Traditionally, each Bitcoin halving — a disinflationary mechanism inscribed within the foreign money’s code by Satoshi Nakamoto — has come a 12 months or two earlier than a brand new all-time excessive.

That is partly as a result of a halving cuts the block reward paid to miners in half, lowering the variety of new bitcoin being created and theoretically making bitcoin extra scarce.

For instance, with the newest halving to return, the block reward will fall from 6.25 bitcoin (BTC) to three.125 BTC.

The three earlier Bitcoin halvings occurred within the run-up to an all-time excessive, which then gave strategy to a worth drawdown — till the subsequent halving helped ignite one other rally, in accordance with some market observers.

Learn extra: The subsequent Bitcoin halving is coming. Right here’s what you must know.

However the upcoming halving has damaged that development. For the primary time in its historical past, bitcoin set an all-time worth excessive within the speedy run-up to the halving when it topped $70,000 this month.

Blockworks examined how bitcoin’s worth responded to prior halvings. Right here’s what we discovered.

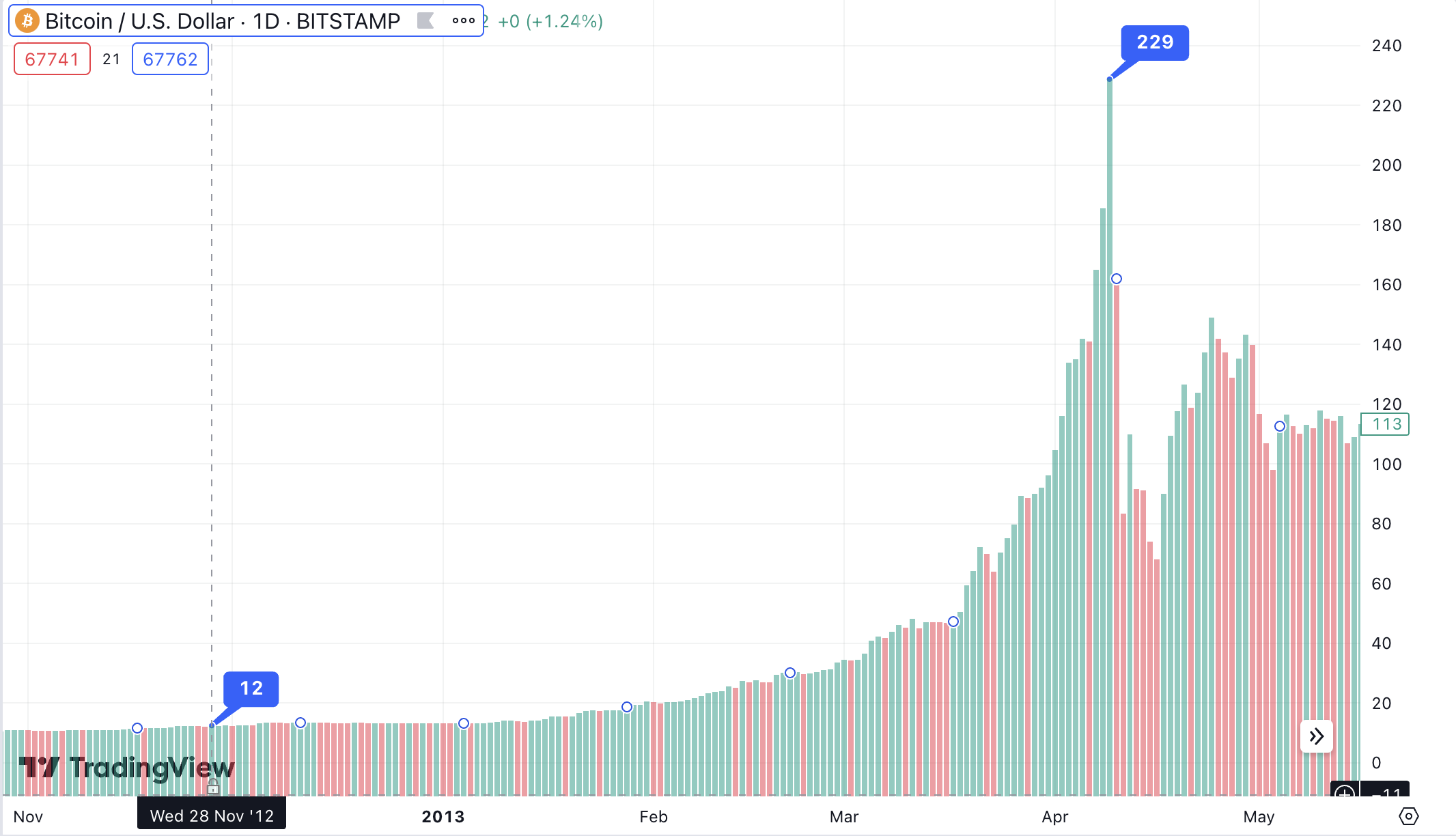

November 28, 2012: 50 BTC to 25 BTC

Practically 4 years after Bitcoin’s genesis block was mined, the community underwent its first halving.

Bitcoin’s nascent group was uncertain whether or not the availability slow-down would drive costs up, or if the halving was already priced in, as a then-teenaged Vitalik Buterin specified by Bitcoin Journal on the time. Bitcoiners gathered at meet-ups across the globe to ring within the halving.

Bitcoin, which had been buying and selling for round $12 within the lead-up to the primary halving in November 2012, jumped to $229 by April 2013, then climbed to roughly $1,132 by the next November, in accordance with TradingView.

Within the wake of the collapse of the Japan-based trade Mt. Gox, bitcoin’s worth would toil away within the tons of of {dollars} vary for the subsequent three years.

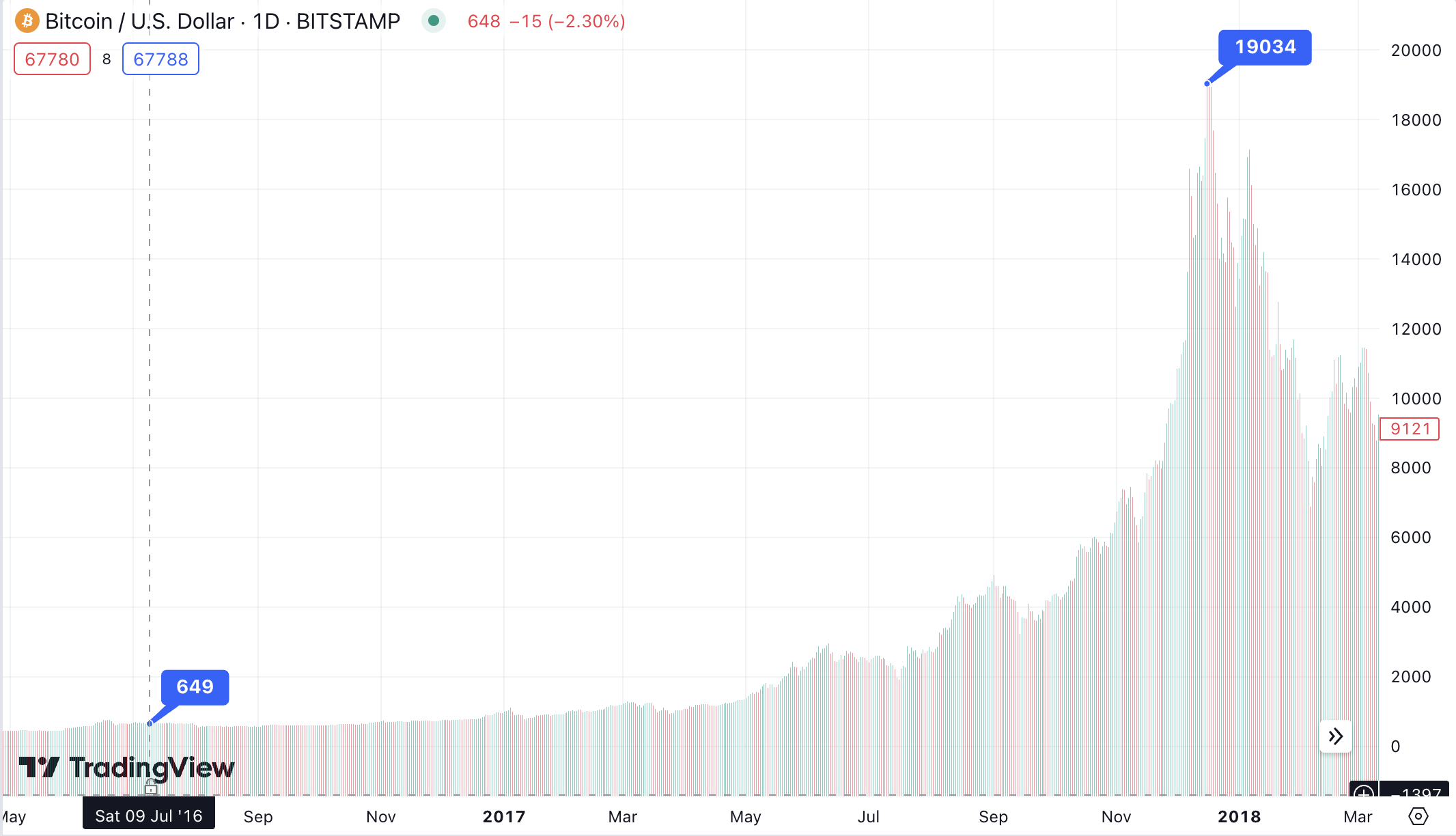

July 9, 2016: 25 BTC to 12.5 BTC

By 2016, a number of recent cryptocurrencies had cropped up. Shortly after the second halving, Ethereum would bear a tough fork within the wake of the catastrophic DAO hack.

Bitcoiners remained break up on how the second halving would have an effect on bitcoin’s worth. “Proper now, I’m disenchanted,” a person wrote on the BitcoinTalk discussion board just a few hours earlier than the block reward was reduce in half.

Learn extra: How the halving might affect bitcoin’s worth

Bitcoin’s worth steadily rose for just a few months after the second halving earlier than selecting up momentum in Could 2017. By December 2017, bitcoin hit a brand new excessive of roughly $19,188, a market occasion that got here a 12 months and a half after the halving.

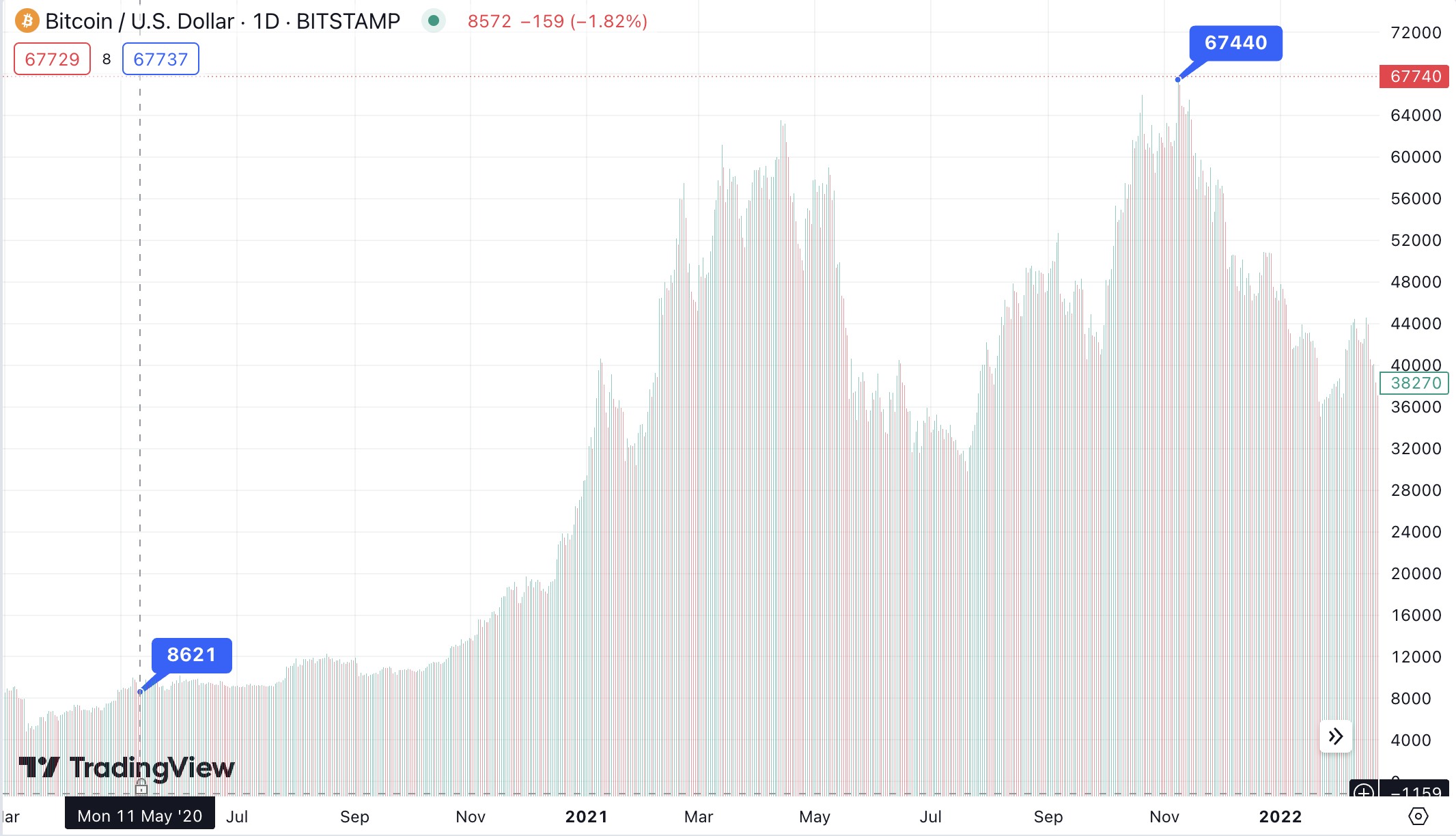

Could 11, 2020: 12.5 BTC to six.25 BTC

By the third halving, Bitcoin was greater than a decade previous and had turn into extra of a recognized commodity.

“Hey guys I believe bitcoin is halving right now, unsure when you’ve heard,” a brand new crypto trade founder named Sam Bankman-Fried tweeted. The markets publication of TD Ameritrade printed a bit questioning whether or not the halving was already priced in.

As soon as once more, it wasn’t.

Bitcoin’s worth rose from round $8,500 on the Could 2020 halving to over $40,000 by January 2021. Bitcoin topped $63,000 in April earlier than peaking above $67,000 in November 2021, 9 years after the primary halving.

April 2024: 6.25 BTC to three.125 BTC

It looks as if a idiot’s errand to query whether or not the subsequent Bitcoin halving will result in a worth run at this level, however the circumstances are noticeably completely different this time round.

When the decade-long combat for the Securities and Alternate Fee’s approval on spot bitcoin ETFs resolved in January, bitcoin launched into an ongoing bull run to an all-time excessive above $73,000.

That is uncharted territory for halvings, which beforehand got here with bitcoin’s worth far under its prior peak.