Fast Take

Current market knowledge reveals that MicroStrategy continues to outperform each Bitcoin equities and Bitcoin itself. The corporate’s share value noticed a big surge of twenty-two% on March 25, catapulting it up 40 locations to the 280th place amongst US firms by market cap. This improve brings its market cap to a hefty $31.50 billion, in response to Corporations Market Cap.

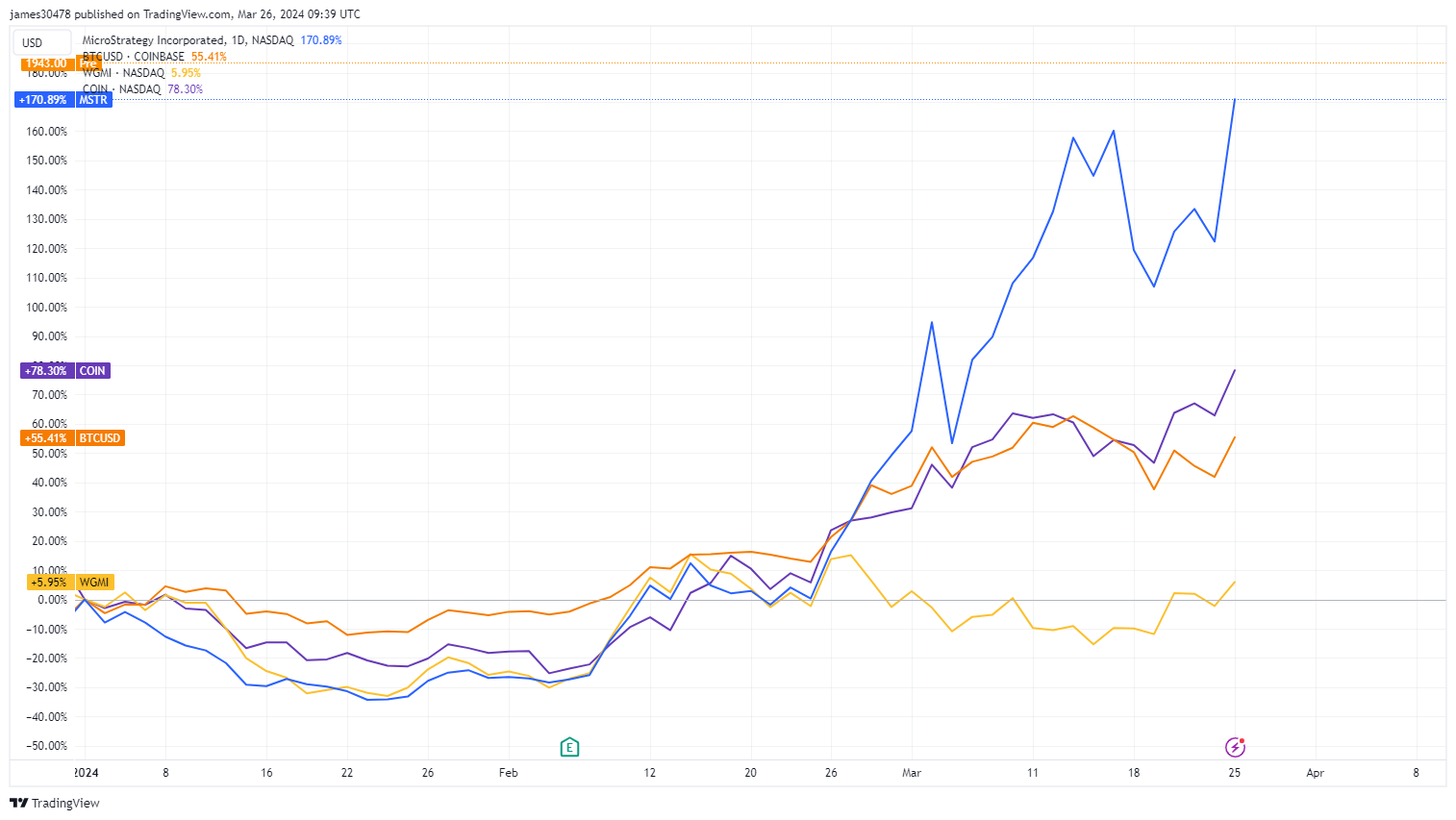

MicroStrategy has exhibited a outstanding efficiency within the year-to-date evaluation, with its worth surging by 171%, outpacing Bitcoin’s 55% improve in the identical interval. Coinbase additionally demonstrated sturdy progress, with a commendable 78% rise. In distinction, the WGMI ETF, which serves as a proxy for the Bitcoin mining business, has proven a modest acquire of 6%.

Whereas MicroStrategy’s all-time excessive share value peaked at $3,300 in 2000, it at the moment trades at roughly half that determine, round $1,856. Nevertheless, in response to Market Watch, early market indicators present a 4% improve in pre-market commerce, making the $2,000 mark nicely inside attain.

Regardless of the launching of the Bitcoin spot ETFs on Jan. 11, MicroStrategy’s premium worth standing stays unchallenged. Opposite to market chatter predicting a decline, the corporate noticed a staggering 246% improve, far outpacing the 52% improve of the BlackRock ETF IBIT.

As of March 19, MicroStrategy has accrued a complete of 214,246 BTC, which represents a considerable holding exceeding 1% of the overall international provide of Bitcoin.