On April 20, Bitcoin will endure its anticipated halving. This four-yearly incidence slashes mining rewards by half, with the upcoming one decreasing rewards to three.125 BTC per block.

The timing of the halving is especially intriguing because it unfolds amidst a bullish development in Bitcoin’s value. Analysts anticipate this halving might considerably affect Bitcoin’s trajectory within the coming years.

Is Now the Greatest Time To Purchase Bitcoin?

Bitcoin surged by 67% within the preliminary quarter of 2024, pushed predominantly by heightened demand for Bitcoin exchange-traded funds (ETFs). The substantial value development already skilled now prompts discussions concerning the potential impression of Bitcoin halving.

Some analysts argue that Bitcoin stays undervalued, foreseeing a possible climb to $100,000 inside the yr. The exceptional efficiency of the asset to this point, coupled with anticipated price cuts from the Federal Reserve, renders this projection believable.

“We might see a short correction, however as central banks ease up on financial coverage, that ought to drive each direct Bitcoin gross sales and ETFs as a result of Bitcoin tends to behave like a tech inventory or speculative asset, which usually see good points round easing of financial coverage. My estimate is that Bitcoin might attain anyplace from $100,000 to $150,000 in 12 to 18 months post-halving,” Jason Fernandes, co-founder at AdLunam instructed BeInCrypto.

Conversely, different specialists counsel that the market has already factored within the halving. But, with Bitcoin’s provide poised to lower and Bitcoin ETF-driven demand steadily rising, some view the present juncture as opportune for Bitcoin funding.

Learn extra: Bitcoin Halving Countdown

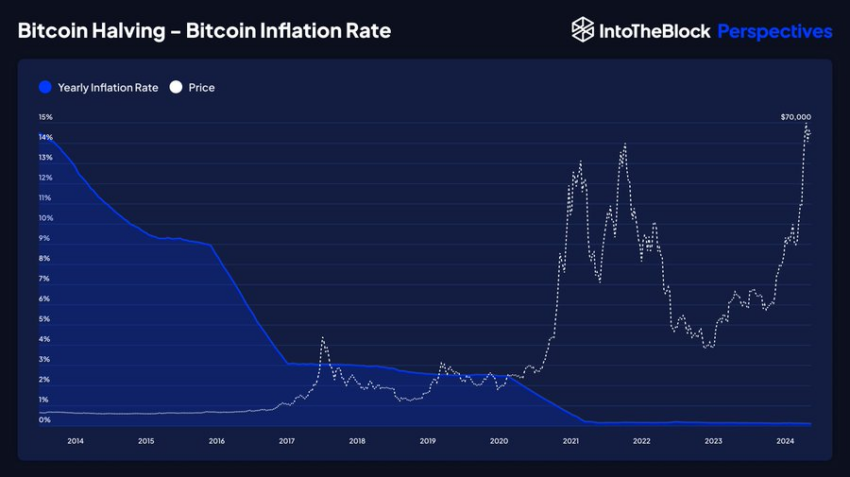

Bitcoin Value and Inflation Price. Supply: IntoTheBlock

Researchers at NYDIG contend that the impression of the Bitcoin halving on costs could also be marginal in comparison with the affect of ETF demand. Consequently, they anticipate that the roughly 450 BTC in day by day provide is not going to exert vital stress on costs.

“Whereas the halving occasion could not function a direct value catalyst, historic information means that it performs an important position in shaping Bitcoin’s value cycles. Usually, there’s a lead-up to the halving adopted by substantial returns post-event. With the present constructive value efficiency pre-halving, traders have causes to be optimistic concerning the future potential of Bitcoin,” NYDIG’s Greg Cipolaro wrote.

Nonetheless, historic information reveals a diminishing proportion improve following every halving. After the primary halving, Bitcoin soared from $13 to $652, marking a staggering 4,802% surge. Subsequent halvings have yielded diminished proportion will increase, hinting at an identical sample this time.

Learn extra: Bitcoin Value Prediction 2024/2025/2030

Bitcoin Halving Value Adjustments. Supply: IntoTheBlock

Nonetheless, Fernandes instructed BeInCrypto that Bitcoin’s efficiency post-halving has differed attributable to totally different macro-economic occasions.

“2012’s Bitcoin halving occasion noticed restricted funding by tech-savvy people and area of interest communities. In 2016 we noticed an elevated consciousness of Bitcoin as an alternate foreign money that might face up to financial instability. The pandemic yr of 2020 was a little bit of an outlier because the halving was offset by a horrible general monetary scenario. In sum. I’d say the results of the halving are usually evenly cut up between macro-economic components prevalent on the time,” Fernandes defined.

The nuanced views spotlight a broader consensus that, whereas the instant impression of the halving on BTC’s value could also be debatable, the occasion is essential for setting the stage for future value cycles. Nonetheless, the main results of this occasion shall be seen on miners’ profitability amid escalating vitality bills.

Nevertheless, insights from IntoTheBlock point out that miners’ income, measured in USD, is presently at a peak, propelled by Bitcoin’s rising worth. If the halving precipitates additional worth appreciation, the diminished rewards could have negligible repercussions on miners.