Bitcoin (BTC) is at the moment hovering and consolidating above the $70,000 mark, partly buoyed by a slowdown in outflows from spot exchange-traded funds (ETFs). With the cryptocurrency having not too long ago shattered two file highs inside days, all eyes are on its potential for yet one more historic milestone.

On this regard, TradingShot, a crypto buying and selling skilled, shared insights in a TradingView publish on March 30. In response to the evaluation, Bitcoin’s technical indicators strongly level to a bullish instant worth goal that would pave the best way for a brand new file excessive of $78,000.

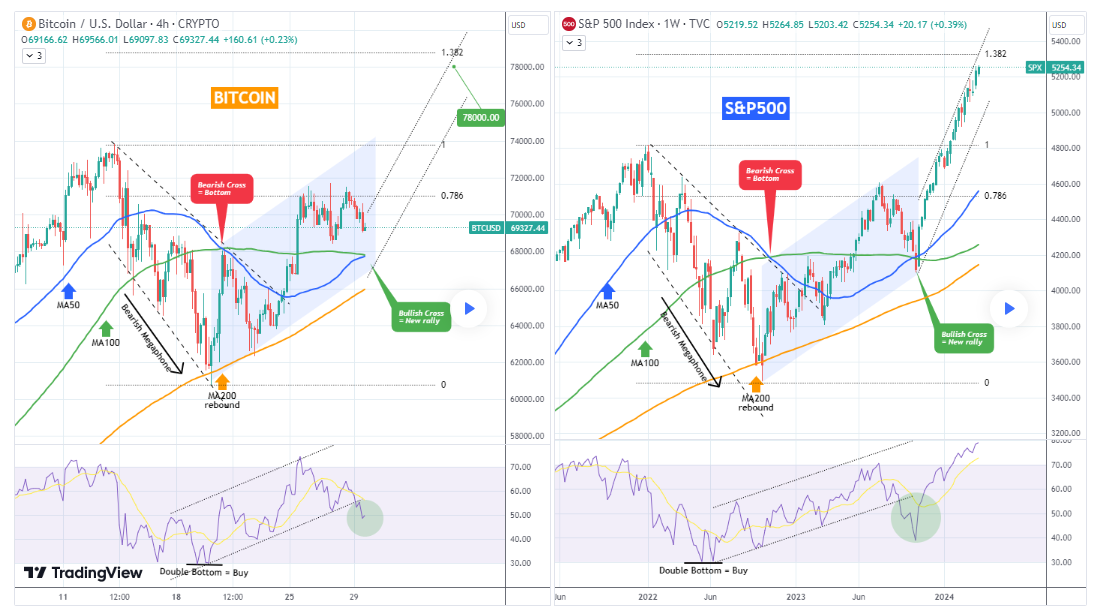

The analyst identified that Bitcoin is mirroring a fractal sample noticed within the S&P 500 index, albeit in numerous time frames. Whereas Bitcoin operates on a four-hour timeframe, the S&P 500 evaluation is on a weekly timeframe.

The evaluation notes that Bitcoin is retracing towards its four-hour transferring common of fifty (MA50) and is on the verge of forming a bullish cross. The analyst attracts parallels with the S&P 500 fractal and means that traders ought to understand this cross as a big purchase sign. This sign, very similar to it was for the S&P 500, initiated an aggressive rally that continues to dominate the market.

Moreover, the comparability notes that the asset lessons commenced with a bearish megaphone sample following their respective peaks. Subsequently, they reached and maintained their transferring common of 200 (MA200).

Bitcoin overbought territory

From a Relative Power Index (RSI) perspective, each Bitcoin and the S&P 500 skilled an analogous journey, with a channel-up sample main them to the overbought territory subsequent to an oversold double backside formation, which acted as a further purchase sign.

He famous that primarily based on this evaluation, Bitcoin is at the moment within the 0.786 rejection section. Upon completion of this pullback, the S&P 500 fractal means that Bitcoin’s instant goal ought to hover across the 1.382 Fibonacci extension, culminating in a price of roughly $78,000.

It’s value noting that Bitcoin is at the moment sustaining its place above $70,000 after efficiently avoiding a dip under the $60,000 threshold. This sustained stability is partly as a result of lowered outflows from most spot ETFs, coupled with anticipation surrounding the upcoming halving occasion.

Bitcoin worth evaluation

As of the time of writing, Bitcoin was buying and selling at $70,180, marking features of practically 9% over the previous seven days.

Along with the components surrounding the upcoming halving and ETF flows, the present worth of Bitcoin stays vulnerable to selections made by the Federal Reserve relating to rates of interest.

Disclaimer: The content material on this web site shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.