Based on Bitwise’s Chief Funding Officer, Matt Hougan, the Securities and Trade Fee (SEC) is contemplating a delay in approving extremely anticipated Ethereum exchange-traded funds (ETFs).

This improvement comes on the heels of Bitwise Asset Administration’s intention to listing a spot Ethereum ETF.

Potential Ethereum ETF Approval Delay

Bitwise launched its spot Bitcoin ETF, the Bitwise Bitcoin ETF (BITB), on January 11. Since then, the ETF has seen a meteoric rise, amassing over $2 billion in belongings and rating fifth within the so-called “Cointucky Derby.”

Hougan shared insights into the explosive development of BITB and different spot ETFs, underscoring their unprecedented acceleration in comparison with historic ETF launches.

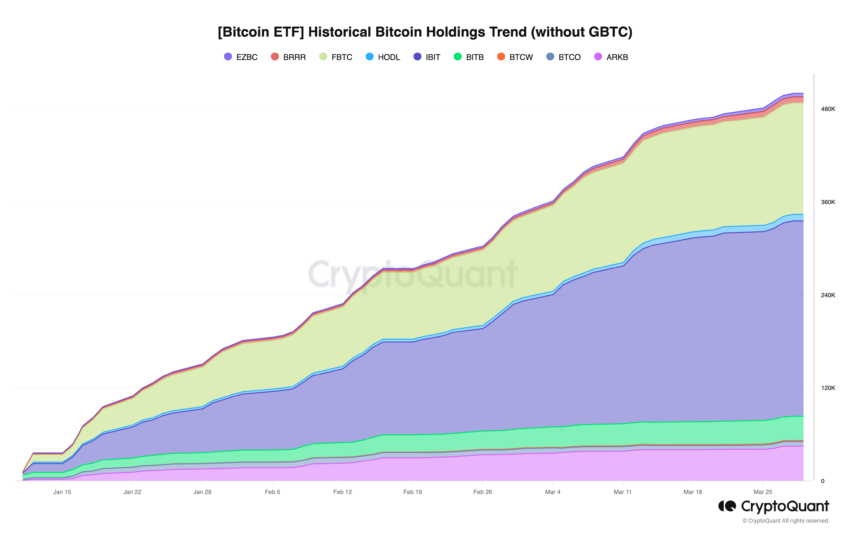

“These [spot Bitcoin ETFs] are the quickest rising ETFs of all time by a big fraction. I imagine the quickest rising ETF prior to those was the Nasdaq 100 ETF (QQQM), which went from zero to $5 billion in a single 12 months. These ETFs have pulled in internet $10-plus billion in below two months,” Hougan emphasised.

Bitcoin ETF Holdings. Supply: CryptoQuant

Regardless of the sucess spot Bitcoin ETFs have seen, Hougan warned concerning the potential delay within the Ethereum ETF’s approval. This will likely stem from regulatory warning, given the rising curiosity in cryptocurrency investments and the complicated dynamics of the market.

Hougan expressed confidence within the eventual launch of an Ethereum ETF. Nonetheless, he anticipated {that a} delay till later within the 12 months would possibly really profit the market by permitting conventional finance (TradFi) extra time to grasp and embrace crypto.

“We expect that’s a pure pathway that crypto buyers have adopted for 15 years. They begin with Bitcoin after which they need publicity to different issues. I believe Ethereum can be very enticing. I believe the [Ethereum] ETFs can be extra profitable in the event that they launch in 12 months than in the event that they launch in Might. I do know that sounds goofy, however I believe TradFi remains to be digesting Bitcoin and in the event you give TradFi time to get comfy with Bitcoin and crypto, they are going to be prepared for the following factor,” Hougan defined.

This strategic persistence might pave the best way for a extra strong and knowledgeable entry of institutional and retail buyers into Ethereum, following the overwhelming success of Bitcoin ETFs.

Hougan’s insights reveal a big shift within the notion of cryptocurrencies, from skepticism to a acknowledged potential for substantial returns on funding. Because the SEC weighs its determination, the cryptocurrency neighborhood stays on edge, longing for a inexperienced mild that might additional legitimize and catalyze investments in Ethereum and past.