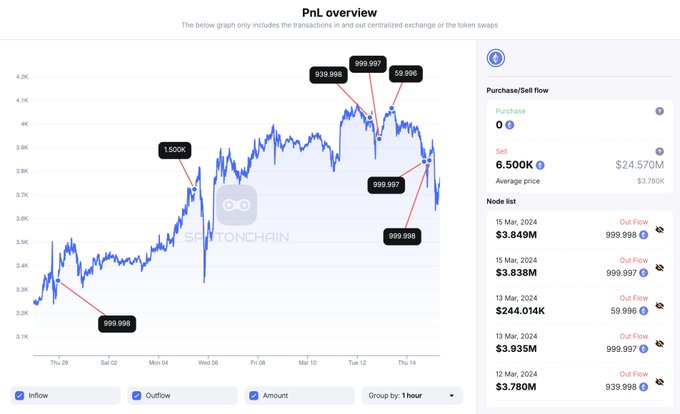

The latest fluctuations in Ethereum’s value have drawn consideration to the involvement of main gamers like FTX and Alameda Analysis. Up to now days, information from Spot on Chain exhibits these entities have been actively shifting vital quantities of Ethereum, totaling 6,500 ETH valued at $24.57 million, to Coinbase. Curiously, these transactions have been intently adopted by notable drops in Ethereum’s market worth, indicating a possible correlation between the actions of FTX and Alameda Analysis and Ethereum’s value dynamics.

Evaluation of Current Transactions and Value Affect

FTX and Alameda Analysis have been busy within the Ethereum market, executing a number of transactions in latest days. These transactions contain vital quantities of Ethereum being deposited to Coinbase, together with actions of different property totaling $6.26 million.

Notably, the market has reacted swiftly to those transactions, with Ethereum experiencing notable value drops following the vast majority of these actions. Graphical representations of those value actions spotlight the correlation between the transactions executed by FTX and Alameda Analysis and the next dips in Ethereum’s market worth, suggesting a possible causal relationship between the 2.

Additionally Learn: NFPrompt Suffers Main Hack: FBI Steps In To Guarantee Person Security

Technical Evaluation and Outlook

Turning to technical evaluation, Ethereum’s present value pattern reveals the formation of a big bearish pattern line, with resistance noticed round $3,850. Key resistance ranges are recognized close to $3,850 and the pattern line, intently aligned with the 50% Fibonacci retracement degree from latest swing highs to lows. Potential eventualities for Ethereum’s value motion hinge on breaking these resistance ranges.

A profitable breach above $3,880 may sign a resurgence in bullish momentum, doubtlessly pushing Ethereum in the direction of the $4,000 mark. Conversely, failure to beat $3,850 would possibly result in additional draw back motion. Preliminary help is anticipated round $3,680, adopted by a serious help zone close to $3,600. A decisive break beneath $3,500 may set off a deeper decline in the direction of $3,350, warranting shut monitoring of key help and resistance ranges within the days forward.

Additionally Learn: Digital Chamber CEO Advocates Bitcoin As “Inflation Proof” Amid Scorching CPI & PPI