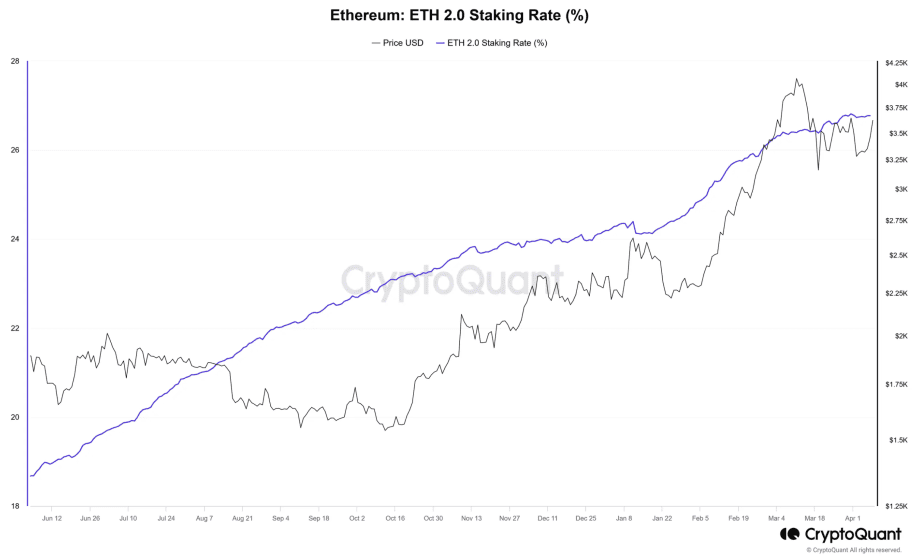

- Ethereum staking has concurrently reached an all-time excessive, with practically 27% of all ETH staked, reflecting rising confidence within the community’s safety.

- Ethereum can be seeing heightened exercise by restaking protocols with main platform EigenLayer amassing $13 billion in TVL.

Within the final month of March, the Ethereum blockchain efficiently carried out the Dencun improve ushering in larger scalability and lowering gasoline charges on the community. This resulted in a robust surge within the DeFi exercise happening on the Ethereum mainnet, as reported by Crypto Information Flash.

As per the present knowledge from Cryptoquant, Ethereum staking has surged to a brand new all-time excessive degree with practically 27% of all ETH staked at this level. The continual enhancements and enlargement of Ethereum, notably with the mixing of DeFi protocols like EigenLayer, have bolstered the enchantment of staking.

Heightened investor engagement underscores their dedication to fortifying the community’s safety and, consequently, its general prosperity. Notably, the collective worth of all staked ETH has surged to unprecedented ranges, indicating rising confidence and participation in Ethereum’s ecosystem.

Courtesy: CryptoQuant

The surge in staking information mirrors the escalating demand for restaking providers. EigenLayer, a pioneer in restaking, has soared to a brand new pinnacle, amassing over $13 billion in Whole Worth Locked (TVL) and securing the second spot amongst Ethereum’s most sought-after purposes. With its mainnet launch on the horizon, EigenLayer’s potential success may doubtlessly dethrone the present TVL chief, Lido Finance.

The enduring recognition of restaking could be attributed to the attract of airdrops, which customers anticipate receiving. The introduction of the Ether.fi restaking initiative in March exemplifies this pattern, rewarding restakers with ETHFI tokens. Even earlier than EigenLayer’s debut, the smallest allocation of ETHFI tokens, valued at over $1,000, showcased the potential features. EigenLayer, anticipated as Ethereum’s largest airdrop, has sparked fervent buying and selling exercise in anticipation of its launch, per the Crypto Information Flash report.

Ethereum Whales Accumulate, ETH Value Motion Forward

Information from the @lookonchain analytics account reveals that two massive wallets lately acquired substantial quantities of Ethereum on centralized exchanges and proceeded to make vital purchases over the previous three days. Nevertheless, one in all these wallets seemingly belongs to Jihan Wu’s firm. In the meantime, as these whales accumulate Ethereum, one other sizable pockets has executed a considerable ETH sale on Binance at the moment.

In keeping with Lookonchain, two whales have amassed appreciable quantities of Ethereum. Considered one of these entities is more likely to be Matrixport, the blockchain firm based by former Bitmain CEO Jihan Wu in 2019 as his second entrepreneurial enterprise.

Reportedly, Matrixport’s pockets has additionally transferred 22,251 ETH from cryptocurrency exchanges in latest hours, valued at a formidable $80.06 million. Furthermore, over the previous three days, the identical pockets has withdrawn 33,925 ETH, value $122.06 million on the time of acquisition.

Whales are accumulating $ETH!

0xACc7(most likely #Matrixport) withdrew 22,251 $ETH($80.06M) from exchanges prior to now 1 hour and has withdrawn 33,925 $ETH($122.06M) from exchanges prior to now 3 days.https://t.co/R43ImnYb5H

Whale”0x4359″ withdrew 3,092 $ETH($11.12M) from #Binance… pic.twitter.com/g3inogSVel

— Lookonchain (@lookonchain) April 11, 2024

At present, Ethereum is surpassing the $3,500 mark and the 100-hourly Easy Transferring Common. The preliminary vital barrier lies across the $3,620 mark. Subsequently, an important resistance degree occurs to be at $3,650, past which the worth may doubtlessly purpose for the $3,720 threshold. crossing this, the ETH value may set off a rally to $4,000.