On-chain analytical platform Spot On Chain reveals that crypto whales have channeled $35.11 million in stablecoins into Ethereum (ETH), propelling its worth previous $3,400.

These crypto whales’ actions will doubtlessly carve the trail for Ethereum’s forthcoming worth motion.

How Crypto Whales’ Actions Established a Sturdy Assist For ETH Worth

A better have a look at the transactions reveals a strategic play. Eight crypto wallets, probably underneath a single entity’s management, deployed $20.86 million in USDT to buy 6,144 ETH, averaging a worth of $3,395.

“Notably, 5 wallets labeled “Tackle Group 1” have been funded with USDT by pockets 0x065 whereas these from “Tackle Group 2” have been funded with USDT by pockets 0x8ce. These two funding wallets, in flip, had made a number of transfers in USDT and ETH with each other; thus, probably belong to 1 entity,” Spot on Chain defined.

Furthermore, one other vital commerce concerned crypto pockets 0x5e9, which purchased 4,178 ETH with $14.245 million in DAI, averaging $3,410 per ETH. This crypto whale beforehand earned a hefty revenue of $7.48 million from buying and selling actions in Ethereum and Wrapped Bitcoin (WBTC).

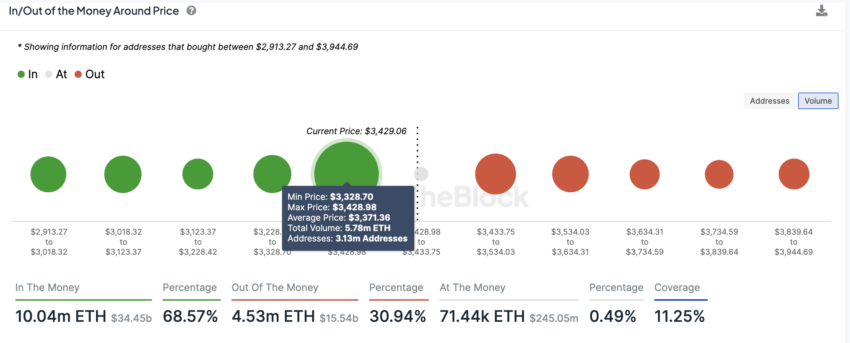

Now, specializing in market developments, the In/Out of the Cash Round Worth (IOMAP) chart reveals Ethereum tightly bracketed by current crypto whales’ transactions. Consequently, a strong assist degree has shaped between $3,328 and $3,428. Right here, about 3.13 million addresses acquired 5.78 million ETH, with a median worth of $3,371.

If Ethereum dips beneath this assist, it might face substantial resistance, doubtlessly curbing its upward momentum. Conversely, above this zone, resistance seems much less daunting.

The subsequent vital barrier spans from $3,433 to $3,534. At this degree, 2.1 million addresses beforehand purchased 1.6 million ETH, setting a median worth of $3,499.

Learn Extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum IOMAP Chart. Supply: IntoTheBlock

There are possibilities that some traders would possibly promote at these ranges to interrupt even, probably inflicting Ethereum’s worth to appropriate. Thus, these transactions are pivotal in shaping Ethereum’s near-term worth trajectory.

Nonetheless, Hitesh Malviya, the founding father of the on-chain analytical platform DYOR, believes that Ethereum has shaped a neighborhood backside.

“After 17 days of re-accumulation interval on ETH, the market worth is lastly shifting above the truthful worth, indicating that we’ve discovered the native backside and are able to go up,” Malviya stated.

DYOR claims that its truthful worth mannequin helps estimate the intrinsic worth of a token based mostly on provide and demand dynamics. Nevertheless, it’s an experimental mannequin with a margin of error concerned.