Bitcoin and Ethereum choices value early $2.6 billion in notional worth expired as we speak amid a broader market pullback.

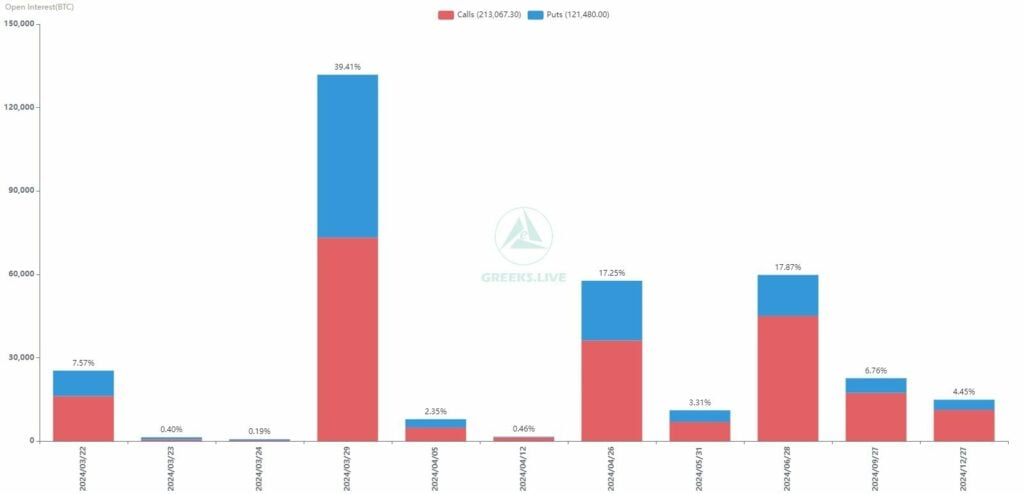

In line with Greeks.dwell, 25,000 BTC choices expired, showcasing a Put Name Ratio of 0.56. The ratio signifies a better curiosity in name choices than places, suggesting optimism amongst a phase of buyers.

The Max Ache level stood at $67,000 with a notional worth of $1.7 billion. Equally, 250,000 ETH choices expired, with a Put Name Ratio of 0.51 and a Maxpain level of $3,500, amounting to a notional worth of $890 million. The Max Ache level represents the strike value at which most choices would expire nugatory, typically thought of a stress level for the market.

Bitcoin Open Curiosity | Supply: Greeks.dwell

You may additionally like: Heco Bridge hackers launder over $145m through Twister Money in 8 days

The crypto market just lately skilled a shift, transferring away from the potential rally anticipated final week. Bitcoin’s incapability to carry above $70,000 led to a pullback, defying earlier expectations of a sustained rally.

This week, the market noticed a surge in put demand alongside a pointy improve in implied volatility throughout all important phrases. Nonetheless, opposite to expectations, many put positions closed at a revenue, reflecting a strategic exit by buyers.

Bitcoin’s value is now slightly below $63,000, marking a 6% lower as we speak. The worth decline aligns with a report outflow of $742 million from Bitcoin ETFs over the week, underscoring investor warning and a shift in market sentiment.

As costs align nearer to the Maxpain factors, the as soon as prevalent FOMO (Concern of Lacking Out) sentiment has diminished, signaling a extra cautious method by market contributors.

Learn extra: Ronin’s RON jumps 11% on the heels of Coinbase itemizing