The success of spot Bitcoin ETFs inside simply two months of launch has clearly irked some lawmakers within the U.S. On Thursday, March 14, Senator Reed and Senator Butler wrote to the U.S. Securities and Alternate Fee (SEC) urging them to chorus from approving extra Alternate-Traded Merchandise (ETPs) for different tokens past Bitcoin. Not directly, the lawmakers have been pushing the SEC to disclaim the spot Ethereum ETF that has been just lately into account.

The success of the BTC spot merchandise clearly ruffling some feathers on the Hill. @SenatorJackReed and @Senlaphonza write to the @SECGov urging:

-no additional ETPs for different tokens

-make life troublesome (i.e. examinations/opinions) for brokers and advisers that suggest BTC ETPs pic.twitter.com/enxdumC02N— Alexander Grieve (@AlexanderGrieve) March 14, 2024

ETH Is Extra Liquid Than Most S&P 500 Shares

Paul Grewal, Chief Authorized Officer at Coinbase, respectfully responds to Senators, offering proof that contradicts their assertions. He highlights that their evaluation has been shared with SEC workers and affords to debate it with them or some other policymakers looking for clarification.

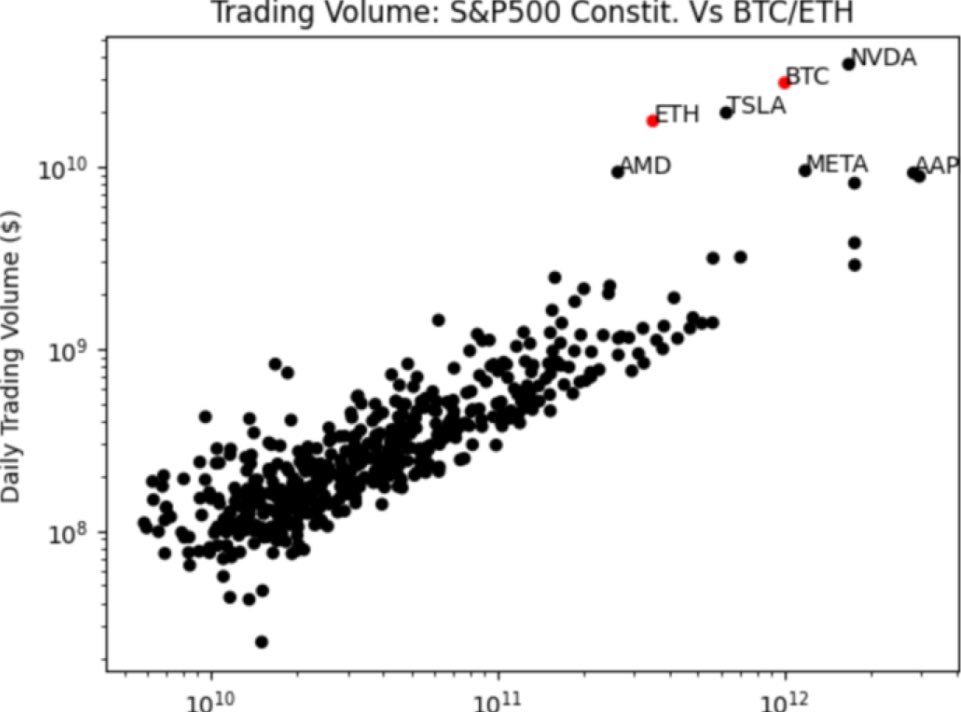

Grewal emphasizes that many digital asset commodities, not restricted to Bitcoin, exhibit market high quality metrics that surpass even the most important traded equities. For example, Ethereum’s (ETH) spot market is characterised by depth and liquidity, with solely two S&P 500 shares boasting greater notional greenback buying and selling volumes. Furthermore, just one S&P 500 inventory has decrease adjusted bid-ask spreads than ETH.

Courtesy: Paul Grewal

Compared to Bitcoin, Grewal factors out that ETH’s futures and spot markets display the identical excessive and constant correlation, which facilitates market surveillance. This underscores the robustness and reliability of Ethereum’s market infrastructure.

Main Ethereum contributor Anthony Sassano argues that no matter private emotions in the direction of Ethereum (ETH) or the need for it to have an ETF, people ought to oppose this growth. He highlights that many policymakers view all cryptocurrencies as the identical entity, resulting in potential implementation of unfavorable insurance policies affecting your entire crypto business. Sassano emphasizes the significance of advocating towards such actions to stop detrimental outcomes for all cryptocurrencies, irrespective of non-public preferences.

Even in the event you hate ETH and do not wish to see it get an ETF, try to be pushing again on this

“Crypto” is all in the identical bucket for these boomers so they may deal with it as such and attempt to advance actually dangerous coverage round all of crypto – not simply the cash you personally hate https://t.co/RW86D1YmE2

— sassal.eth/acc 🦇🔊 (@sassal0x) March 15, 2024

Spot Ethereum ETF Can Outpace Bitcoin ETFs

As just lately reported, the optimism surrounding the spot Ethereum ETFs has been waning amid the strain from the lawmakers. Nevertheless, VanEck revealed a report on Thursday, March 14, stating that spot Ether ETFs might be really larger than Bitcoin ETFs. VanEck Portfolio Supervisor Pranav Kanade stated:

“From a market perspective, a part of me believes that the market measurement for a spot ETH ETF is probably as massive if not larger than the spot bitcoin ETFs. The world of buyers who’re searching for money producing property is huge and ETH clearly generates charges that goes to the token holders. Even in the event you don’t have an ETF that may provide staking as part of it, it’s nonetheless a money producing asset, so I believe ETH might make extra sense as an asset to extra individuals than Bitcoin does.”

With Ethereum’s Proof of Stake, ETH holders can earn yield by staking on the blockchain. Coinbase affords round a 3% yield for ETH stakers. Nevertheless, SEC approval for spot ETH merchandise is unsure. Bloomberg analysts now estimate a 30% likelihood, whereas Kanade suggests it’s nearer to 50%.