Following the profitable implementation of the Dencun improve, Ethereum has encountered important promoting stress. As of the newest replace, the Ethereum (ETH) worth has declined by 7.8%, buying and selling at $3,669 with a market capitalization of practically $450 billion. Moreover, Ethereum’s each day buying and selling quantity has surged by 45% to $32.29 billion

Ethereum (ETH) Worth Ranges to Watch Forward

The Ethereum worth confronted resistance on the $4,000 stage and initiated a downward correction, mirroring Bitcoin’s motion. ETH dipped beneath essential assist ranges at $3,920 and $3,850, signaling a short-term bearish pattern.

It briefly dropped beneath the $3,680 assist space, reaching a low of $3,625 earlier than consolidating losses. At present, a big bearish pattern line is forming with resistance round $3,850. The first resistance ranges are close to $3,850 and the pattern line, near the 50% Fibonacci retracement stage from the latest swing excessive at $4,083 to the low of $3,625.

If the Ethereum (ETH) worth surpasses the $3,880 resistance, it might regain bullish momentum, aiming for the $4,000 stage. Conversely, failure to interrupt above $3,850 might result in additional draw back motion. Preliminary assist is at $3,680, adopted by a significant assist zone close to $3,600, with a possible draw back goal at $3,500. A decisive break beneath $3,500 would possibly set off a decline towards $3,350.

Supply: Buying and selling View

Well-liked crypto analyst CrediBULL Crypto defined that the vary of $3600-$3700 for Ethereum is prone to appeal to important shopping for curiosity within the brief time period.

Moreover, blockchain analytics agency Elliptic uncovered a considerable transaction involving $12 million price of Ether by the Lazarus Group. This switch was facilitated by Twister Money, a cryptocurrency mixer. Regardless of being topic to sanctions, the North Korean hacker group has resumed its use of this platform.

The funds are traced again to a cyber-attack on HTX and the Heco Bridge in November, orchestrated by the Lazarus group. This assault resulted in important losses amounting to $100 million for the affected platforms.

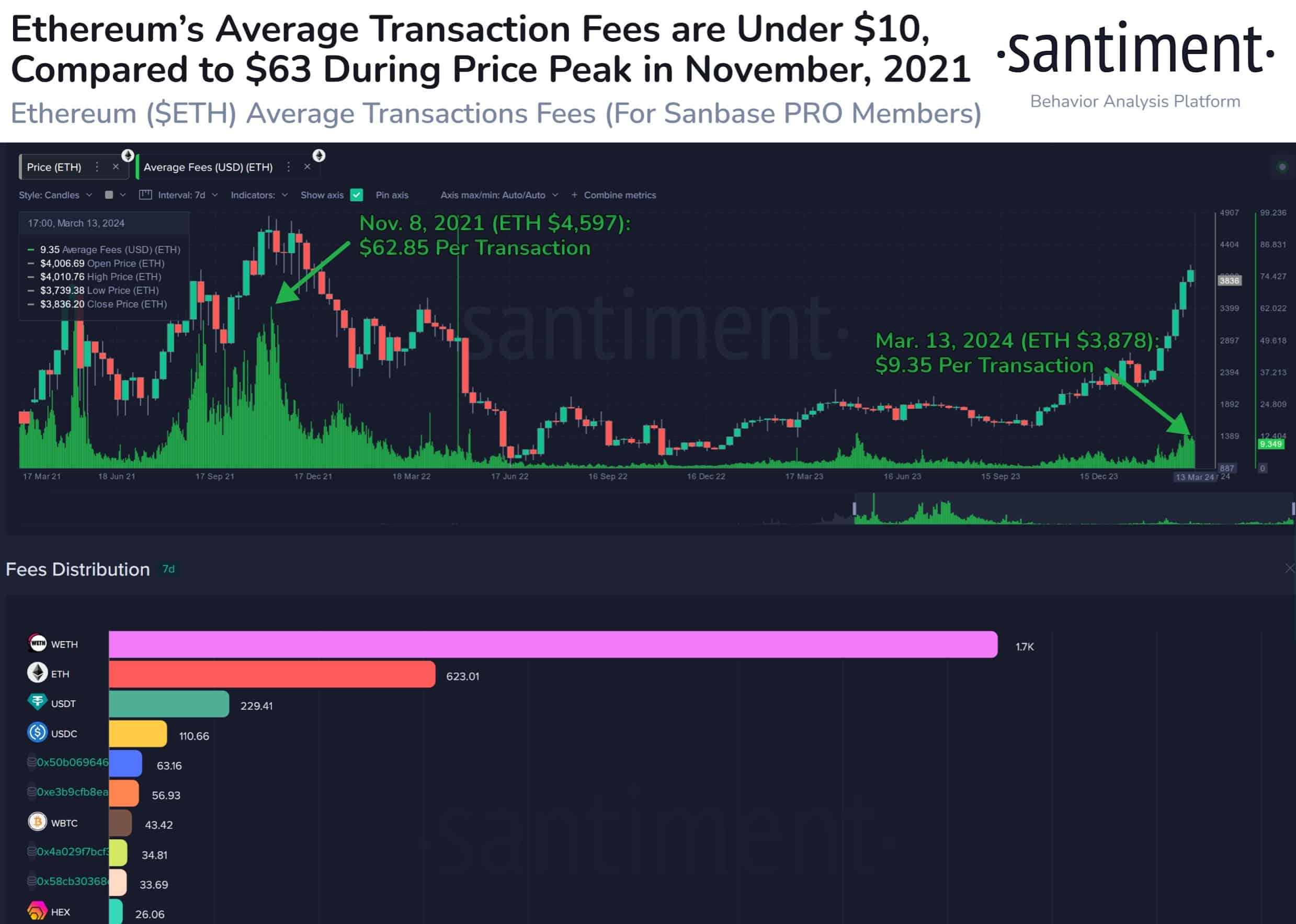

ETH Fuel Payment Drops Underneath $10

In accordance with Santiment, an on-chain knowledge supplier, the present state of affairs of Ethereum surpassing a $4,000 market worth differs from October and November 2021. At this time, the community’s transaction prices are considerably decrease, standing at lower than 1/sixth of the earlier ranges. With fuel charges averaging $9.35, this enchancment will be attributed partially to the enhancements in community charges following the transition to Ethereum 2.0.

Courtesy: Santiment