Over the previous week, the stablecoin trueusd (TUSD) skilled a notable lower in its provide. As of March 19, 2024, the circulation was roughly 1.1 billion TUSD, which then plummeted to simply 612 million.

Provide Slash Sees TUSD Fall From Prime 5 Stablecoin Rankings to eighth Place

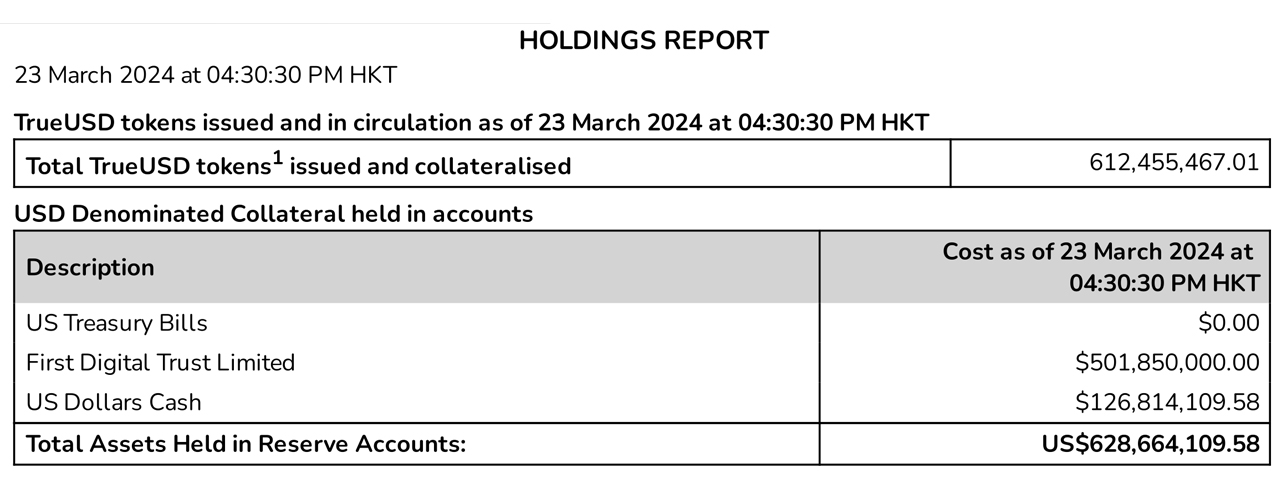

Beforehand ranked among the many prime 5 dollar-pegged cryptocurrencies by market capitalization, TUSD now finds itself within the eighth spot. Its provide has been constantly diminishing, with three-month statistics indicating a place to begin of round 2.4 billion. As lately as March 19, the availability had fallen to 1.1 billion, resulting in the present rely of 612,455,467 TUSD as of March 23, 2024.

The distribution of TUSD is especially on Ethereum, with roughly 389 million TUSD, and on the Tron blockchain, with about 189 million. Moreover, 2.98 million TUSD are circulating on Avalanche, whereas the BNB Chain hosts roughly 30.03 million. The lower in TUSD’s provide comes on the heels of its challenges in sustaining U.S. greenback parity at the start of the yr.

Since recovering its peg, the coin has continued to see a gradual discount in provide. TUSD’s transparency efforts are highlighted by its Verinumus real-time steadiness dashboard, which particulars the property backing the tokens. Presently, the dashboard audit exhibits $501 million in collateral property held in First Digital Belief Restricted, over $126 million in USD money, and nil U.S. Treasury notes. The audit reveals that the collateral is overseen and managed by Techteryx throughout depositories in Hong Kong, Switzerland, and the Bahamas.

This pattern of lowering provide will not be distinctive to TUSD, as different once-prominent stablecoins like Binance’s BUSD have additionally receded considerably from main positions. Equally, Paxos’ USDP and Gemini’s GUSD have skilled notable reductions of their provides over the past yr. In the meantime, newer entrants comparable to FDUSD and USDE have risen to change into the fourth and fifth largest stablecoins, overtaking a number of former frontrunners within the realm of dollar-pegged crypto property.

What do you consider TUSD’s provide drop? Share your ideas and opinions about this topic within the feedback part beneath.