On-chain knowledge reveals Bitcoin miners have at all times offered as Halvings have occurred. With the subsequent one simply across the nook, how are miners behaving this time?

Subsequent Bitcoin Halving Is Much less Than Two Days Away Now

In a CryptoQuant Quicktake publish, an analyst mentioned Bitcoin miners’ habits within the build-up to the subsequent Halving.

The “Halving” is a periodic occasion on the Bitcoin community the place the cryptocurrency’s block rewards (the compensation miners obtain for fixing blocks) are completely slashed in half.

This occasion happens roughly each 4 years, and in line with NiceHash’s countdown, the subsequent one will happen in simply over 32 hours.

The countdown to the subsequent halving occasion | Supply: NiceHash

Bitcoin miners earn income from two sources: transaction charges and block rewards. Traditionally, the previous has been fairly low on the BTC community, so the miners primarily depend upon the latter to repay their operating prices.

Because the block rewards are reduce in half throughout Halvings, these occasions naturally deal a major blow to the miner’s revenues. As such, it’s not shocking that the miners have usually proven a response to the occasion prior to now cycles.

“One of many frequent dynamics that happen in each cycle of reducing the issuance of latest BTC is the numerous promoting strain exerted by miners,” says the quant. One technique to gauge the diploma of promoting strain coming from these chain validators is by way of the Miner to Change Move metric.

This indicator tracks the whole quantity of Bitcoin shifting from miner-associated addresses to wallets linked to centralized exchanges. As miners normally deposit Bitcoin to those platforms for promoting, this stream can present hints about their promoting habits.

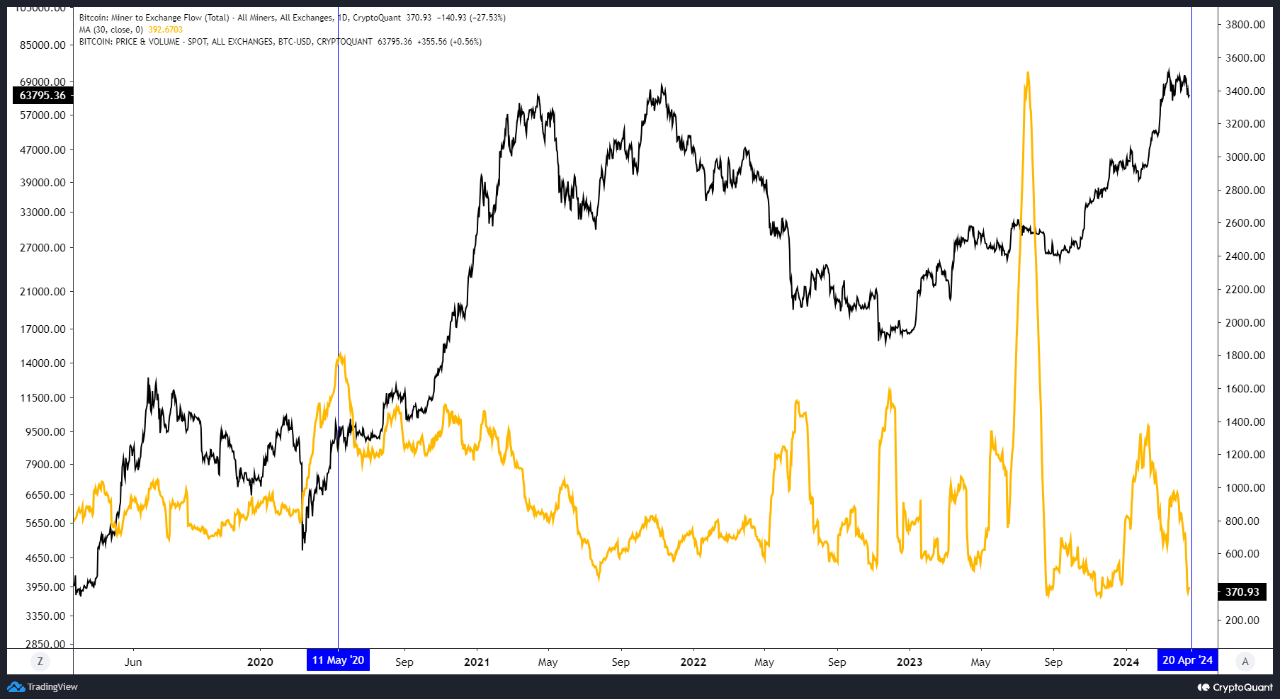

Now, here’s a chart that reveals the development within the 30-day shifting common (MA) BTC Miner to Change Move over the previous few years:

Seems to be just like the 30-day MA worth of the metric has noticed a steep plunge in latest days | Supply: CryptoQuant

As displayed within the above graph, the 30-day MA Bitcoin Miner to Change Move had surged to excessive ranges within the 2020 Halving occasion, implying that this group had doubtlessly been taking part in a selloff.

This promoting push might have come from the miners planning to exit, given the sharp income discount that was set to happen. The graph, although, clearly reveals that no such promoting strain has emerged this time round regardless of the occasion being simply across the nook.

Associated Studying: 69% Of PEPE Holders Left In Income After 26% Plunge

So, what’s occurring right here? The analyst means that the Bitcoin miners might have already accomplished the newest spherical of promoting prematurely (because the trade inflows from the cohort did spike in February). If that is true, the quant thinks this might profit the market within the brief time period.

BTC Value

Bitcoin has continued to maneuver sideways inside a spread lately, as its worth remains to be buying and selling round $63,500.