Bitcoin mining firms are dealing with a notable lower in inventory worth in anticipation of the upcoming halving.

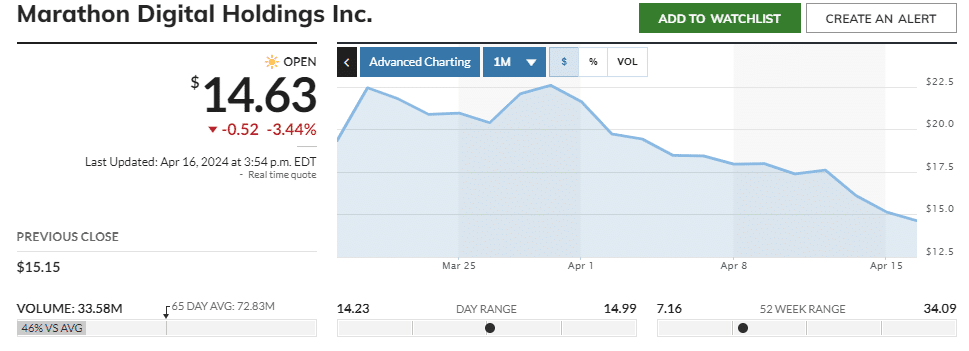

Shares of Marathon Digital Holdings, Riot Platforms, and CleanSpark have declined for 3 consecutive days. Marathon Digital Holdings, the biggest public Bitcoin miner, misplaced almost 25% of its inventory worth up to now month, whereas Riot Platforms misplaced nearly 30%. Moreover, the Valkyrie Bitcoin Miners exchange-traded fund has seen a discount of about 28% in its worth this month.

The decline in inventory costs continues towards a backdrop of accelerating quick curiosity in cryptocurrency mining shares and geopolitical tensions following latest conflicts between Iran and Israel, main buyers towards safer property.

Marathon Digital Holdings Inc. inventory value | Supply: MarketWatch

Regardless of these challenges, the CEOs of those mining firms stay optimistic, based on Bloomberg. The mining firms’ cost-efficient operations, superior mining know-how, and elevated demand for cryptocurrencies are potential compensatory elements for the anticipated $10 billion annual income loss because of the upcoming Bitcoin halving.

You may also like: Railgun refutes FBI claims of North Korean misuse, upholds privateness

Moreover, the businesses are hopeful that the surge in demand pushed by new spot ETFs will bolster Bitcoin’s value sufficiently to offset the adversarial results of the replace. Since their introduction by conventional asset administration corporations in January, these ETFs have attracted a complete cumulative internet influx of $12.4 billion.

The latest approvals of Bitcoin ETFs in Hong Kong additionally draw important optimism from crypto leaders. In a remark shared with crypto.information, Sumit Gupta, co-founder of CoinDCX, one of many largest exchanges in India, shared enthusiasm in regards to the first main ETF approval in Asia.

“Institutional involvement has traditionally served as a driving drive behind the elevated consideration and traction noticed in numerous asset courses. The truth that this improvement has occurred in Asia for the primary time brings it nearer to our residence, underscoring the worldwide nature of this evolving narrative. The trajectory of the crypto trade is shifting in a course that fosters adoption, albeit steadily, signaling promising prospects for its future development and mainstream acceptance.”

– Sumit Gupta, co-founder of CoinDCX

Learn extra: South Korean gained tops world crypto buying and selling, overthrowing USD