Bitcoin (BTC) has as soon as once more captured the highlight this week, exhibiting important fluctuations in its worth amidst a fancy backdrop of worldwide financial shifts and cryptocurrency-specific developments.

As of April 2, 2024, Bitcoin‘s worth hovers at $65,816 down by roughly 7.97% over the previous week. This current downturn has pushed the market capitalization of Bitcoin to $1.293 trillion.

Key BTC ranges to Watch

Bitcoin’s present buying and selling dynamics current a vital juncture, with the cryptocurrency testing key help and resistance ranges.

The rapid help degree is recognized at $63,119, intently adopted by a extra optimistic resistance degree at $68,858.

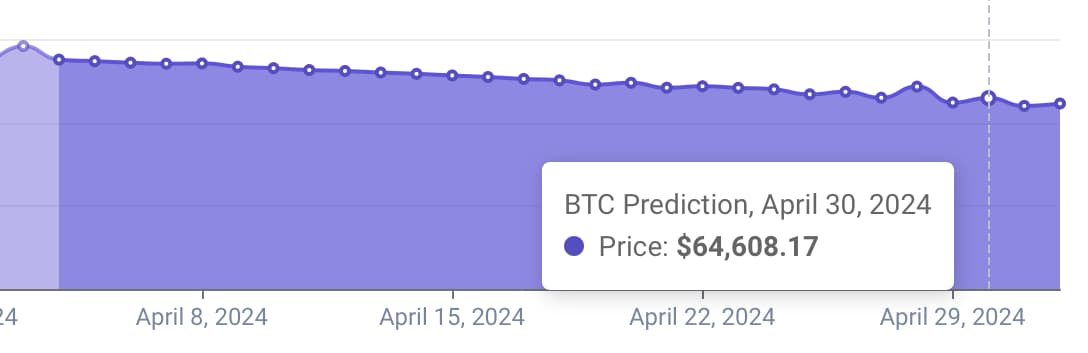

Based on predictions from AI machine algorithm fashions, Bitcoin is predicted to see a slight adjustment to round $65,417 by the top of April 2024, marking a noticeable lower from its current valuation.

The influence of worldwide financial elements on Bitcoin

A major issue contributing to Bitcoin’s current worth actions is the strengthening of the US greenback. Following upbeat US manufacturing facility knowledge, the greenback index (DXY), which measures the dollar’s power towards a basket of main fiat currencies, surged previous the 105 mark, reaching its highest degree since mid-November.

This four-week achieve of two.58% has made dollar-denominated belongings like Bitcoin and gold dearer and probably much less engaging to traders, resulting in decreased demand.

Furthermore, the continued power of the greenback is anticipated to induce monetary tightening globally, diminishing the urge for food for riskier investments corresponding to cryptocurrencies. Regardless of these challenges, some analysts stay optimistic, suggesting that the growing fiscal debt may compel the Federal Reserve to quickly decrease rates of interest, probably offering a big enhance to crypto markets.

This optimism is ready towards the backdrop of the Fed’s aggressive price hikes from zero to five.5% inside 16 months as much as July 2023, a transfer that performed an element in Bitcoin’s 80% worth crash in 2022.

The Position of Cryptocurrency-Particular Components

Past world financial indicators, Bitcoin can also be navigating by way of crucial occasions particular to the cryptocurrency area. The upcoming quadrennial mining reward halving later this month provides one other layer of uncertainty and volatility to Bitcoin’s worth dynamics.

Crypto knowledgeable Michael van de Poppe commented on the scenario, noting the chance of the worth peaking pre-halving, adopted by a interval of consolidation and subsequent continuation.

#Bitcoin consolidating and #Bitcoin peaking pre-halving.

Two important elements and I feel we can’t be seeing a brand new ATH pre-halving.

If Bitcoin dips additional within the Summer season, I will be blissful to be shopping for it at $56-60K.

It is nonetheless altcoins time. pic.twitter.com/CongTohvNA

— Michaël van de Poppe (@CryptoMichNL) April 3, 2024

Moreover, behavioral evaluation from the platform Santiment signifies a sturdy group response to the current worth drops. Regardless of a retracement in Bitcoin and much more important losses in altcoin market caps to kick off April, the crypto group has proven resilience.

👍 Is #crypto nonetheless in a #bullmarket after #Bitcoin’s +144% worth return since October fifteenth? Effectively, based on the gang, the assumption has fizzled out considerably. Traditionally, much less long-term optimism will increase the likelihood of a continued market rise. https://t.co/J4o0RdgEuT pic.twitter.com/4C7ooFl1r7

— Santiment (@santimentfeed) April 2, 2024

The sentiment is notably bullish, with discussions round buying Bitcoin doubling these associated to promoting. Historic traits recommend that such sentiment may signify an opportune second for traders to purchase the dip, usually leading to a redistribution of belongings from smaller wallets to extra substantial traders, often known as whales and sharks.

With a number of job studies and different crucial indicators on the horizon such because the Bitcoin halving, the approaching weeks are poised to be a crucial interval for Bitcoin and the broader cryptocurrency market. Traders and observers alike can be keenly watching how these varied elements play out in influencing Bitcoin’s worth and the cryptocurrency panorama at massive.

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.