The world’s second-largest cryptocurrency by market cap, Ethereum (ETH) ,surged previous $4,000 on Friday, March 8. Nevertheless, the ETH crypto confronted a minor pullback. At press time, the Ethereum worth was buying and selling at $3,933 with a market cap of $472 billion.

Ethereum (ETH) Worth To See All-Time Excessive Quickly

CrediBULL crypto, a distinguished crypto analyst, has weighed in on the present market dynamics, significantly specializing in Ethereum (ETH) following Bitcoin’s latest achievement of tagging its earlier all-time excessive (ATH).

In line with the analyst, there’s widespread anticipation throughout the crypto group that Ethereum is the subsequent in line to surge, given Bitcoin’s ATH milestone. Those that have remained on the sidelines are reportedly eyeing a possible pullback to the $3600-$3700 vary, a sentiment echoed by many individuals out there.

Nevertheless, CrediBULL crypto means that such a pullback won’t materialize instantly, because the demand for Ethereum stays sturdy. The analyst says he wouldn’t be shocked to witness Ethereum’s worth surge by one other 25% or extra earlier than any vital correction happens.

Then again, Ethereum continues to outperform Bitcoin as we transfer forward in 2024. Over the past week, Bitcoin (BTC) worth gained by 10% whereas ETH added 15% positive factors in the identical interval.

Boosted by the approaching Dencun improve and a bullish ambiance from Bitcoin’s revenue recirculation, Ethereum, the second-largest cryptocurrency, is gaining momentum. Evaluation of the ETH/BTC chart signifies that altcoins are nearing a breakout level.

All Eyes on Dencun Improve

Within the subsequent week, the Ethereum blockchain will endure its much-awaited Dencun improve bringing vital enhancements to the community. The upcoming Dencun improve scheduled for this month will scale back transaction prices on layer 2 networks, stimulating elevated exercise and probably drawing mainstream shopper curiosity to Ethereum.

One other catalyst is the pending regulatory choice on spot Ethereum ETF purposes, anticipated in Might. Though the approval odds are much less sure in comparison with spot Bitcoin ETFs, it nonetheless brings pleasure to ether, in line with the Bitwise analyst.

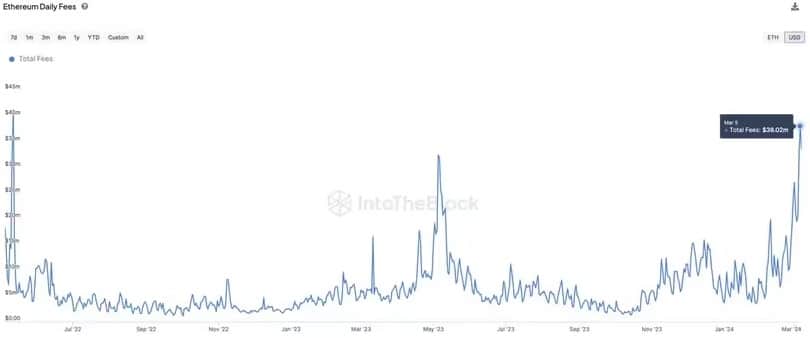

In line with IntoTheBlock knowledge, ETH mainnet’s income from community charges surged to $193 million this week, marking the very best stage since Might 2022 and reflecting a 78% rise from the earlier week. This notable improve in on-chain exercise was primarily fueled by heightened hypothesis involving meme cash.

Courtesy: IntoTheBlock