Ethereum worth up to now month has generated billions of {dollars} in income for its traders, following a 56% rally.

Nevertheless, it will most probably be paused because the bull market has reached its saturation level, and ETH will start a decline whereas the market cools down.

Ethereum Market High Confirmed

Ethereum worth could possibly be seen buying and selling at $3,921 on the time of writing. The second greatest cryptocurrency on the earth has grown by 56% up to now month, rising from $2,500 to buying and selling worth.

In doing so, the ETH in circulation additionally grew to become worthwhile, and with the digital asset now lower than 18% away from the all-time excessive of $4,626, the market high seems to have shaped. A market high signifies the height degree attained by asset costs or indices earlier than a subsequent decline. This usually signifies a shift from bullish sentiment to potential downward tendencies or corrections.

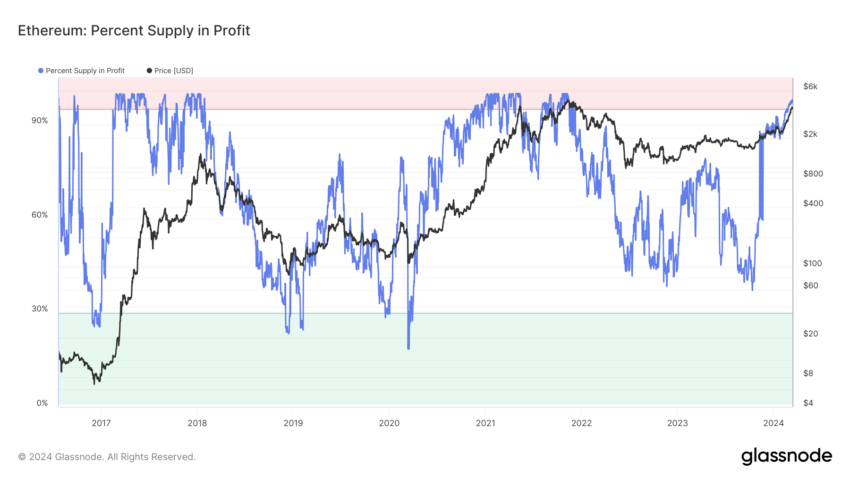

Such a market high is shaped when greater than 95% of the circulating provide is in revenue, and in the intervening time, 97.5% of the provision is in revenue. The occasion final occurred in November 2021, when ETH shaped the earlier all-time excessive.

Ethereum Provide In Revenue. Supply: Glassnode

This confirms {that a} worth fall is on the playing cards. Secondly, technical indicators are additionally turning bearish, confirming that the bull run is coming to a halt. The MACD (Transferring Common Convergence Divergence) is a technical evaluation indicator that measures the connection between two shifting averages of an asset’s worth, serving to establish pattern reversals and momentum shifts.

MACD on the each day chart is on the cusp of forming a bearish crossover, with the histogram set to show crimson candles over the approaching days. The identical could be noticed within the Relative Energy Index (RSI).

Ethereum RSI and MACD. Supply: TradingView

It is a momentum oscillator gauging the velocity and alter of worth actions to establish overbought or oversold situations in an asset. In the intervening time, it’s receding from the overbought zone, suggesting the bullishness is waning.

ETH Value Prediction: The Resistance Block Is Now a Assist Block

Ethereum worth is buying and selling above the three-year-old resistance block between $3,582 and $3,829. By the appears of it, ETH will principally possible fall via this block to check the 50% Fibonacci Retracement line marked at $3,582.

If the profit-taking is powerful and the second-generation cryptocurrency falls additional, a decline to $3,336 is feasible. This could mark a 14% drawdown for Ethereum, bringing it again to early March’s worth.

ETH/USDT 1-week chart. Supply: TradingView

Nevertheless, for the reason that higher restrict of the resistance block coincides with the 61.8% Fibonacci Retracement. This degree is also referred to as the bull run help flooring. If ETH sustains above it, it could actually strive one other hand at establishing a brand new all-time excessive. For a similar, it will must climb by 17.93%, invalidating the bearish thesis.