Fast Take

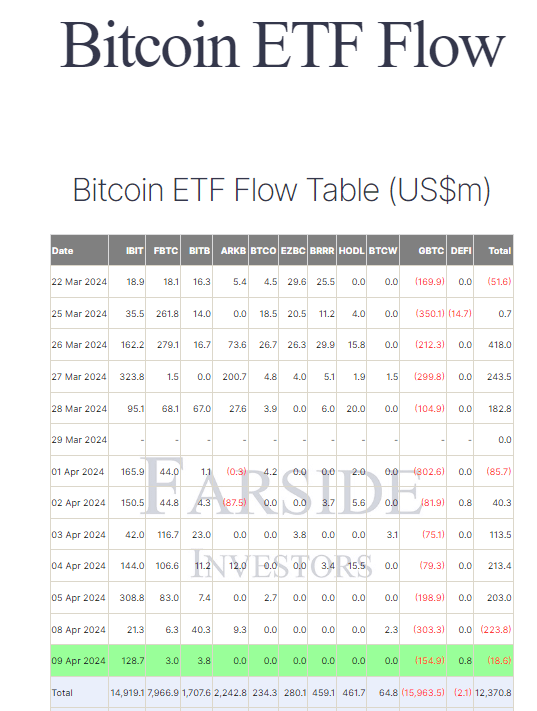

Knowledge from Farside reveals outflows for Bitcoin (BTC) exchange-traded funds (ETFs) on Apr. 9. BTC ETFs skilled an outflow of $18.6 million, marking consecutive outflows. Grayscale GBTC noticed outflows of $154.9 million, the smallest each day outflow since Apr. 4, bringing its whole outflows to $15,963.5 billion. In distinction, BlackRock IBIT witnessed an influx of $128.7 million, its largest since Apr. 5, with whole inflows reaching $14,919.1 billion.

Total, in keeping with Farside knowledge, BTC ETFs have attracted $12,370.8 billion in internet inflows, indicating a continued curiosity on this asset class.

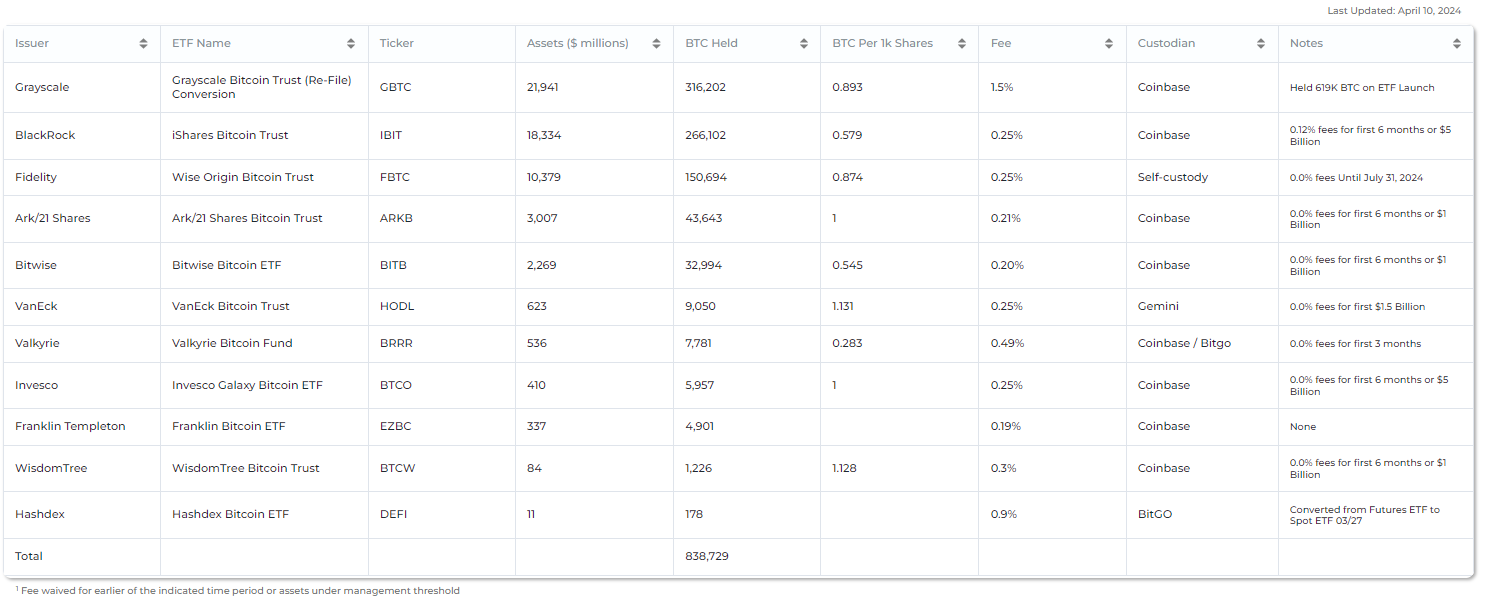

Knowledge from heyapollo reveals that when it comes to BTC holdings, GBTC presently holds 316,202 BTC, whereas IBIT holds 266,102 BTC, a distinction of fifty,100 BTC. Constancy FBTC has collected 150,694 BTC, showcasing the rising curiosity from institutional traders. Collectively, the 11 BTC ETFs maintain a formidable 838,729 BTC, highlighting the numerous quantity of Bitcoin now held by these funding autos.