Three days of inflows

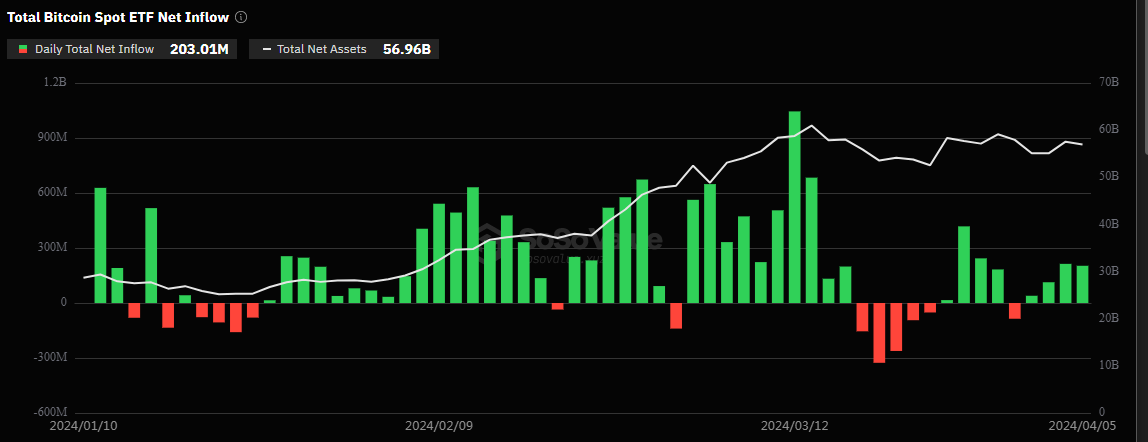

In keeping with SoSoValue, Bitcoin spot ETFs recorded a complete web influx of $213 million yesterday, marking the third consecutive day of web inflows.

In distinction, the Grayscale Bitcoin Belief (GBTC) skilled a major web outflow of $79.3 million in a single day, contributing to GBTC’s historic web outflow, which now stands at $15.31 billion.

Among the many Bitcoin spot ETFs, BlackRock’s ETF, IBIT, noticed the very best single-day web influx of roughly $144 million, contributing to IBIT’s complete historic web influx of $14.4 billion.

BlackRock’s ETFs on rise

BlackRock up to date its Bitcoin ETF prospectus on April 5, including main Wall Avenue corporations like ABN AMRO Clearing, Citadel Securities, Citigroup International Markets, Goldman Sachs and UBS Securities as new licensed individuals.

These corporations be a part of others like JPMorgan Securities, Jane Avenue Capital, Macquarie Capital and Virtu Americas. Approved individuals play a vital position within the ETF operational mechanism, facilitating the creation and redemption of ETF shares.

Just lately, crypto analyst Willy Woo has instructed that BlackRock’s $9.5 trillion in belongings underneath administration may probably shift towards digital belongings, notably Bitcoin, as youthful generations exhibit rising confidence in cryptocurrency.