Bitcoin (BTC) as soon as once more has its sights set on the $70,000 mark after a short correction that momentarily threatened to push the main cryptocurrency decrease.

Regardless of buying and selling beneath $70,000, prevailing market sentiment strongly means that the general sector stays in a bull run, with the highest crypto poised for one more potential file excessive, notably in gentle of the upcoming halving occasion.

In consequence, crypto buying and selling skilled TradingShot has instructed that Bitcoin, buoyed by the approaching halving, is primed for an unprecedented surge, probably signaling the onset of its most aggressive bull cycle to this point.

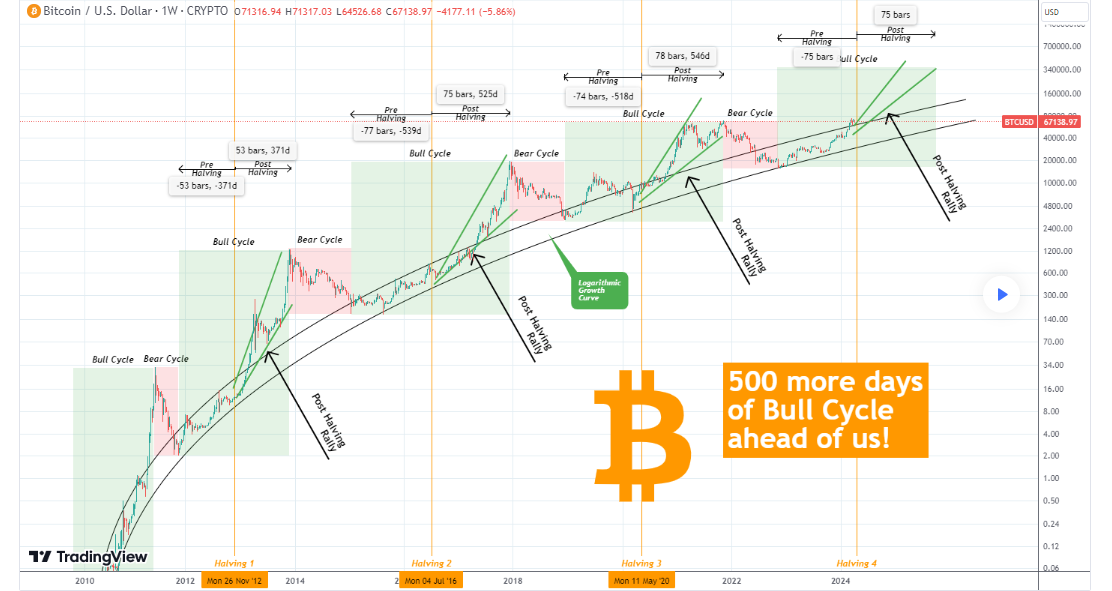

In a TradingView publish on April 5, the market analyst primarily based the evaluation on the juxtaposition of bear and bull cycles towards Bitcoin’s logarithmic development curve (LGC), revealing a notable shift in momentum because the cryptocurrency just lately broke free from the LGC.

Notably, merchants make the most of the logarithmic development curve to discern long-term developments and worth targets for Bitcoin. It gives insights into the magnitude and tempo of Bitcoin’s worth appreciation, aiding traders in making knowledgeable funding selections.

This departure from the norm simply forward of the halving occasion is perceived as a bullish sign, notably when contemplating Bitcoin’s historic shopping for zone.

Accuracy of the golden ratio

A pivotal facet of the evaluation revolves across the halving’s golden ratio, a metric that has confirmed correct in previous cycles. As per the skilled, this ratio means that the interval from the underside of the previous bear cycle to the halving occasion is proportionally equal to the interval from the halving to the height of the following bull cycle.

In line with TradingShot, the golden ratio’s implications are profound, hinting that Bitcoin could also be on the cusp of an prolonged bull cycle spanning at the very least 500 days.

“It has [golden ratio] held superbly on the three earlier Cycles and there’s no cause to not count on it to unfold this time additionally. This means that we now have at the very least one other 500 days of Bull Cycle forward of us and one of the best half is that these might be within the type of essentially the most aggressive a part of the Cycle, the Submit-Halving Parabolic Rally (inexperienced Megaphone),” the analyst famous.

Notably, the upcoming halving stays a pivotal occasion, notably contemplating Bitcoin’s earlier efficiency main as much as such occurrences. Traditionally, Bitcoin has achieved file highs after halving occasions, making this one price monitoring.

Regardless of a short correction, Bitcoin has seen minor beneficial properties just lately, fueled by a number of potential bullish catalysts. One such catalyst is the information that BlackRock (NYSE: BLK), the world’s largest asset supervisor, has included main U.S. banks as contributors in its spot Bitcoin exchange-traded fund (ETF). The submitting shared on-line listed notable names like Goldman Sachs (NYSE: GS), Citadel, UBS, and Citigroup (NYSE: C).

On the similar time, Bitcoin and the broader crypto market skilled beneficial properties following indications from the Federal Reserve suggesting the chance of rate of interest cuts earlier than the top of 2024.

Bitcoin worth evaluation

On the time of writing, Bitcoin was buying and selling at $68,195, posting day by day beneficial properties of roughly 0.5%.

In the meantime, investor concentrate on Bitcoin stays mounted on important help ranges, notably $65,000, as they’ll play a vital function in shaping the asset’s subsequent trajectory.