Bitcoin (BTC) is on the heart of the monetary markets after breaking its all-time excessive in per week to surpass the $70,000 mark within the newest rally. On this line, the main focus is on the place Bitcoin will land subsequent, contemplating that the report excessive has deviated from the previous norms of rising after the halving occasion.

In wanting on the subsequent Bitcoin trajectory, crypto buying and selling professional TradingShot projected in a TradingView submit on March 8 that the subsequent narrative for Bitcoin will probably goal over $300,000.

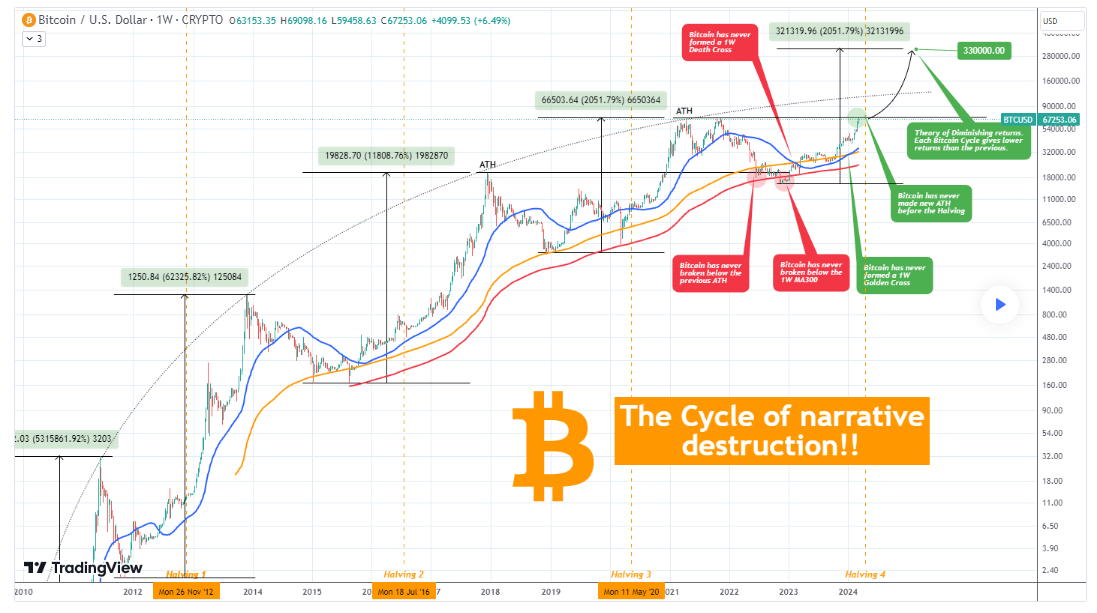

The analyst introduced the ‘Cycle of Narrative Destruction,’ highlighting how historic patterns will probably affect the subsequent BTC trajectory. In line with the professional, Bitcoin’s journey for the reason that starting of the 2021 bear cycle has been marked by sudden twists, prompting hypothesis on the subsequent narrative to be damaged.

The primary narrative emerged on June 13, 2022, when Bitcoin breached the earlier report excessive of $19,350. This sudden transfer set the stage for a collection of narrative shifts.

One other narrative emerged in November 2022, post-FTX crash; it dipped beneath the one-week shifting common of 300 for the primary time, resulting in the inaugural one-week loss of life cross by February 2023. A swift restoration in 2023 noticed Bitcoin kind its one-week golden cross between December and January 2024.

TradingShot identified that these occasions problem typical expectations, emphasizing Bitcoin’s unpredictable and dynamic nature, offering each challenges and alternatives for market individuals.

Analysing Bitcoin’s subsequent narrative

With 5 main narrative breaks in simply 18 months, the next query is how Bitcoin will carry out subsequent, with the analyst presenting the Idea of Diminishing Returns (TODR).

TODR posits that every cycle ought to yield decrease returns than the earlier one. Analyzing historic information, the primary cycle delivered a staggering 531,681% returns, adopted by 62,325%, 11,808%, and the latest 2,051%. If Bitcoin have been to interrupt the Idea of Diminishing Returns, it will want to realize a bit of over 2,051% in the course of the present cycle.

“That implies that we might be a Cycle peak above $330,000! After all, if that occurs, it will imply that Bitcoin can even break above its historic Parabolic Development Channel, which might be thought-about one other narrative destruction,” he mentioned.

Following its latest all-time excessive, Bitcoin has corrected beneath the $70,000 mark. Nevertheless, it maintains buying and selling above the essential $65,000 help zone, which analysts deem essential for sustained features.

Bitcoin faces market exhaustion

Regardless of this correction, the general sentiment in the direction of the asset stays bullish, particularly with the upcoming halving anticipated to spice up the crypto market considerably.

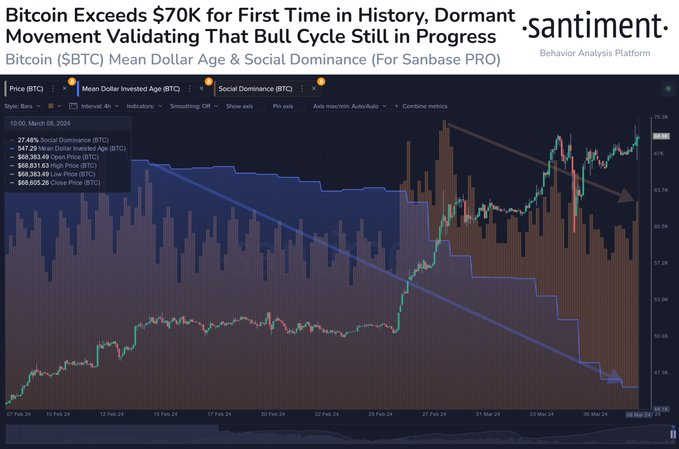

Nevertheless, issues about potential market exhaustion have surfaced, with information from Santiment indicating that discussions about Bitcoin stay “pretty wholesome.”

“The share of discussions associated to $BTC vs. different belongings is at a reasonably wholesome 27.5% proper now, however not practically on the euphoric ranges proven when $60K was being eclipsed simply 9 days in the past… and this can be a GOOD factor. #FOMO and greed are sometimes high alerts,” Santiment mentioned.

As of the present press time, Bitcoin is priced at $68,481, boasting weekly features of roughly 10%.

Disclaimer: The content material on this website shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.