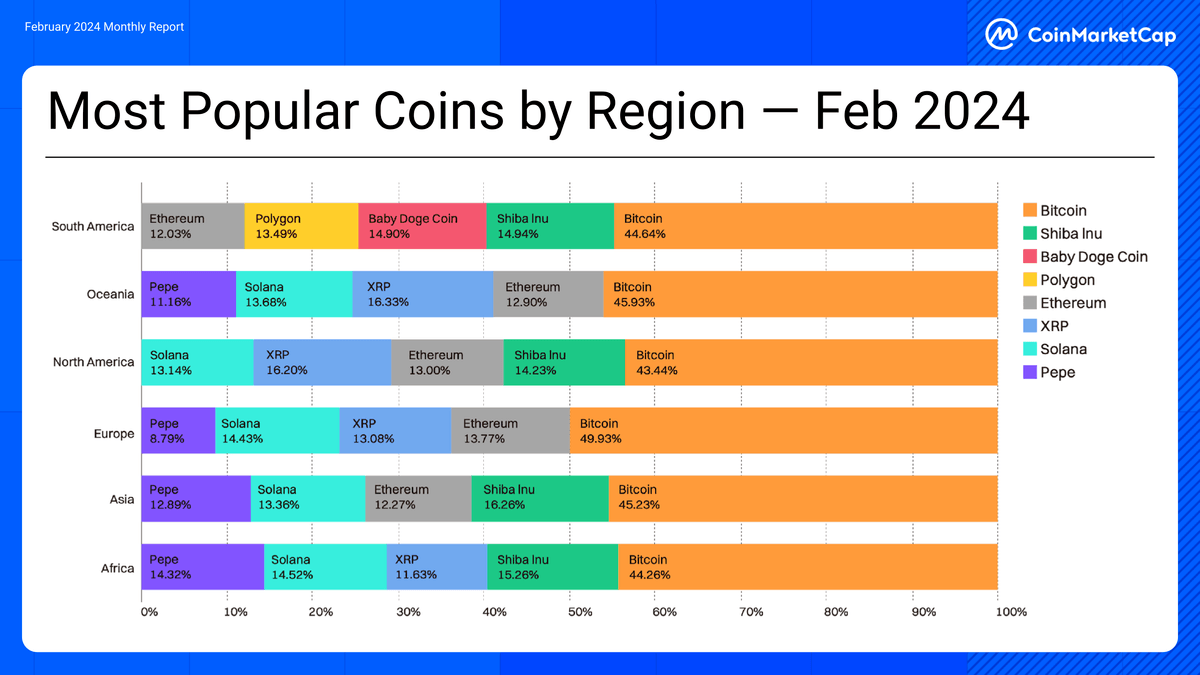

Almost 50% of European cryptocurrency holders owned Bitcoin (BTC) in February, in line with survey information from CoinMarketCap.

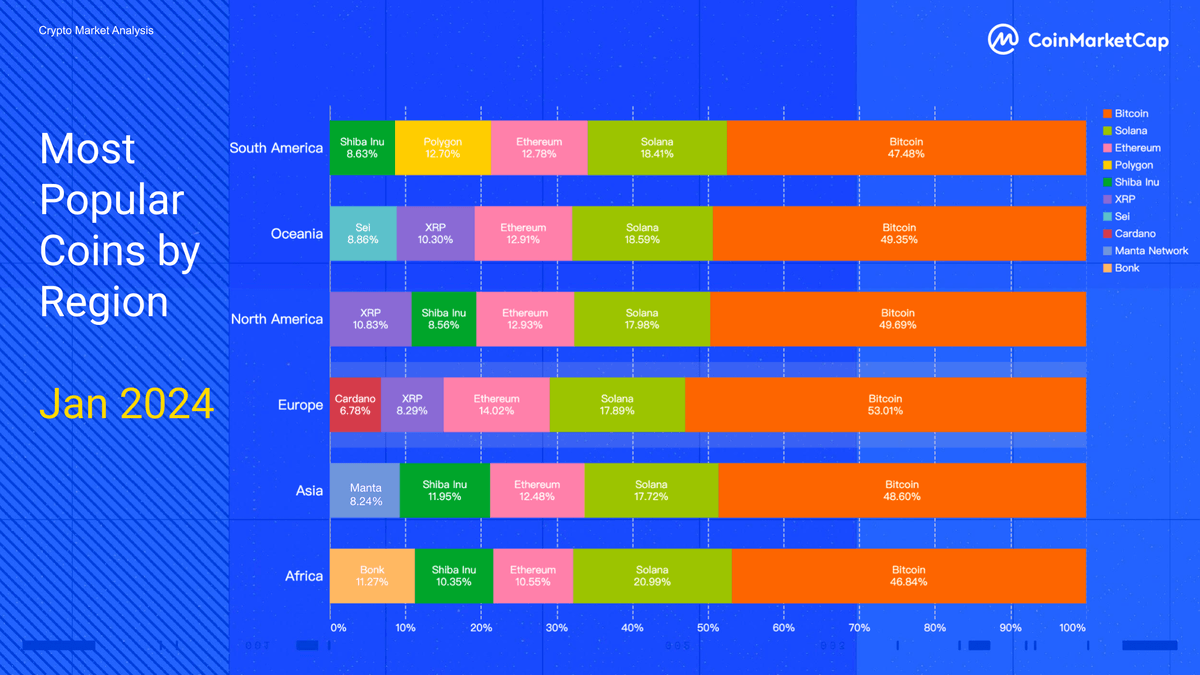

This really represents a 3% drop in comparison with related information for January, but Bitcoin comfortably stays the most well-liked cryptocurrency amongst merchants in all areas of the world, with buyers in Europe the likeliest to carry BTC.

The transfer from January to February additionally reveals some attention-grabbing shifts in possession for different cryptocurrencies, with Shiba Inu (SHIB) seeing noticeable spikes in North and South America, Asia and Africa.

On the identical time, possession of Solana has decreased noticeably in all areas, with many buyers turning to smaller-cap cash and meme tokens within the wake of the rally that adopted January’s Bitcoin ETF approvals.

After all, with the cryptocurrency market remaining unpredictable and risky, merchants shouldn’t count on the identical developments to proceed all year long.

As a substitute, they need to put together for the likelihood that the market will cyclically shift from overbought to underbought tokens, significantly because it strikes from Bitcoin season to alt season (and again once more).

Bitcoin and Ethereum Proceed to Dominate Regardless of Dips

It’s maybe unsurprising that half or practically half of all cryptocurrency buyers in all areas of the world personal some BTC.

Possession ranged from 49.93% in Europe to 43.44% in North America, but such percentages signify a slight however noticeable dip in comparison with January, when 53% of European and 49.7% of North American crypto house owners held some Bitcoin.

Supply: CoinMarketCap

Supply: CoinMarketCapThis decline is attention-grabbing.

Probably the most possible clarification is that some buyers and merchants moved out of BTC and took earnings when the cryptocurrency rallied in February, as Bitcoin ETF volumes elevated.

A lot the identical applies to Ethereum, which noticed its recognition decline barely in all areas in February, whereas in Africa it really disappeared utterly.

As with Bitcoin, some could have determined to take earnings, whereas shifting into smaller alts.

The Rise (and Fall) of Altcoins

In truth, this is kind of precisely what we see within the CoinMarketCap information, with a number of alts seeing will increase in possession from January to February.

In America, Asia and Africa, Shiba Inu (SHIB) possession rose from 8.5%-11.9% in January to 14.2%-16.2% in February.

It is a noticeable spike, and what’s attention-grabbing is that the SHIB value didn’t rally massive this yr till the very finish of February after which early March.

This means that at the very least some retail merchants could be forward of the curve, though with a meme coin equivalent to SHIB it’s all the time potential that on-line and social media-based FOMO goaded buyers to purchase the coin, earlier than it rallied.

We additionally see an enormous surge in possession for PEPE, one of many market’s different massive meme cash.

Curiously, it didn’t even register in CoinMarketCap’s January information, but by February, possession had risen to eight.79% for Europe, 11.16% for Oceania, 12.89% for Asia, and 14.32% for Africa.

This doubtless follows from the sharp rally PEPE loved within the last week of February, which was a prelude to its even larger rally in March.

Supply: CoinMarketCap

But one thing completely different applies to Solana (SOL), which noticed a slight however vital decline in possession between January and February.

Because the chart above illustrates, it went from 17.7%-20.9% possession in all areas of the world to 13.1%-14.5% within the following month.

This time, it’s controversial that some merchants needed to chop their losses, since after a robust finish to 2023 SOL spent a lot of January declining, with some merchants probably exiting to extra promising cash.

The Significance of Localism and Phrase of Mouth

Lastly, one different attention-grabbing entrant is Child Doge Coin (BABYDOGE), which gained a 14.9% share of recognition in South America, after showing nowhere in January.

What’s intriguing about that is that it exhibits how cryptocurrency recognition and possession could be dependent much less on precise costs and fundamentals, and extra on social contagion and phrase of mouth.

So, if a couple of influencers in South America start hyping a coin, it virtually inevitably begins to realize in recognition.

This precept helps to elucidate a lot of the geographical variation we see in cryptocurrency recognition, since as a worldwide market, recognition needs to be uniform if all buyers are 100% rational actors.

They aren’t, in fact, which is why we must always proceed to count on variation in subsequent month’s information, in addition to adjustments in recognition inside areas and throughout time.