CHEX, the native token of Singapore-based blockchain agency Chintai has surged 42% within the final 24 hours because it gained trending standing within the U.S.

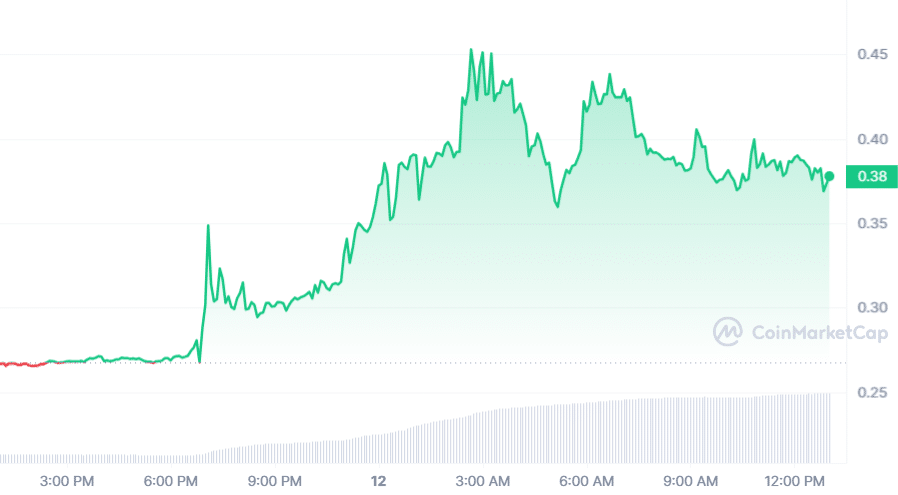

On the time of writing, CHEX was buying and selling at $0.379 with a 24-hour buying and selling quantity of $21.9m million. The most recent surge in buying and selling quantity showcases its heightened market exercise.

CHEX 24-hour value chart | Supply: CoinMarketCap

Chintai which specializes within the blockchain-based tokenization of real-world property (RWAs), comparable to actual property and CO₂ certificates, got here into inception three years in the past. Their method includes bringing tokenized RWAs to common public blockchains like Ethereum, Solana, Avalanche, and so on., utilizing community bridges.

The agency has secured two licenses granted by the Financial Authority of Singapore (MAS), which allow the functioning of a regulated digital asset market. The licensing permits Chintai to deal with a regulated, sustainable pathway that appeals to institutional capital. This encompasses a big selection of choices, from bonds to actual property and carbon credit, aiming to faucet into a considerable market cap forecasted to succeed in $16 trillion by 2030.

On Feb. 8, 2024, Chintai launched an all-in-one real-world asset tokenization platform known as Chintai Nexus. The applying helps the complete commerce life cycle of real-world digital property, comparable to carbon credit, utility tokens, collectibles, and various property.

Chintai’s current developments and the launch of Chintai Nexus signify a big step within the agency’s dedication to advancing the tokenization of real-world property.

Constructing on this momentum, the funding administration agency Blackrock has introduced the creation of the BlackRock USD Institutional Digital Liquidity Fund in partnership with Securitize, a number one asset tokenization agency from the British Virgin Islands.

You may additionally like: RIO token up greater than 190% because the hype round RWAs takes middle stage

Whereas the precise property the fund will maintain stay undisclosed, Securitize’s involvement hints at a deal with tokenizing real-world property (RWA). The method includes representing possession of a broad array of property by means of a blockchain token, a observe gaining traction for its potential to reinforce asset liquidity and effectivity.

The transfer follows BlackRock’s foray into digital asset funds, itemizing a spot-based bitcoin (BTC) exchange-traded fund (ETF) in January, which amassed over $15 billion of property underneath administration. The corporate additionally filed for a spot ether (ETH) ETF final 12 months.

BlackRock CEO Larry Fink mentioned in a January interview with CNBC that BTC and ETH ETFs “are simply stepping stones in direction of tokenization and I actually do imagine that is the place we’re going to be going.”

Tokenization of real-world property is a rising sector within the intersection of digital property and conventional finance that includes putting conventional property on blockchain rails in pursuit of quicker settlements and elevated effectivity.

Learn extra: K33 Analysis: Chainlink is greatest asset that reveals rising tokenization for RWA