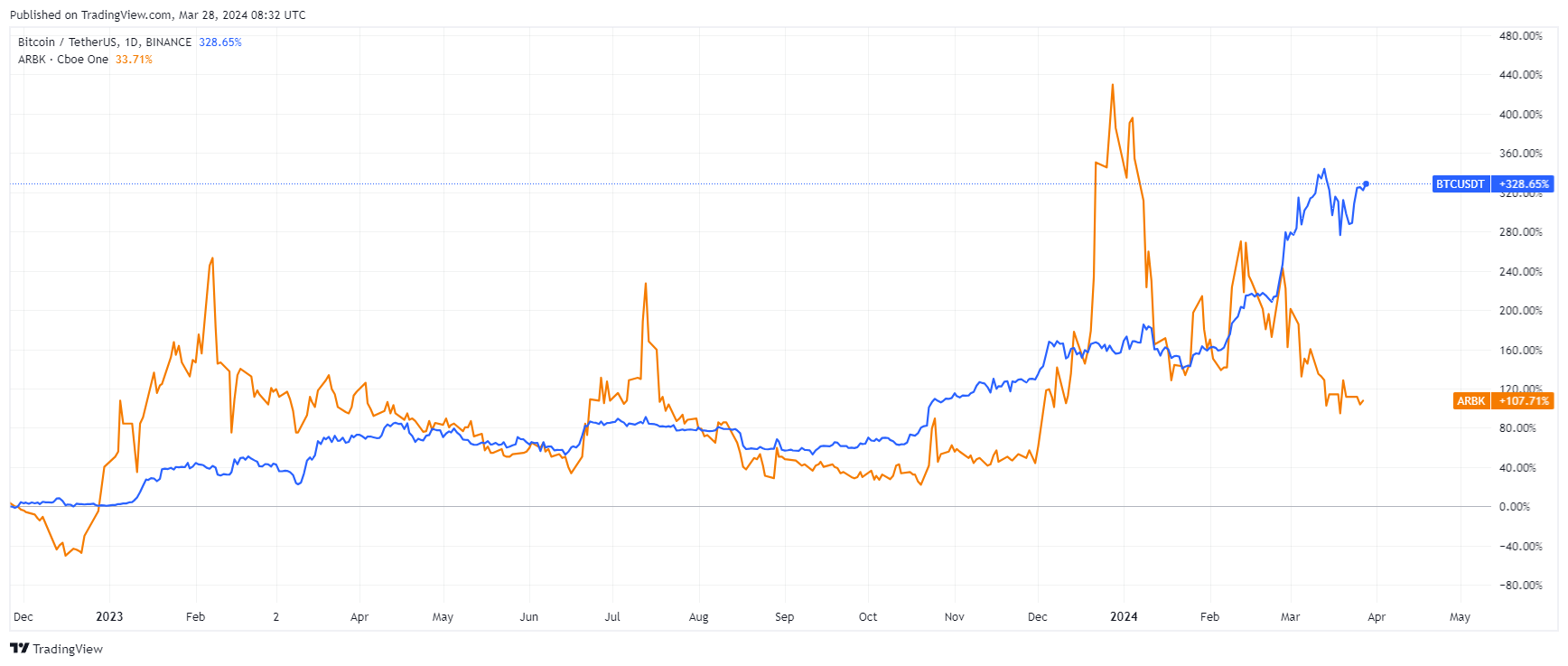

Though Bitcoin (BTC) has already gained practically 70% in 2024, shares of Argo Blockchain, a cryptocurrency mining firm publicly listed in London and the USA, are scraping the underside, falling by 55%.

The corporate’s answer to a few of its issues and shareholder discontent is promoting its knowledge middle in Mirabel, Canada. The corporate’s London department (LSE: ARB) introduced the finalization of this transfer on Thursday. On the similar time, the miner issued over 460,000 new bizarre shares.

The plan to promote an information middle within the Quebec area was first introduced nearly two months in the past. The transaction, which yielded a complete consideration of $6.1 million, has enabled the corporate to scale back its debt and streamline its operations considerably.

The online proceeds from the sale had been used to repay the Mirabel Facility’s excellent mortgage of $1.4 million, with the rest being allotted to repay debt owed to Galaxy Digital Holdings, Ltd.

As of 28 March 2024, Argo’s debt stability with Galaxy is $12.8 million, representing a 63% discount from the unique stability of $35.0 million.

“The Firm continues to execute on its technique of strengthening the stability sheet and lowering non-mining working bills. The Firm diminished its debt by $12.4 million in Q1 2024,” Thomas Chippas, the Chief Govt Officer at Argo, commented on the transaction.

#ARB ARGO BLOCKCHAIN Closing on sale of Mirabel knowledge centre for a complete consideration of $6.1m

— The Dude (@Redpanda73) March 28, 2024

Along with the debt discount, Argo has relocated and deployed mining machines from the Mirabel Facility to its facility in Baie Comeau, Quebec. This consolidation is predicted to scale back the corporate’s non-mining working bills by $0.7 million per 12 months, permitting for extra environment friendly use of the ability and onsite group.

Argo Blockchain additionally introduced the issuance of 460,477 new bizarre shares.

Bitcoin Winter Hits Argo

As talked about on the very starting, the value of Bitcoin is dynamically rising in 2024. Initially, Argo Blockchain’s shares additionally rose together with it, however weaker-than-expected BTC manufacturing within the first months of the 12 months triggered shareholders to lose confidence within the firm. In consequence, the cryptocurrency spring within the broad market became an prolonged winter for the digital asset miner.

Within the meantime, Argo Blockchain underwent important adjustments in its administration ranks. Seif El-Bakly stepped down as Chief Working Officer after serving as interim Chief Govt Officer from February to November 2023.

Whether or not we have a look at Argo’s shares listed in London or the USA, the charts present the identical image: a decline of about 55% for the reason that starting of the 12 months.

Bitcoin value (blue) goes up, whereas Argo (orange) falls. Supply: Tradingview.com

On the similar time, Marathon Digital Holdings, the most important publicly traded cryptocurrency miner, is shedding solely 6%, and Phoenix Group is gaining round 2%.