Bitcoin mining giants, together with RIOT Platforms and Marathon Digital, expertise a manufacturing decline in 2024, whereas CleanSpark stands out with progress.

As Bitcoin‘s fourth halving approaches, Bitcoin mining giants are grappling with a decline in manufacturing because the market faces intensified competitors and reducing charges.

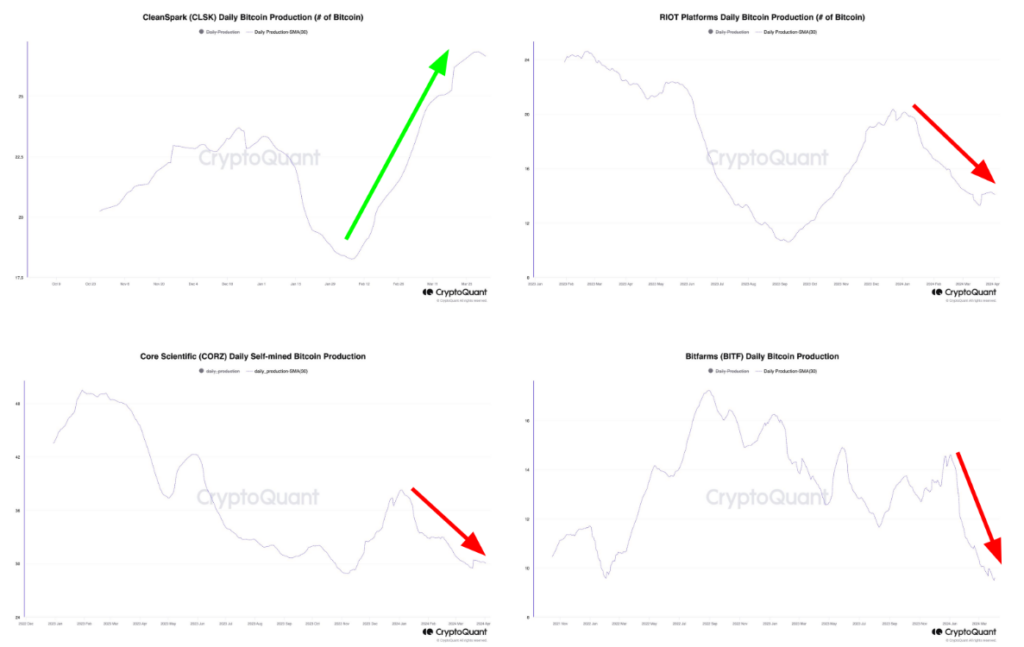

Latest findings from CryptoQuant’s analysis report reveal that the biggest crypto mining companies like RIOT Platforms, Core Scientific, Bitfarms, and Marathon Digital have all witnessed a stoop in BTC manufacturing in 2024.

This decline is attributed to a confluence of things, together with decreased transaction charges on the Bitcoin community, heightened community hashrate, and a few operational disruptions. On the identical time, CleanSpark stands out as an exception, boasting progress in Bitcoin manufacturing amid the business’s downturn, CryptoQuant notes.

Bitcoin miners’ exercise in 2024 | Supply: CryptoQuant

You may additionally like: CoinGecko: Bitcoin rose by 3,230% on common after every halving

In a bid to mitigate monetary pressures, some miners have escalated their promoting exercise forward of the halving, CryptoQuant stated, including that miner day by day promoting to some over-the-counter desks elevated to 1,600 BTC in late March, the best promoting quantity since August 2023.

Regardless of these challenges, competitors stays fierce within the sector, with Bitcoin’s community hashrate persevering with to rise, necessitating elevated assets for sustaining day by day manufacturing ranges. CryptoQuant’s knowledge underscores “record-high competitors for Bitcoin block rewards,” with hashrate surging because the earlier halving in 2020.

Whereas the market faces intense competitors, specialists recommend a unique panorama in comparison with earlier years, noting that present crypto costs are offering reduction to many miners. Based on Hub 8 CEO Asher Genoot, the dynamics differ from these seen in 2022, indicating that the present market circumstances are supporting miners quite than resulting in widespread bankruptcies.

Learn extra: Bitcoin mining problem drops following historic most