Current information from Santiment signifies a major rebound for Ethereum over the weekend, because the cryptocurrency surged previous $3,600. This upward trajectory follows a short downturn, the place ETH worth skilled a drop of as much as 25% between March 11 and 19. Regardless of this setback, Ethereum’s resilience is obvious because it continues to showcase sturdy efficiency.

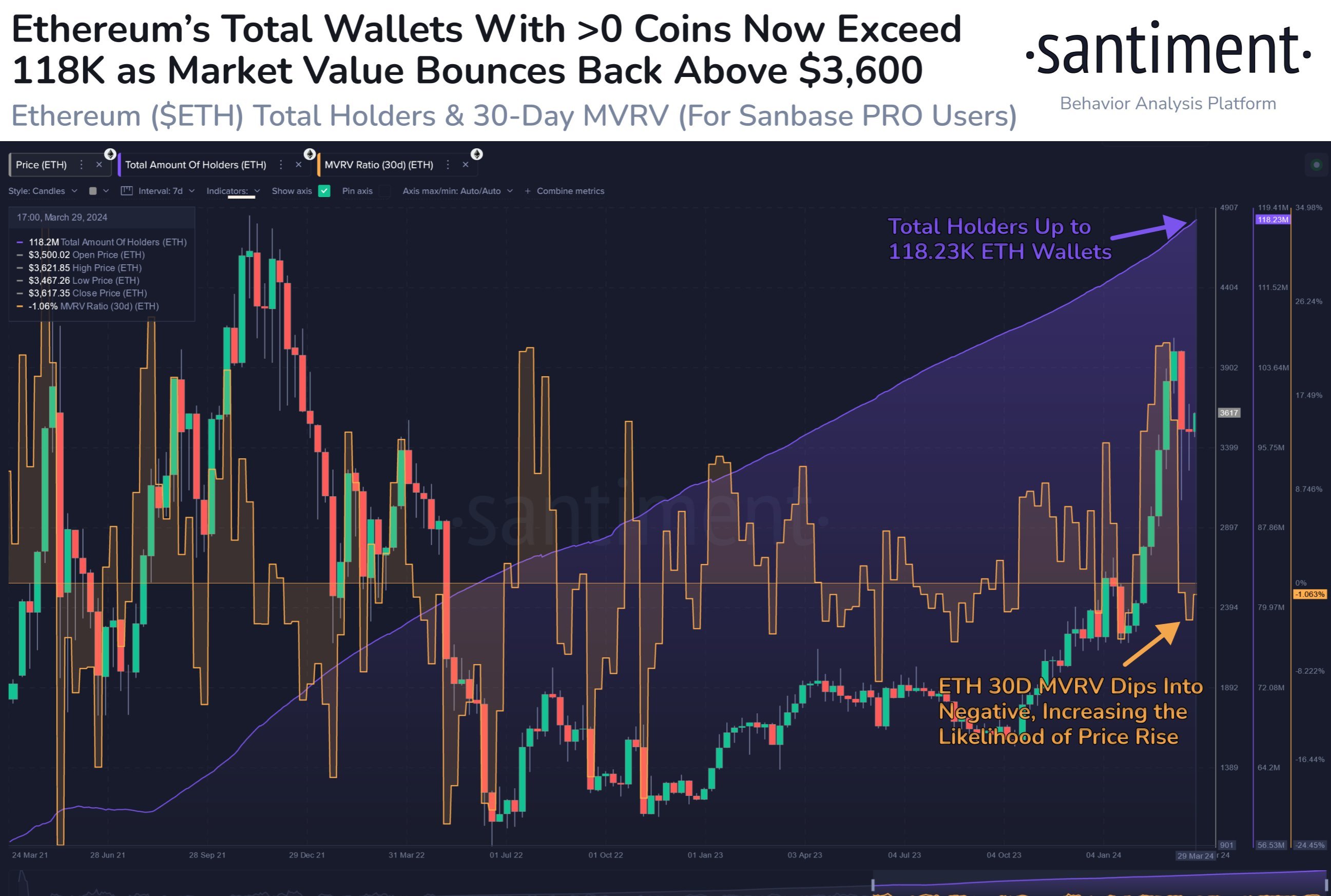

A notable improvement contributing to Ethereum’s bullish outlook is the surge within the variety of ETH addresses holding cash, reaching an all-time excessive of 118,230. Moreover, the midterm market worth to realized worth (MVRV) ratio has displayed a refined bullish sign, additional bolstering investor confidence.

For these unfamiliar, MVRV serves as an important metric within the cryptocurrency market, providing insights into the connection between a crypto-asset’s market worth and its realized worth. This ratio not solely aids in figuring out potential worth fluctuations but additionally sheds gentle on merchants’ habits, offering priceless cues for market tendencies.

Inspecting Ethereum’s 30-day MVRV pattern reveals a dip into detrimental territory, suggesting a possible worth surge within the close to future. Whereas Ethereum presently trades over 30% under its all-time excessive of $4,868, its on-chain exercise stays sturdy, significantly evident within the enhance of energetic non-empty addresses. Such exercise usually serves as a precursor to important worth actions.

In contrast to Bitcoin, which has surpassed its earlier all-time excessive within the present cycle, Ethereum’s ascent to this milestone is eagerly anticipated. With the MVRV indicator signaling a bullish trajectory and on-chain metrics pointing towards elevated exercise, Ethereum’s prospects seem promising within the altcoin panorama.