Ethereum has just lately breached a big resistance degree, crossing the psychological milestone of $4K and reaching a brand new excessive for the 12 months.

Nevertheless, this breakthrough was met with resistance, resulting in a noticeable correction. The query that arises now’s whether or not this correction is merely a short lived setback or the start of a broader reversal within the bullish pattern.

By Shayan

The Each day Chart

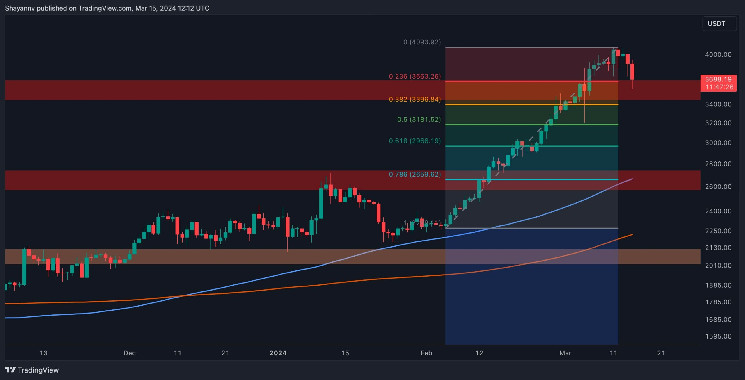

An intensive evaluation of the each day chart signifies a prevailing bullish sentiment surrounding Ethereum, evident in a powerful and sudden upward surge that surpassed the vital resistance at $4K. This surge displays heightened curiosity from market individuals in Ethereum, leading to elevated volatility.

Nevertheless, after briefly surpassing the essential $4K resistance degree, the worth encountered intensified promoting strain, seemingly because of profit-taking amongst individuals, resulting in a big decline towards the substantial help zone of round $3.5K. It appears seemingly that the market will discover help on this area and provoke a recent rally.

Nevertheless, within the occasion of a continued corrective retracement, Ethereum’s worth is anticipated to search out help round key ranges inside the Fibonacci retracement, particularly between the 0.5 ($3,181) and 0.618 ($2,966) ranges.

The 4-Hour Chart

Additional examination of the 4-hour chart confirms the presence of patrons within the Ethereum market, propelling the worth to its highest degree since April 2022. This surge, accompanied by elevated market volatility, demonstrates important shopping for curiosity geared toward surpassing the earlier all-time excessive of $4.8K.

Nevertheless, following the breakthrough above the vital $4K resistance degree, the worth confronted rejection, resulting in a pointy decline aiming for the important thing help zones round $3.5K and $3.3K. Moreover, an increasing bearish divergence between the worth and the RSI indicator suggests the potential for a notable market correction.

Nonetheless, it is very important acknowledge that wholesome bullish markets usually expertise durations of consolidation correction, permitting the asset to relaxation and rebuild demand. Due to this fact, it appears seemingly that the worth will discover help within the medium time period, persevering with its total upward pattern.

By Shayan

Ethereum’s worth has surged quickly in current weeks, briefly surpassing its earlier all-time excessive of $4,000. This surge has attracted quite a few speculators to the market, driving up shopping for strain and instilling confidence amongst traders.

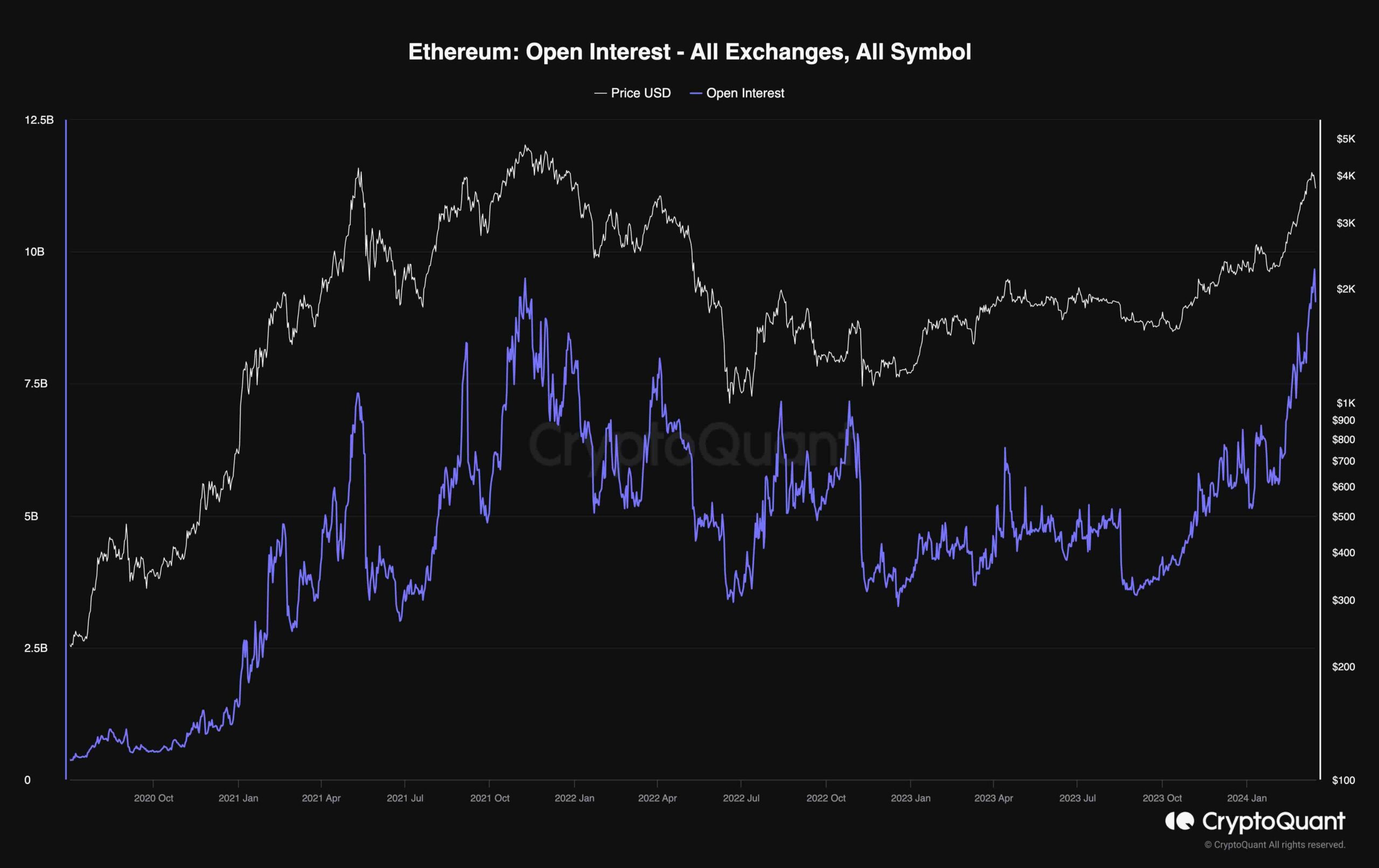

The accompanying chart illustrates the open curiosity, a invaluable metric for assessing sentiment within the futures market. Open curiosity quantifies the variety of excellent perpetual futures contracts throughout varied crypto exchanges.

It’s evident that the open curiosity has soared alongside the current bullish pattern, reaching unprecedented ranges. This surge signifies the depth of each lengthy and brief positions within the perpetual futures market, leading to an overheated atmosphere.

Whereas elevated open curiosity is typical in a sturdy bull market, it will probably additionally contribute to heightened volatility and surprising market corrections. As such, it’s prudent for traders to fastidiously handle their danger within the brief time period.