Because the fourth Bitcoin (BTC) halving will get nearer, some specialists consider the occasion might result in centralization threat, threatening the blockchain community.

As soon as each 4 years, the block reward for Bitcoin miners is lower in half to assist the asset preserve its shortage. The occasion is named halving. Traditionally, miners have stayed totally operational and even grown in quantity during the last three compensation cuts because of the rising BTC worth.

Nonetheless, many marvel if the BTC worth is excessive sufficient for miners to stay operational or if it will face centralization and even existential dangers after the fourth halving occasion.

Talking with crypto.information, Ryo Coin co-founder Lani Dizon says market dynamics can change, and unexpected occasions can have important impacts.

“Attempting to foretell the precise affect of a halving on Bitcoin’s worth is a problem. Many components can affect the market, together with total demand for Bitcoin, investor sentiment, market tendencies, international financial situations, regulatory modifications, and technological developments inside the blockchain ecosystem, and extra.”

Lani Dizon, Ryo Coin co-founder

Dizon believes whereas some miners would possibly discover the diminished block reward “difficult,” particularly if the value doesn’t enhance instantly or sufficiently to offset the discount in rewards, the “Bitcoin community is designed to regulate.” She added:

“Nonetheless, from a logical perspective, when mining prices are decrease than Bitcoin’s market worth, extra miners will keep within the community. When mining prices enhance past the miner’s income, some miners will go away.”

You may additionally like: Bitcoin miners ramp up funding forward of halving, set new power consumption document

Compensation issues

One of many primary issues across the centralization of Bitcoin is the compensation of the miners serving to the community keep operational.

Because the block reward reduces by 50% within the upcoming halving — falling from 6.25 BTC to three.125 BTC — Bitcoin’s excessive worth volatility might make it more durable for particular person miners to be nicely compensated to function their nodes in difficult situations.

Traditionally, the BTC worth reached new all-time highs a 12 months or 18 months after every halving occasion. Right here’s how the Bitcoin worth reacted after every halving:

- First halving on Nov. 28, 2012: Bitcoin was buying and selling at $12.35 and surged to $964 a 12 months later.

- Second halving on July 9, 2016: Bitcoin’s worth elevated from $663 to $2,500 in round one 12 months.

- Third halving on Might 11, 2020: BTC was buying and selling at round $8,500 and reached nearly $69,000 in simply 17 months.

In keeping with Lucian Calin, the info heart technician at Argo Blockchain, some over-leveraged miners may not make it by way of the halving due to excessive overhead prices or large debt, however it’ll all even out ultimately. He added:

“It’s like a sport of monopoly, the wealthy hold getting richer, on this case, different miners will purchase out smaller miners and take over their actions. Mining will at all times exist on Bitcoin till the final Bitcoin is mined and even previous that to verify the transactions are confirmed.”

Halving rewards, rising centralization dangers

Halving Bitcoin’s block reward might pressure small-scale and particular person miners due to the excessive prices concerned in mining. Smaller miners would possibly exit the market in the event that they lack ample sources. This case might favor bigger mining firms, doubtlessly resulting in extra centralized community management.

Bitcoin’s centralization might pose a a lot greater risk to the worldwide monetary system than it appears, with BTC exchange-traded funds (ETFs) registering over $11.2 billion in whole web flows.

Centralization might doubtlessly expose the Bitcoin community to the 51% assault and will even result in a single entity having full management over the blockchain.

This doesn’t appear not possible, on condition that the Foundry USA Pool controls 27% of the overall Bitcoin hashrate. The biggest BTC mining pool has a mean hash energy of 160.43 EH/s adopted by AntPool’s 141.46 EH/s — accounting for 23.8% of the overall community hash fee.

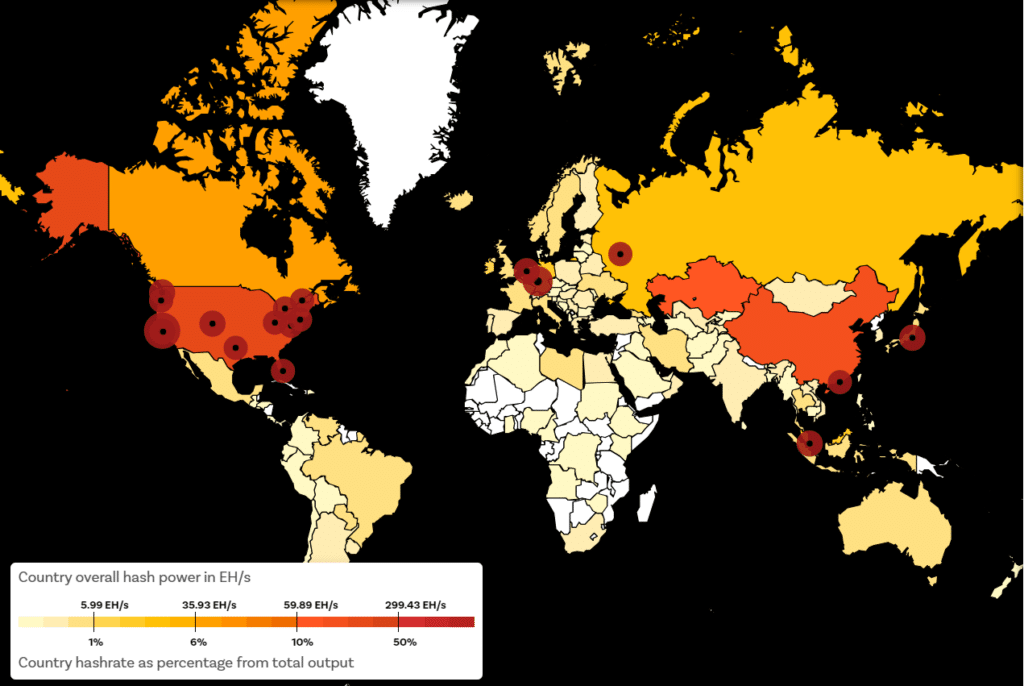

Bitcoin hash fee map | Supply: The Chain Bulletin

Nonetheless, Lani Dizon says that Bitcoin’s decentralized nature is designed to stop any single entity from controlling it. Its community depends on a proof-of-work (PoW) consensus mechanism, the place miners compete to validate transactions and safe the community. Dizon added:

“Though there are centralization issues within the mining ecosystem, the place massive mining swimming pools or entities might doubtlessly exert affect, Bitcoin’s decentralized design makes it resistant for any massive entity to have full management.”

Lucian Calin argues that with this present ETF from BlackRock and different huge establishments, “we’d see them attempt to take over Bitcoin and make it extra centralized.” Calin added:

“However it is going to be very laborious for them to take action with out making the value explode up like they did up to now few weeks. All of that’s due to the low provide of obtainable Bitcoin on exchanges which is able to intensify with the Bitcoin halving developing.”

Calin believes that huge establishments can not monopolize Bitcoin with out making its worth attain “tens of millions of {dollars}” since there’s a restricted variety of cash accessible on exchanges. Per information from Coinglass, roughly 1.78 million BTC tokens can be found on all exchanges, which accounts for lower than 10% of the utmost Bitcoin provide.

“Bitcoin completely can’t be centralized”

On March 18, Bitfinex crypto trade launched a report claiming that the forthcoming Bitcoin halving might result in the centralization of the BTC mining energy. Centralization might finally result in vulnerabilities and censorship which is “opposite to Bitcoin’s ethos.”

The U.S. alone has a 37.84% share of the overall BTC hash fee with a complete hash energy of 226.61 EH/s, based on The Chain Bulletin.

Whereas this poses issues about Bitcoin’s centralization, the diversified international distribution of miners and their various strengths to adapt primarily mitigate that threat, guaranteeing the community stays decentralized.

Bitcoin miner and the director of enterprise growth at Canaan, Christopher James Crowell, believes that Bitcoin mining is an excessive amount of of a world “phenomenon to be managed by a central entity.” Crowell instructed crypto.information:

“Nations everywhere in the world have their very own distinctive benefits. Whether or not it’s low labor prices, low cost energy, or nice innovation, there are many distinctive entities in mining Bitcoin to soundly say that it completely can’t be centralized.”

You may additionally like: From donations to choices: how crypto PACs goal Senate races

Authorized dilemma

If the not possible occurs, specialists have various concepts on how the governments would react to the state of affairs since Bitcoin’s centralization might mood with the worldwide monetary state of affairs.

Dizon says that governments would view any try to regulate Bitcoin by a single entity as a major risk to monetary stability and should take regulatory actions to mitigate the focus of energy. She acknowledged:

“They’d probably reply with elevated regulatory scrutiny and doubtlessly implement measures to decentralize management, safeguard monetary stability, and defend in opposition to manipulation or monopoly energy within the Bitcoin ecosystem.”

However, Calin says that the federal government can’t do something because of the worldwide nature of Bitcoin. He stated:

“The businesses will merely transfer their headquarters and operations elsewhere on the earth the place it’s extra favorable for them and provide it to many different people who means.”

Learn extra: Layer-2 options surge after Dencun improve. Is it protected for the system?