Fast Take

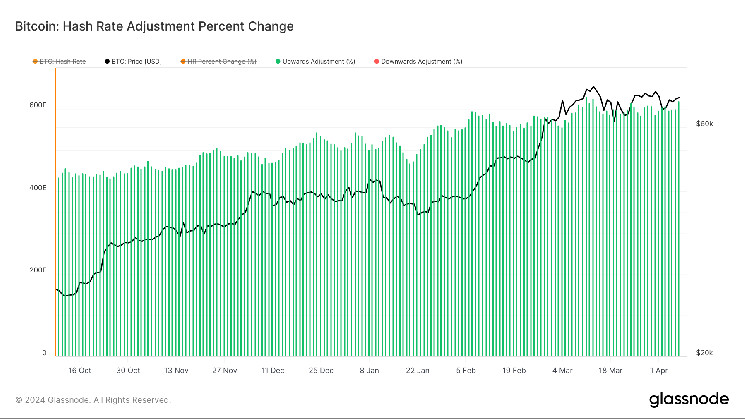

The Bitcoin community is experiencing a outstanding surge in its hash fee, a vital metric that displays the computing energy devoted to processing transactions and sustaining the blockchain. In response to the most recent Glassnode information, the 7-day transferring common hash fee has reached an astonishing 620 EH/s, nearing all-time highs.

Notably, the upcoming issue adjustment, scheduled for Apr. 10, is projected to exceed 3%, in line with Newhedge, additional reflecting the rising computational energy securing the community. This adjustment is especially important because it precedes the much-anticipated Bitcoin halving occasion scheduled for Apr. 20, the place the block reward for miners will probably be diminished by 50%.

Marathon Digital Holdings CEO Fred Thiel shared a thought-provoking perspective throughout his look on Anthony Pompiliano’s podcast. Thiel means that sovereign nations are actually actively contributing to the worldwide hash fee surge, a development with probably important implications.

Thiel defined:

“Soverigns who’re involved in entering into the mining of Bitcoin initially for monterary causes however actually for money reserve and treasury causes and people are people who find themselves prepared to mine at probably decrease earnings than companies whose focus is producing a revenue from Bitcoin mining”.

A compelling angle to think about is CryptoSlate’s evaluation of a possible hash fee correction following the halving, as older miners could turn into unprofitable and disconnected. Suppose a big correction within the hash fee fails to materialize. Might or not it’s attributed to sovereign nations participating in mining with out profitability issues, probably leveraging plentiful entry to cheap renewable power sources?