Ethereum’s (ETH) momentum may be set for a change, as on-chain fundamentals are strengthening, in keeping with the “On-chain Insights” e-newsletter from on-chain evaluation agency IntoTheBlock. The e-newsletter highlights the criticism in the direction of ETH in latest months each inside crypto over underperformance versus Bitcoin (BTC) and within the mainstream over hypothesis of it being deemed an unregistered safety.

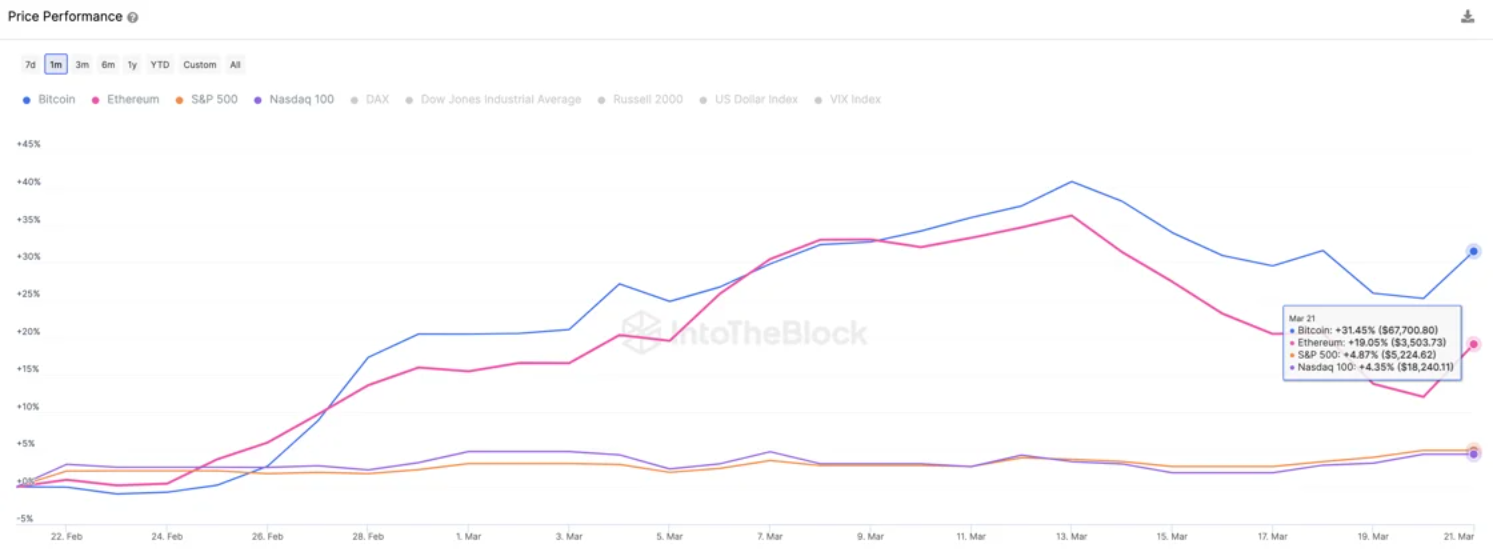

Lucas Outumuro, head of analysis at IntoTheBlock, says the underperformance is actual. The ratio of ETH to BTC not too long ago hit 0.05, close to its lowest level since June 2022, and ETH has lagged each Bitcoin and the S&P 500 in risk-adjusted returns.

But Ethereum’s day by day common switch quantity on mainnet reached its highest stage since Might 2022 this week. Furthermore, layer-2 (L2) exercise has boomed, with over 10 million ETH now deposited and transactions greater than double mainnet’s.

Outumuro assesses that the decrease charges post-Dencun ought to drive additional L2 progress and that the bettering of the basics didn’t go unnoticed by long-term ETH buyers.