Bitcoin’s present conduct mirrors its path in a earlier halving cycle. What can we count on from the subsequent halving?

Following the U.S. SEC’s approval of spot ETFs on Jan. 11, Bitcoin (BTC)started a bullish streak, hovering to spectacular heights.

Bitcoin hit a brand new all-time excessive of $73,750 on Mar. 14. Nevertheless, this peak was short-lived as Bitcoin skilled a correction, dropping to ranges round $60,000 to $61,000 on Mar. 20.

Amid bullish sentiments, Bitcoin recovered from this dip. As of Mar. 22, it trades at round $63,000.

In keeping with a report by Coinbase, Bitcoin’s present path mirrors its conduct in 2018-2022, the place Bitcoin witnessed a outstanding 500% improve from its lowest level within the cycle.

For these unfamiliar, the Bitcoin community halves the speed at which it generates new Bitcoins roughly each 4 years in an occasion referred to as the Bitcoin halving. This built-in function of Bitcoin’s code goals to regulate its inflation fee.

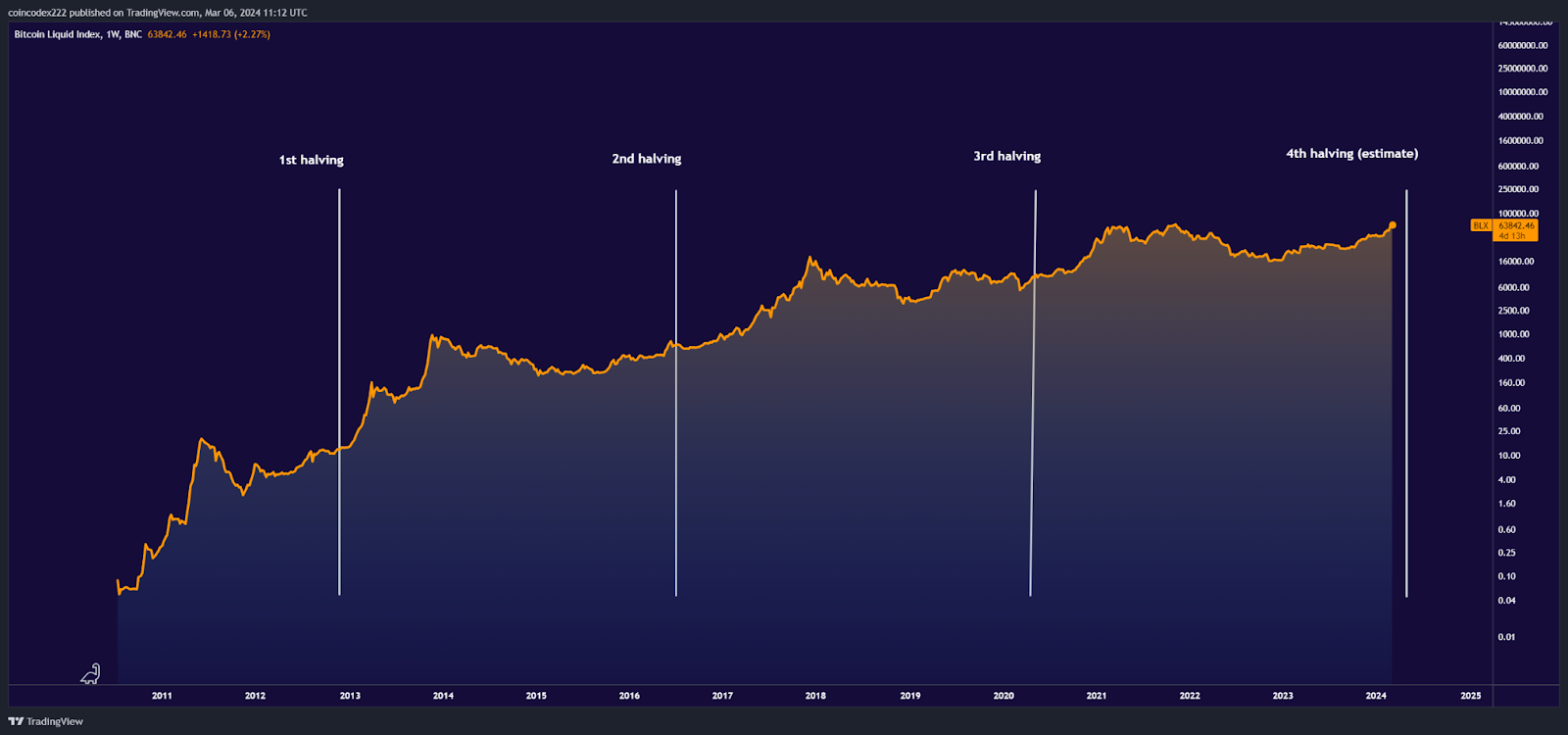

Traditionally, Bitcoin has adopted a sample surrounding its halving occasions. It often experiences a value improve main as much as the halving, adopted by a interval of correction or consolidation, earlier than ascending to new highs post-halving.

BTC halving value chart | Supply: TradingView

Let’s delve deeper into Bitcoin’s previous cycles, study its conduct, and predict its potential course within the present cycle.

The primary halving: 2012

The primary halving occasion in 2012 diminished the block reward from 50 to 25 BTC, slowing down the speed at which new Bitcoins entered circulation.

Throughout this time, Bitcoin was largely flying underneath the radar, and it was identified inside area of interest tech communities. It wasn’t till the worth skyrocketed from double digits to over $1,000 in 2013 that it started to seize mainstream consideration.

You may also like: Why aren’t massive Bitcoin holders promoting regardless of excessive costs? Insights and evaluation

Regardless of this surge, the broader monetary world dismissed Bitcoin as a passing fad, failing to acknowledge its potential.

Following this meteoric rise, Bitcoin skilled a fast correction, with costs falling again to round $200 by 2015.

Critics had been fast to declare the top of Bitcoin, citing the burst of what they deemed a speculative bubble. Nevertheless, as subsequent cycles have proven, such claims had been untimely.

The second halving: 2016

In July 2016, Bitcoin underwent its second halving, lowering the block reward from 25 to 12.5 BTC. This occasion garnered widespread consideration as Bitcoin had already began to achieve traction within the mainstream monetary world.

Earlier than the 2016 halving, Bitcoin exhibited a considerably bullish sample. In January that 12 months, costs hovered round $430, climbing to over $750 by early June, forward of the halving.

Nevertheless, because the halving occasion approached, the worth skilled some volatility, dipping to round $590 by the top of Jun.

Following the completion of the halving, Bitcoin entered a interval of consolidation, buying and selling sideways for a number of months. Nevertheless, this section was short-lived as the results of the halving started to materialize.

By Dec. 2017, roughly 1.5 years after the halving, Bitcoin had surged to new heights, reaching above $19,000, making over 12,000% features in that cycle.

BTC value chart from Jan. 2016 – Dec. 2017 | Supply: CoinGecko

The second halving noticed Bitcoin taking the highlight, attracting widespread media consideration. Alongside Bitcoin’s rise, there was a proliferation of altcoins and preliminary coin choices (ICOs), which sadly introduced a wave of scams and failed tasks.

You may also like: Scammers on the rise: three on-chain cybersecurity predictions for 2024 | Opinion

The third halving: 2020

Main as much as the 2020 halving, Bitcoin displayed a consolidation section. In early January, costs traded in a slender vary of $7,000 to $7,500. Because the 12 months progressed, Bitcoin’s worth noticed modest features, reaching round $9,000 in anticipation of the halving.

Following the halving, Bitcoin witnessed a notable uptick in momentum as the availability of recent cash turned scarcer.

You may also like: The flippening debate: can Ethereum surpass Bitcoin?

By November 2020, Bitcoin had surged to round $15,000, marking an uptick from its pre-halving ranges. This upward trajectory continued, leading to Bitcoin reaching a brand new all-time excessive of almost $69,000 in Nov. 2021.

BTC value chart from Jan. 2020 – Nov. 2021 | Supply: CoinGecko

BTC gained about 2,000% throughout this cycle, which was decrease than in earlier cycles however nonetheless important sufficient.

It’s value noting that the 2020 halving occurred amid the backdrop of the COVID-19 pandemic, a world disaster that disrupted economies and monetary markets worldwide.

Regardless of the turmoil, Bitcoin’s value sample largely adhered to the established cycle, demonstrating its resilience within the face of exterior challenges.

Throughout this era, distinguished institutional buyers, resembling Paul Tudor Jones and Michael Saylor, publicly introduced their allocations to Bitcoin, signaling a rising acceptance of the crypto amongst conventional buyers.

The third halving cycle additionally reiterated the acquainted sample noticed in earlier cycles: a surge in value main as much as the halving, adopted by a quick correction and consolidation section earlier than a major bull run. The height occurred roughly 18 months post-halving, in line with historic developments.

What to anticipate from the subsequent halving?

Reddit customers counsel we’re on the cusp of a bull market. But, this time, it’s not nearly halving.

Many see the spot BTC ETFs as a game-changer, an indication that Bitcoin is transferring from the fringes to the mainstream monetary world.

Michaël van de Poppe, a well-regarded crypto-analyst, echoes this sentiment. He means that we’re coming into an “institutional cycle” marked by enormous capital inflows into the market, as evidenced by latest ETF actions. In keeping with van de Poppe, this units the stage for a bull cycle not like any earlier than.

#Bitcoin to $200,000 or $500,000 on this bull cycle?

It is the institutional cycle.

Which means that an inflow of cash, which the markets have not seen earlier than, is coming to the markets. The latest influx within the ETF has proven curiosity.

What does that imply? The place’s the highest? ⬇️… pic.twitter.com/hxTZMQvetl

— Michaël van de Poppe (@CryptoMichNL) February 10, 2024

Van de Poppe questions the “diminishing returns” idea, which suggests every crypto bull cycle will peak decrease than earlier than.

He highlights technological developments and institutional investments as drivers for doubtlessly unprecedented market highs, arguing that peaks would possibly hit wherever between $250,000 to $600,000, or much more, as markets typically outdo expectations.

Van de Poppe additionally speculates that we could be getting ready to a “Crypto Dot.com” bubble, drawing parallels to the dot-com bubble of the late Nineteen Nineties.

Nevertheless, he anticipates this crypto cycle may last more, influenced by financial components like liquidity and rates of interest.

He cautiously predicts a peak in Q3/This fall 2025, with the potential for the bull cycle to increase into 2026 or 2027, relying on financial circumstances.

But, he warns of a subsequent crash and advises buyers to deal with buying energy relatively than USD valuations.

Wanting ahead

Specialists predict the subsequent Bitcoin halving will possible occur round late April, although it would stretch into Might.

Each halving brings its market patterns, and the subsequent one will too. So, put together for some ups and downs, and watch out together with your trades.

Learn extra: The Bitcoin impact: why altcoins observe BTC’s lead