A dealer identified for a number of correct crypto market calls says that Bitcoin (BTC) might soar past $160,000 this bull cycle if its present market construction holds up.

Pseudonymous analyst Dave the Wave tells his 143,000 followers on the social media platform X that primarily based on Bitcoin’s value motion from 2020, the crypto king might hit $160,000 earlier than Might and proceed to soar.

“A BTC $160,000 goal, ought to we see a continued parabolic run, is definitely fairly conservative on this comparability.”

Supply: Dave the Wave/X

Dave the Wave makes use of his personal model of logarithmic development channels (LGC) to try to forecast market cycle tops and bottoms whereas filtering out short-term volatility and noise.

his chart, the dealer means that Bitcoin is printing an identical value sample as 2020 the place it breaks out of an ascending channel and right into a parabolic impulse upward, finishing a 154% transfer.

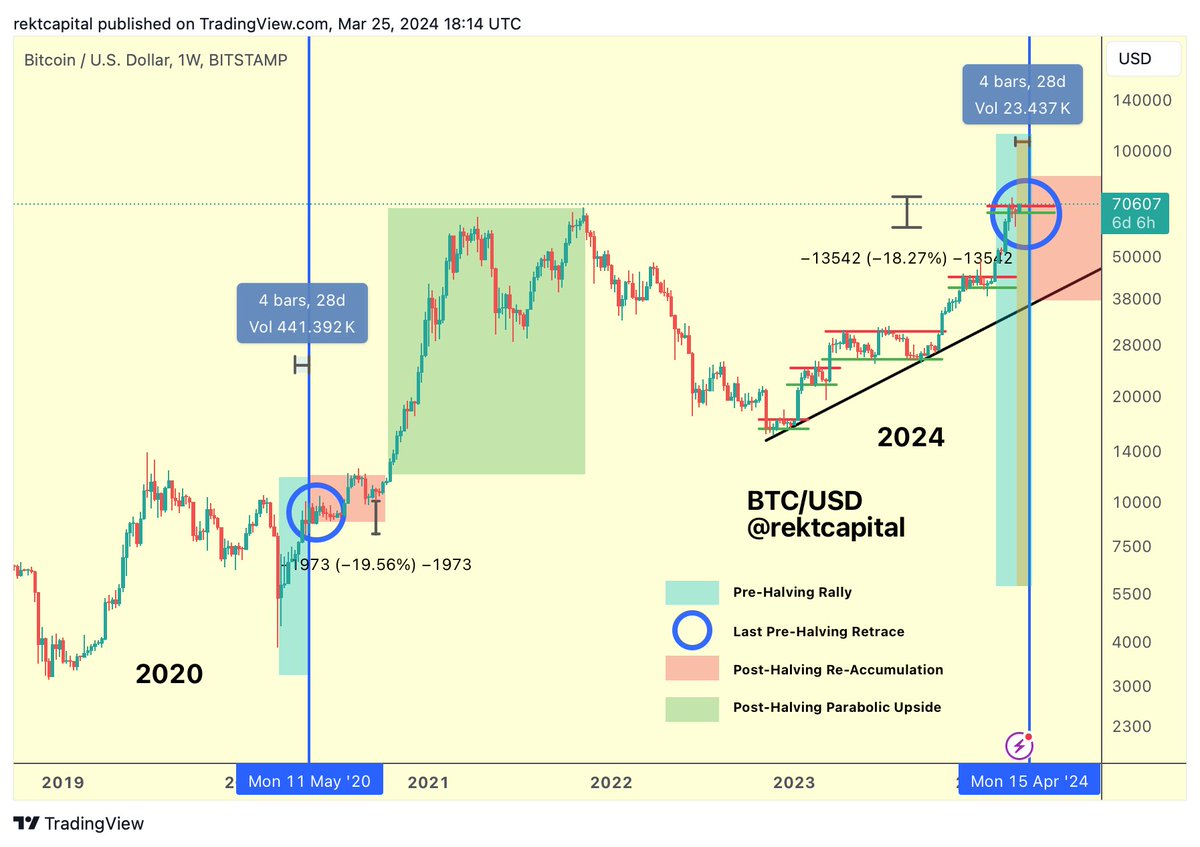

Pseudonymous crypto dealer Rekt Capital can be drawing a comparability between Bitcoin’s present cycle and 2020 as BTC heads into the April halving occasion when miners’ rewards are lower in half. He means that Bitcoin might consolidate within the excessive $60,000 vary because it enters the halving and later breakout just like the 2020-2021 cycle.

“This present cycle has been a narrative of re-accumulation ranges (green-red). And one fascinating chance for value going into the halving is additional consolidation at highs (i.e. re-accumulation). This flip of technical occasions can be traditionally correct. It could fulfill the truth that a pre-halving retrace happens 28-14 days earlier than the halving. And it might fulfill the truth that pre-halving retraces transition into post-halving re-accumulation.

If Bitcoin manages to show the outdated all-time excessive of ~$69,000 into new assist then this ‘re-accumulation vary’ thought can be invalidated as a result of value can be prepared for value enlargement into value discovery. If nonetheless, Bitcoin isn’t in a position to flip ~$69,000 into assist earlier than the halving this re-accumulation vary might turn into a actuality and can be in step with historic value tendencies across the halving.”

Supply: Rekt Capital/X

Bitcoin is buying and selling for $69,847 at time of writing, down barely within the final 24 hours.

Generated Picture: Midjourney