The fourth Bitcoin halving occasion, anticipated to fall on or round April 19, 2024, heralds a big transformation within the cryptocurrency panorama.

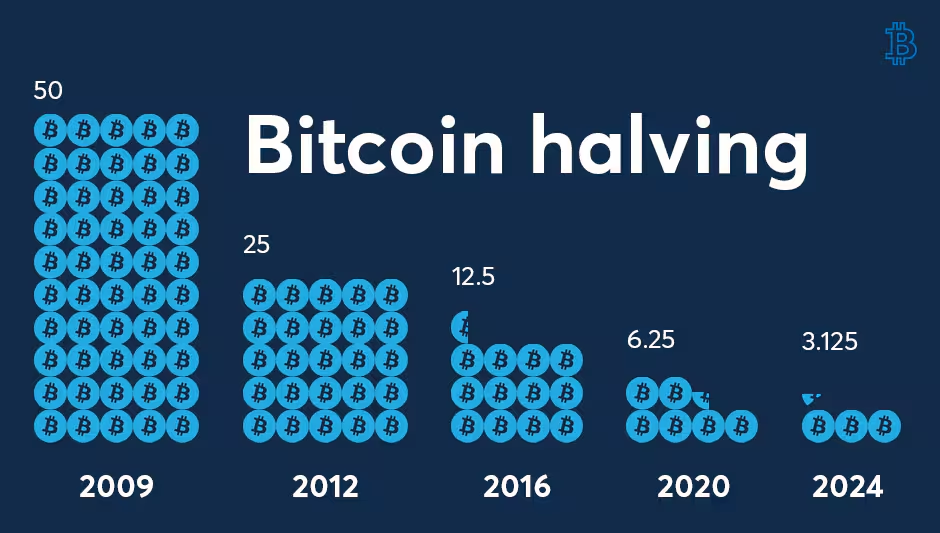

At its core, the quadrennial halving occasion entails a discount within the reward granted to miners for every block mined on the Bitcoin blockchain (the block subsidy) as decided by the protocol.

Halvings are scheduled to happen roughly each 4 years, or each 210,000 blocks till all the 21 million bitcoin provide is mined, roughly by 2140.

As a part of bitcoin’s deflationary method to its capped provide, the upcoming halving will cut back the bitcoin provide subsidy from 6.25 BTC per block to three.125 BTC, fostering a extra stringent provide panorama.

Learn extra: The historical past of Bitcoin halvings — and why this time would possibly look totally different

By steadily reducing the variety of bitcoin coming into circulation, and, as long as the adoption of Bitcoin grows over time, the halving mechanism ensures the legal guidelines of provide and demand will constantly affect the worth of the asset.

Impression on value dynamics

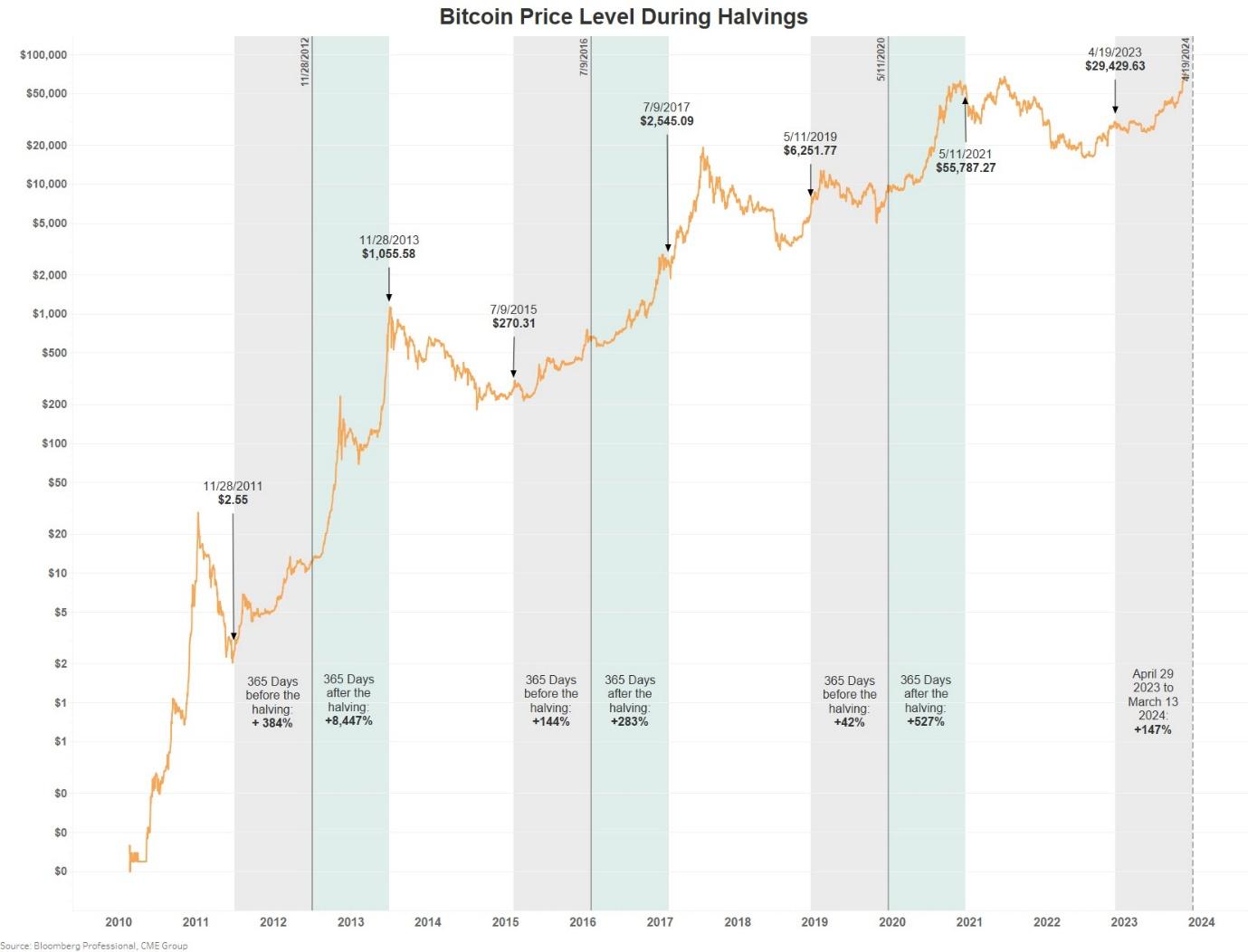

Traditionally, every halving occasion has been accompanied by a big surge in bitcoin value within the months previous and following the occasion.

- Notably, within the 365 calendar days after the Nov. 28, 2012, halving, bitcoin costs rose 8,447%, when the reward was minimize from 50 BTC to 25 BTC.

- Within the yr following the July 9, 2016, halving, bitcoin costs rose a extra modest however nonetheless spectacular 283%, and the block reward was diminished to 12.5 BTC.

- Within the 12 months after the Might 11, 2020, halving, the place the reward was minimize to six.25 BTC per block, bitcoin value jumped 527%.

Supply: CME CF Bitcoin Reference Fee

The pre-halving rally has proven a diminishing development over time, doubtless on account of miners promoting off their bitcoin holdings to safe income forward of the upcoming reward discount.

Learn extra: Bitcoin miner consolidation seems imminent as halving looms

However, the historic sample suggests the potential for bitcoin to succeed in new all-time highs within the aftermath of the 2024 halving.

Impression of bitcoin spot ETFs

The panorama surrounding bitcoin has advanced considerably, significantly with the approval of spot bitcoin ETFs and the inflow of institutional capital into the market.

These ETFs have generated substantial every day demand, surpassing the tempo of recent bitcoin provide even earlier than the halving and have the potential to soak up a substantial portion of the restricted new issuance.

To place the spot bitcoin ETF inflows into perspective, on the present charge of block rewards, the bitcoin community produces about 900 new cash per day, or round $54 million value of bitcoin (assuming a median value per coin of $60,000).

In April 2024, issuance will fall to 450 cash, or about $27 million value of bitcoin.

In the course of the month of February, internet inflows into the US-listed spot bitcoin ETFs averaged $208 million per day, far outstripping the tempo of recent provide, even earlier than the halving.

Learn extra: Bitcoin ETF snapshot: Section’s week internet inflows hit report $2.5B

This imbalance between new demand and restricted new issuance has doubtless contributed to the robust upward strain on the value.

Evolution of a giant liquid derivatives market

The emergence of a strong, regulated derivatives market marks a basic shift within the narrative surrounding the halving for 3 key causes: It permits value dangers to be hedged, it facilitates the administration of bitcoin demand threat, and it gives market contributors with actionable value discovery.

Miners usually bought their bitcoin for fiat forex as they mined them, to pay for operational prices. This fixed promoting meant that value appreciation was measured. After a halving occasion, miners would have fewer bitcoin to promote, that means the value might go up.

Mining is now dominated by bigger, usually publicly traded, corporations and with a liquid regulated derivatives market, it’s attainable for these corporations to hedge and lock in future bitcoin costs to cowl bills with out promoting their cash.

If that is so, then promoting strain from miners is much less prone to act as a drag on bitcoin costs going ahead.

The next variety of buyers and merchants means higher liquidity and enhanced value stability for bitcoin. It’s value noting that bitcoin has turn out to be much less unstable in recent times, with fewer excessive strikes each to the upside and to the draw back

Impression on miners

The upcoming halving poses challenges and alternatives for miners, as evidenced by shifts in miner conduct and trade dynamics.

Decreased bitcoin reserves held by miners, coupled with heightened competitors and report excessive hash charges, underscore the necessity for operational effectivity and strategic adaptation.

The variety of bitcoin held in wallets related to miners has dropped to the bottom degree since July 2021, suggesting miners are maybe capitalizing on bitcoin’s latest value surge, operating down their stock forward of the halving or leveraging them to boost capital for upgrading equipment and mining services.

In earlier cycles, there weren’t many large-scale miners and even fewer publicly traded ones. The halving could catalyze merger and acquisition actions amongst mining corporations, driving trade consolidation and fostering innovation in sustainable mining practices.

The rise of Ordinals

The latest surge in retail demand might be attributed partly to the rise of bitcoin Ordinals BRC-20 tokens, that are reshaping the crypto panorama.

These tokens, usually likened to “NFTs for Bitcoin,” have the potential to drive on-chain exercise and improve transaction charges, thereby bolstering miners’ income streams amid declining block rewards post-halving.

Lengthy-term outlook

Bitcoin’s designation as “digital gold” underscores its function as a retailer of worth, significantly amid the shortage bolstered by halving occasions.

Institutional buyers who view bitcoin as a hedge towards inflation could discover the halving supportive of its perceived worth.

Shifts in central financial institution insurance policies, reminiscent of extended increased rates of interest and potential quantitative easing measures, might additional bolster bitcoin’s enchantment as a hedge towards forex devaluation.

Learn extra from our opinion part: Cease worrying a lot in regards to the subsequent Bitcoin halving

Wanting forward, the implication of bitcoin’s programmed shortage intersecting with evolving demand dynamics stays intriguing. Whereas previous having cycles, with the related value rallies provide priceless insights, the 2024 halving presents a singular confluence of things that might usher in a brand new period for bitcoin.

With 28 extra halving occasions anticipated over the subsequent 112 years, the longer term trajectory of bitcoin adoption and community progress warrants shut monitoring — particularly when broader entry to bitcoin was solely made attainable within the US lower than 90 days in the past with the approval of spot bitcoin ETFs.

As institutional and retail curiosity converges with regulatory developments and macroeconomic shifts, sustaining a balanced perspective is crucial to navigating the evolving Bitcoin panorama.

Payal Shah serves as CME Group’s Director of Fairness and Cryptocurrency Analysis and Product Growth. She is chargeable for main the event of recent and revolutionary merchandise throughout the crypto, fairness and different funding markets. This features a complete suite of futures and choices contracts on key benchmark indices such because the S&P 500 and NASDAQ-100, in addition to worldwide entry by way of regional indices. Since becoming a member of the corporate in 2016, Shah has been closely concerned within the crypto area and has helped with the creation of CME Group’s greater than 50 cryptocurrency reference charges, together with Bitcoin and Ether futures and choices contracts, Micro contract suite and event-driven markets. She serves on the CME CF Cryptocurrency Oversight Committee. Earlier than becoming a member of CME Group, Shah was an ETF Specialist at MSCI and held buying and selling roles throughout the Fairness Derivatives Group at Morgan Stanley.