Bitcoin’s value has undergone a interval of corrective retracements, lately witnessing a 9% drop in the direction of the $64K stage.

Nonetheless, the cryptocurrency is fortified by a number of strong help ranges, probably halting additional downward stress from market sellers.

Technical Evaluation

By Shayan

The Every day Chart

A radical examination of the each day chart reveals important promoting stress on Bitcoin’s value after surpassing the vital $70K resistance, leading to a notable rejection. This led to a 9% decline in the direction of the vital $64K threshold.

At the moment, Bitcoin seems to be forming a possible double-top sample, with the neckline positioned at $62K. A breach beneath this stage might signify the completion of the sample, triggering an extra downward motion in the direction of the vital help space at $59K.

Nonetheless, the BTC value has a number of help factors to depend on forward, notably the vary between the 0.5 ($62,181) and 0.618 ($59,444) Fibonacci retracement ranges. These marks could serve to halt additional downward stress and provoke a bullish reversal.

The 4-Hour Chart

Evaluation of the 4-hour chart reveals intensified promoting stress as Bitcoin tried to reclaim the higher boundary of the sideways wedge, equivalent to the essential $70K resistance.

This resulted in a big bearish reversal, driving BTC’s value in the direction of the decrease trendline of the wedge, roughly at $64K, as anticipated in our final evaluation.

At the moment, Bitcoin sellers are striving to breach the decrease boundary of the sideways wedge. Nonetheless, if consumers regain management and the value finds help close to this important stage, a bullish rebound in the direction of the $70K mark might ensue.

Conversely, if promoting stress persists and the value breaches the sample’s decrease boundary, an extension of the bearish retracement in the direction of the $62K area turns into more and more probably.

Sentiment Evaluation

By Shayan

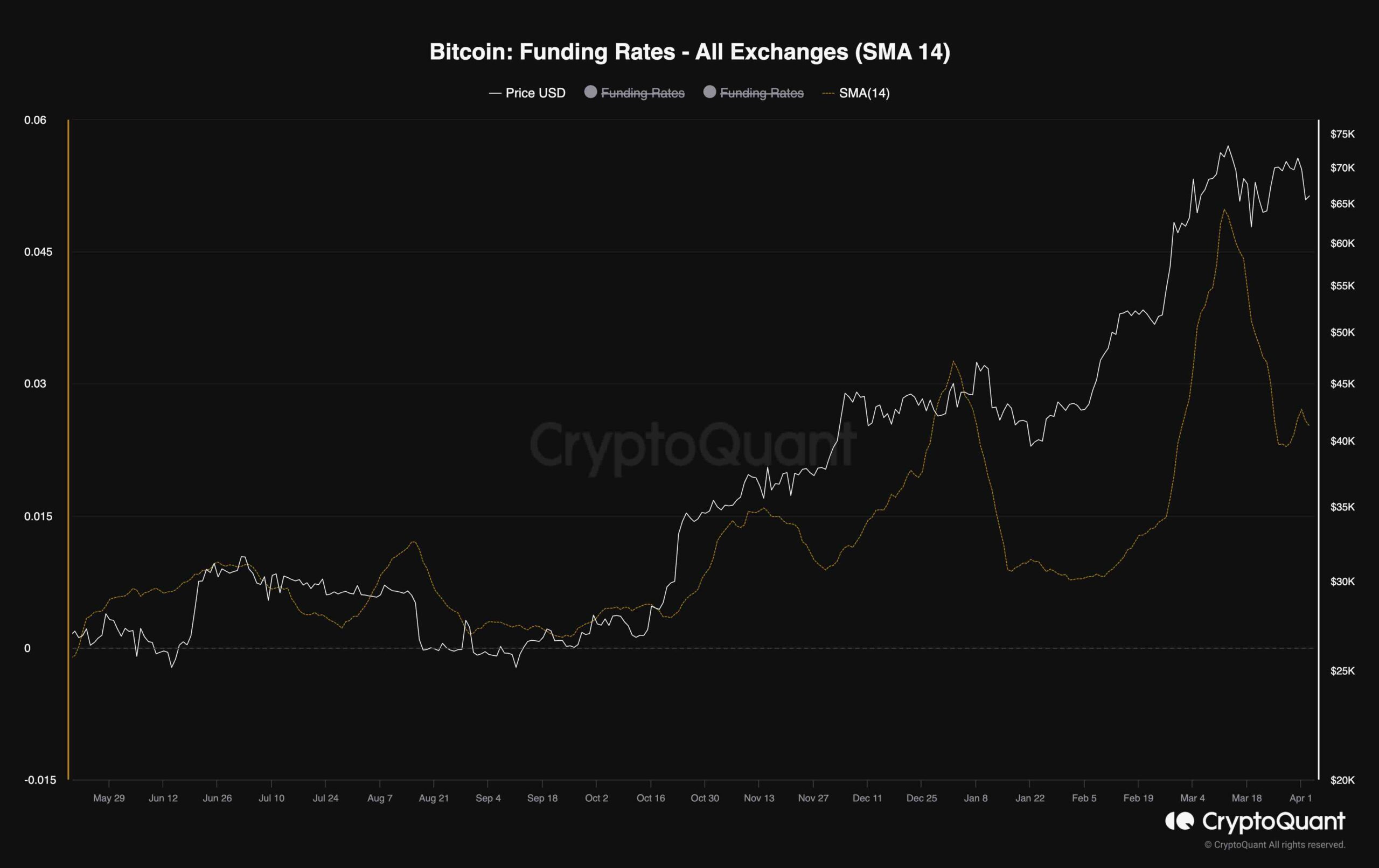

Bitcoin has lately undergone a pullback, witnessing a decline in the direction of the $64K stage. Assessing whether or not this correction has resulted in a cooling down of the futures market can present beneficial insights for traders.

The chart introduced illustrates Bitcoin funding charges, which function indicators of whether or not consumers or sellers are executing their orders extra aggressively. Whereas optimistic funding charges are important, elevated values can elevate considerations, typically resulting in a cascade of lengthy liquidations.

Observing the chart, it turns into obvious that the value has undergone corrective retracements lately. This has triggered a notable lower in funding charges following a considerable surge in early February. This decline suggests a shift within the futures market from an overheated state to a part of cooling down.

Such a growth could be interpreted as optimistic in the long run, because it alleviates the stress for additional liquidations and fosters situations conducive to a sustainable uptrend. Consequently, traders could discover reassurance on this shift, because it probably indicators a more healthy market setting in a broader view.