Ethereum’s worth has declined considerably over the weekend because of the rising tensions within the Center East. But, there are nonetheless potential help ranges out there to carry the value.

Ethereum Value Technical Evaluation

By TradingRage

The Each day Chart

Throughout the day by day timeframe, Ethereum’s worth has shaped a big bullish flag sample. The latest drop has briefly pushed the value under the $3,000 help stage, however the market has rebounded from the decrease boundary of the channel. Judging by the short restoration, the drop under $3,000 could be thought of as a false bearish breakout.

Subsequently, ETH’s worth could be anticipated to rally towards the $3,600 resistance stage and the upper boundary of the flag within the coming days. The response to those ranges could be essential, as it could decide the longer-term market pattern.

The 4-Hour Chart

Dropping decrease to the 4-hour timeframe, the value is approaching the $3,300 short-term resistance stage. If the market efficiently climbs above the talked about mar, it might rally towards the $3,600 resistance and retest it as soon as extra.

The Relative Power Index can be rising above the 50% threshold, indicating that the momentum is shifting in favor of the patrons, and the market may quickly return to the upper area of the big channel. Subsequently, buyers could be hopeful that the long-term bull market is way from over.

Sentiment Evaluation

By TradingRage

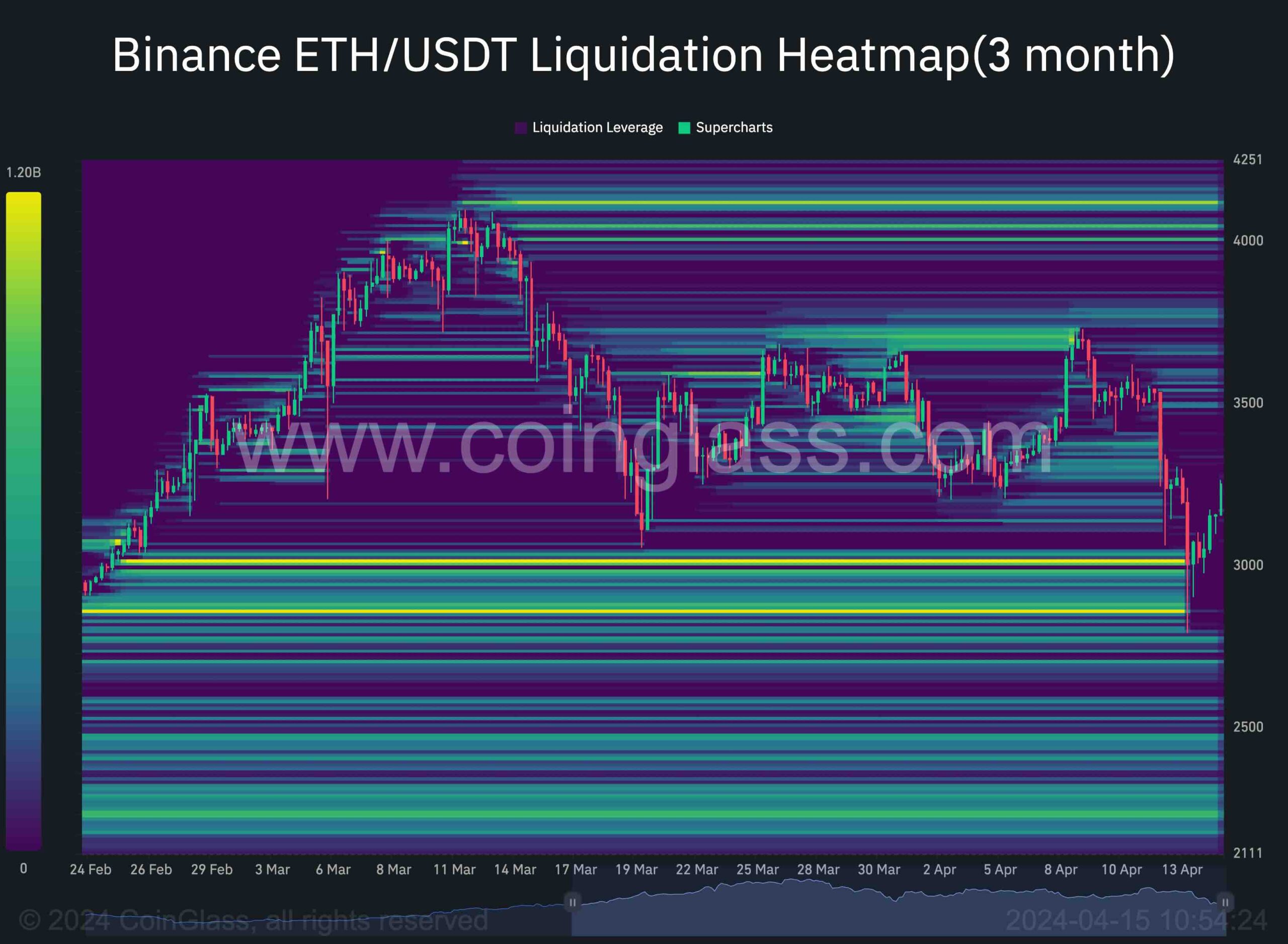

Ethereum Liquidation Heatmap

Throughout the weekend, the value briefly dropped under the $3,000 help stage. This space could be thought of a vital zone from a technical evaluation standpoint. Subsequently, many buyers may need put their cease losses there.

This chart demonstrates the Binance ETH/USDT pair’s liquidation heatmap. The value’s decline under the $3,000 stage has liquidated a substantial portion of the lengthy positions.

Because the cryptocurrency is at the moment recovering, it may be assumed that the promoting stress ensuing from these liquidations has been met with enough demand, and the latest drop may need been a bear entice. Subsequently, the market can goal liquidity above the $4,000 stage if nothing surprising occurs within the quick time period.