Bitcoin’s worth has lastly corrected after weeks of aggressive rallying. It dropped by round 10% not too long ago, leaving market members questioning whether or not a deeper crash needs to be anticipated.

Technical Evaluation

By TradingRage

The Day by day Chart

Trying on the day by day chart, the value has been rallying over the previous few months, constantly making greater highs and lows. But, the $75K resistance degree rejected Bitcoin decrease, and the market is presently dropping under the $68K assist degree. But, there’s nonetheless a major assist degree out there across the $60K mark to stop a crash.

In the meantime, the Relative Power Index has been exhibiting a transparent bearish divergence recently, indicating that the market is more likely to undergo a extra extended correction section.

The 4-Hour Chart

On the 4-hour chart, the value motion seems a lot clearer. The market has made a excessive under the $75K degree and is presently testing the $68K assist zone.

A bearish breakout is more likely to result in an additional decline towards the $60K degree within the quick time period. The RSI exhibiting values under 50% confirms that the momentum has now switched to bearish, and an additional drop appears possible.

On-Chain Evaluation

By TradingRage

Bitcoin STH SOPR

Whereas Bitcoin’s worth has lastly proven some willingness to tug again after making a brand new all-time excessive, it could be helpful to investigate the underlying fundamentals of the community to determine the rationale.

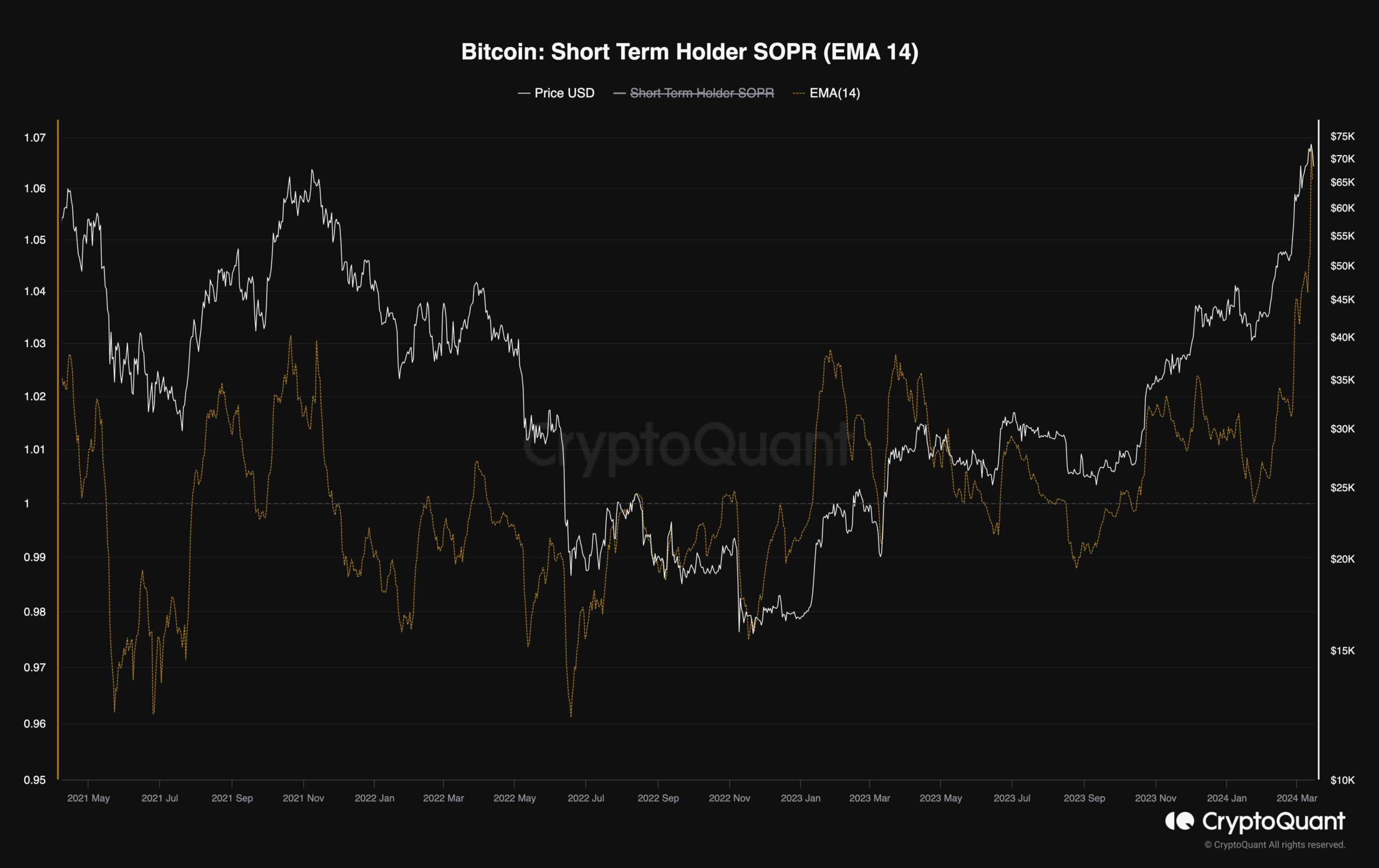

This chart demonstrates the Bitcoin Quick-Time period Holder Spent Output Revenue Ratio. The STH SOPR calculates the ratio of revenue realization by holders who’ve held their cash for lower than 155 days. Values above one point out realizing income, whereas values under one are related to realizing losses.

Because the chart reveals, the STH SOPR has been making a brand new file excessive, indicating that the short-term holders have been aggressively realizing their income. But, their promoting strain has positively contributed to the current worth drop. Till this promoting conduct continues, the value can nonetheless drop decrease within the coming weeks.