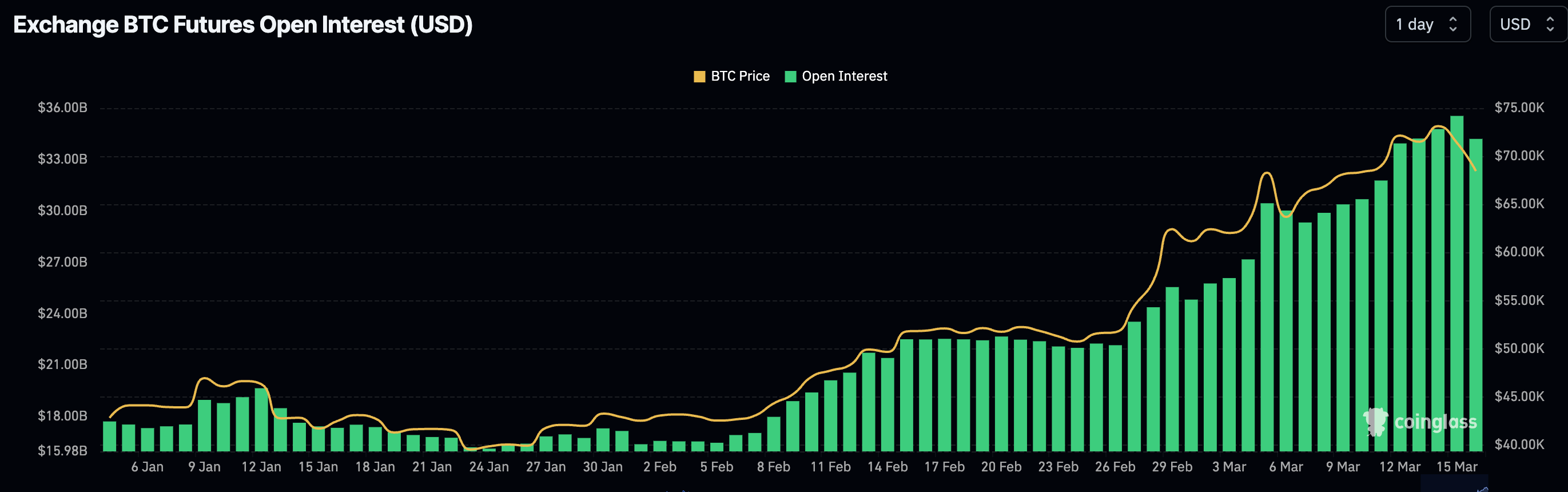

The notional complete of leveraged lengthy Bitcoin derivatives merchants nonetheless surpasses $40 billion even after the current swathe of liquidations, in line with knowledge from Coinglass. Shorts are primarily above $71,000 and quantity to round $12 billion in notional worth. Complete open curiosity in futures contracts involves $35 billion, whereas choices contracts maintain $31 billion as of press time.

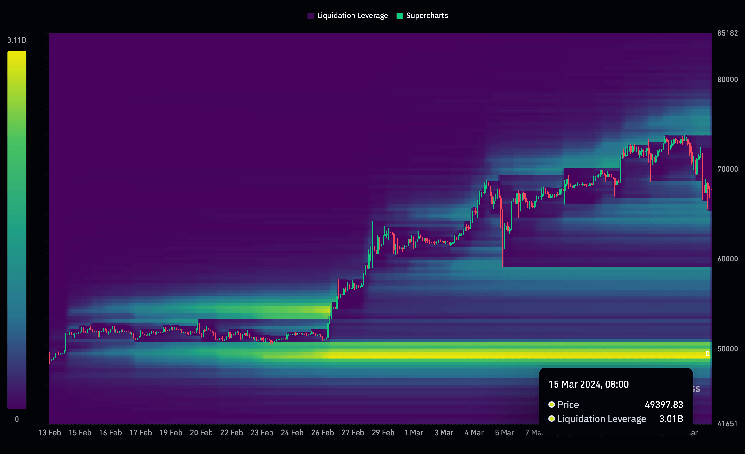

The Coinglass Liquidation Heatmap beneath exhibits a coloration band representing a variety of costs at which a certain quantity of notional worth is susceptible to liquidation. As the colours progress from purple to yellow, they point out rising notional worth and, thus, greater positions that may be liquidated if the value strikes via these ranges.

Suppose the value of Bitcoin reaches the degrees indicated by hotter colours (like yellow). In that case, it means that there might be the next quantity of pressured promote (in case of lengthy positions) or purchase (in case of brief positions) orders to cowl leveraged positions, which may result in important worth volatility. Merchants use this data to establish potential assist and resistance zones and estimate the market sentiment and potential worth instructions.

At $35 billion, Bitcoin’s future open curiosity stays at an all-time excessive. Nonetheless, not like 2021, CME futures comprise over 30% of the market, resulting in fewer over-leveraged positions. CME doesn’t provide leverage on the identical scale as Binance or OKX, the place merchants place bets at 100x leverage.